Заглавная страница Избранные статьи Случайная статья Познавательные статьи Новые добавления Обратная связь FAQ Написать работу КАТЕГОРИИ: ТОП 10 на сайте Приготовление дезинфицирующих растворов различной концентрацииТехника нижней прямой подачи мяча. Франко-прусская война (причины и последствия) Организация работы процедурного кабинета Смысловое и механическое запоминание, их место и роль в усвоении знаний Коммуникативные барьеры и пути их преодоления Обработка изделий медицинского назначения многократного применения Образцы текста публицистического стиля Четыре типа изменения баланса Задачи с ответами для Всероссийской олимпиады по праву

Мы поможем в написании ваших работ! ЗНАЕТЕ ЛИ ВЫ?

Влияние общества на человека

Приготовление дезинфицирующих растворов различной концентрации Практические работы по географии для 6 класса Организация работы процедурного кабинета Изменения в неживой природе осенью Уборка процедурного кабинета Сольфеджио. Все правила по сольфеджио Балочные системы. Определение реакций опор и моментов защемления |

X. Make comments on the following charts, paying attention to the information given belowСодержание книги

Поиск на нашем сайте

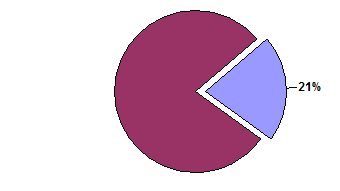

The Printing Works of the Bank of England operate in support of the Bank’s first core purpose: maintaining the integrity and value of the currency. The trends of continuously improving productivity and reducing new note unit costs were maintained for the 10th successive year despite increases in pay rates and the cost of materials – mostly paper. Make comments on the following charts.

*The unit cost data are not clearly comparable with the figures for the cost of producing Bank of England notes shown in the statements of account of the Issue Department, since the latter are prepared on a cash basis.

The recent modernization programme – initially of equipment, followed by the major refurbishment of plant and buildings – has now initially bee completed.

Of equal importance is the continuing Printing Works 2000 Programme which aims to encourage staff to focus on three key values: team working, continuous improvement and customer partnership. Most teams have completed the initial re-design of their working methods and all have transferred to a new pay structure, which rewards the acquisition of skills and demonstration of competencies.

XI. Complete the following sentences using your own words:

1. If the inflation rate is low, it _____. 2. The Personnel Division’s purpose is to help the Bank recruit, _____. 3. Decisions on interest rate policy are made _____. 4. The Bank of England Act 1946 requires the Bank to pay to HM Treasury, in lien of dividend on the Bank’s capital, a sum _____. 5. Today the Bank of England, the central bank of the UK, has three core purposes: _____. 6. Most countries have a central bank: for example the USA (give its name) _____, Germany _____, France _____, Ukraine _____, and Japan _____. 7. The Bank of England is one of the _____. 8. Like any other bank, the Bank of England offers _____. 9. All the clearing banks _____. 10. The first objective of any central bank is _____. 11. Interest rates affect _____. 12. The Bank can try to influence the exchange rate using _____.

XII. Study the text given below and explain in English the meaning of the following words and word combinations:

A Stable Financial System

Ensuring a sound and stable banking system is another important central banking function - important in its own right and vital to the efficient conduct of monetary policy. The Bank of England has long recognized this and for many years sought informally to ensure that banks and other City institutions were financially sound and well-run. But it had no legal basis for doing so until the Banking Act of 1979 gave it power to authorize and supervise all deposit-taking institutions. (Building societies, however, are supervised by The Building Societies Commission.) The Banking Act, which was updated and strengthened in 1987, provides that any UK bank wishing to take deposits from the public (that is, to conduct a banking business) in the UK must gain prior authorization from the Bank, and must submit to the continued supervision of its activities by the Bank. Under European legislation this does not apply to the UK branches of banks incorporated in other countries of the European Economic Area. These are supervised by their home state authority, To become authorized, and to remain authorized, a bank must have adequate capital, and must make appropriate provisions against possible bad debts. The aim is to ensure that there are sufficient resources available to the bank to absorb losses without putting depositors' money at risk. The bank must also have enough ready cash or liquidity, to meet likely withdrawals. The quality of management is very important: directors and senior managers must be honest and competent - fit and proper, in the language of the Act. So must those who control banks - major shareholders, for example. There must be adequate internal systems and controls to enable management to assess their risks properly and to ensure that prudent banking procedures are observed. The purpose of all this is to protect depositors with banks against the risk of losing their money. But it does not provide a guarantee against loss: to make banking so completely safe would involve preventing bankers from taking any risks at all. Supervision reduces the risk of failure, but does not eliminate it. If an authorized bank does fail, depositors are entitled to limited compensation from a Deposit Protection Fund set up under the Banking Act and administered by the Bank, but financed by contributions levied on the banking system as a whole. There are about 480 authorized banks in the UK. More than half of these are branches or subsidiaries of foreign banks. The Bank liaises closely with overseas supervisors in monitoring the position of these banks. In recent years the Bank has also played a prominent part in negotiations aimed at establishing common international standards of capital adequacy designed to increase the stability of the financial system of the world as a whole. The Bank is also involved in the supervision of certain other institutions - primarily those operating as brokers and marketmakers in the professional (or wholesale) financial markets where the Bank itself is active such as gilts, bullion and foreign exchange. These specialized firms apart, the Bank is not involved in the direct supervision of investment business, which falls under the Securities and Investments Board (SIB) and the self-regulatory bodies which report to the SIB. However, many institutions and groups undertake business which spans both banking and investment activities. In these cases, the Bank co-operates with the SIB and the self-regulatory bodies to ensure a consistent regulatory treatment and a common response in cases of difficulty.

XIII. The teacher asks the students to prepare a role play. One of the students is asked to play the role of chief of Issue Department of the Bank of England and is ready to speak out at one of the staff meetings, on the performance of Issue Department.

The Note Issue

The Bank of England is probably most familiar to the public as the name on the banknotes. The Bank is the sole issuer of currency notes in England and Wales, and although Scottish and Northern Irish banks issue their own notes, most of these must be backed, pound for pound, by Bank of England notes. (Coin is issued by the Royal Mint on behalf of the Treasury, and is not a responsibility of the Bank of England.) The net profits from thenote issue (which are considerable) are paid over to the government. The notes are designed and produced at the Bank's own Printing Works and issued mainly through the commercial banks' branch networks. The Bank itself has only 5 branches (in Bristol, Birmingham, Leeds, Manchester and Newcastle) and these play a part both in distributing new notes and in taking in old notes for sorting and reissue or destruction. The average life of a Bank note ranges from a year for a J5 note to 3-4 years for a J50 note. Banknotes are printed on special watermarked paper and much technical and design effort goes into making them difficult to counterfeit. The present series of banknotes was introduced between 199o and 1994. The Bank's notes originally represented deposits of gold coin and bullion with the Bank and until 1931, when Britain finally came off the gold standard, could be exchanged for gold at a fixed rate - hence the words "I promise to pay" on the face of the notes. Since 1844 the Bank has been authorized to issue notes against securities - the fiduciary issue of notes - instead of just gold or silver. After 1939 only a nominal amount of gold was held and today the note issueis wholly backed by securities.

Issue Department

Text B The Value of Money

The first objective of any central bank is to safeguard the value of currency, in terms of what it will purchase at home and in terms of other currencies. Monetary policy is directed to achieving this objective and to providing a framework for non-inflationary economic growth. As in most other developed countries, monetary policy operates in the UK mainly through influencing the price of money - in other words, the rate of interest. The price stability objective is made explicit in the present monetary policy framework, which has been in place since the UK left the Exchange Rate Mechanism of the European Monetary System in the autumn of 1992. It has two main elements: first, a medium-term inflation target, set by the Government, of 2S% or less; and second, a commitment to a more open policy-making regime. Setting monetary policy - decidingon the level of interest rates necessary to meet the inflation target - is a matter for the Bank and the Treasury. Unlike some central banks, the Bank cannot act independently of government. The 1946 Bank of England Act gives the Treasury the power to issue directions to the Bank and, although it has never formally exercised its powers, the relationship is clearly understood to be one in which the Chancellor of the Exchequer takes the final decisions on interest rates. Nonetheless, the Bank plays an important role in advising the Chancellor and is closely involved in the decisions. As part of the Government's move to increase public scrutiny of policy making, the Bank now publishes a quarterly Inflation Report, which provides a detailed analysis of inflation and gives an independent assessment of prospects for inflation relative to the target. The monthly meetings between the Governor and the Chancellor to review the level of interest rates have been put on a formal footing, and the minutes, which include the Governor's advice, are now published six weeks after the meetings take place. Once policy is decided, the Bank implements it by means of its operations in the financial markets described below. Although the decision on whether, and by how much, to change interest rates is the Chancellor's, the Bank has discretion over the precise timing of the changes. Unless there is a compelling reason to delay, the Bank will act sooner rather than later. Interest Rates The Bank's influence on short-term interest rates arises from its role inthe domestic money markets. As banker to the government and to the banks, it is able to forecast fairly accurately the pattern of flows between the government's accounts on the one hand and the commercial banks on the other, and acts on a daily basis to smooth out the imbalances, which arise. When more money flows from the banks to the government than vice versa, the banks' holdings of liquid assets are run down and the money market finds itself short of funds. When more money flows the other way, the market can be in cash surplus, but the pattern of government and Bank operations usually results in a shortage of cash in the market each day - a shortage which the Bank then relieves. Because the Bank is the final provider of liquidity to the system, it can choose the interest rate at which it will provide funds each day. Rather than deal directly with every individual bank, the Bank uses the discount houses as an intermediary. These are highly-specialized dealers who hold large stocks of commercial bills and with whom the major banks place their surplus cash. The discount houses have borrowing facilities at the Bank. The Bank may provide cash either by purchasing securities from the houses, or by lending to them direct. The rates at which the Bank deals with the discount houses are quickly passed on through the financial system, influencing interest rates for the whole economy. When the Bank changes its dealing rate, the commercial banks promptly change their own base rates from which deposit and lending rates are calculated. The Exchange Rate Interest rates affect domestic monetary conditions and thus borrowing, consumer demand, investment, output and ultimately prices. They can also have an effect on the value of sterling in terms of foreign currencies. Other things being equal, higher interest rates will tend to attract foreign funds into sterling, and thus increase the sterling exchange rate against other currencies. The Bank can try to influence the exchange rate using the country's gold and foreign exchange reserves. Management of the reserves is carried out by the Bank on behalf of the Treasury. The reserves are held in a government account called the Exchange Equalization Account, which was set up in the 1930s after Britain left the gold standard: its purpose was and remains to check undue fluctuations in the external value of sterling. This process, known as intervention, involves the Bank buying sterling in exchange for foreign currencies when it wants to curb a fall in sterling - or alternatively selling sterling if it wants to curb a rise. These operations cannot exactly determine the course of sterling in the markets: there are many other influences, and commercial dealers can exert very substantial upward or downward pressure on a currency which official intervention on its own may have difficultly reversing. As a member of the ERM from 8 October 1990, the UK was obliged to keep sterling within agreed bands relative to other European currencies. The UK's membership of the ERM was suspended on 16 September 1992, since when sterling has been allowed to float freely against other currencies. Other Policy Instruments Short-term interest rates and foreign exchange market intervention are the principal instruments of UK monetary policy. Other techniques have been used in the past. In the early 1980s, for example, the Bank sold more government debt than was necessary to fund the government's borrowing requirement, in order to reduce the growth of the broad money supply. This policy of overfunding was abandoned in 1985. Other techniques, now abandoned, have included the imposition of quantitative ceilings on banks' lending (abolished in 1971), requirements on banks to place special deposits with the Bank of England according to how fast their deposits were growing (ended in 1980), and guidance on bank lending, aimed at discouraging loans to consumers. In practice, only market-based instruments have been found to be effective, and as markets have become increasingly open - particularly since the abolition of exchange controls in 1979 - direct methods of monetary management are increasingly unlikely to work.

I. Key terms

II. Answer the following questions in your own words: 1. What is the first objective of any central bank? 2. Does the Bank act independently of government? 3. How often are meetings between the Governor and the Chancellor held? 4. What is the role of the Bank in the domestic money markets? 5. What organization does the Bank use as an intermediary rather than deal directly whith every individual Bank? 6. What do intrest rates affect? 7. How can the Bank try to influence the exchange rate? 8. What are the principal instruments of UK monitory policy? III. Fill in the blanks in this passage, using words from the list given below:

facility, arrangements, supervisory regime, auction bidding, capital, counterparties, forecasts, gilt repo, were allowed.

First the Bank decided to use ________ in its daily operations as an instrument to provide liquidity to the market. Hitherto, gilt repo had been used only as the basis for a twice-monthly ________. Second, the Bank chose to broaden the range of _______ with which it is prepared to deal beyond the small group of discount houses to include those banks, building societies and securities houses active in either the bill or gilt repo markets, so long as they met a number of functional criteria. Transitional _________ were made available for discount houses that chose to continue as counterparties. Third, technical changes to the Bank's end-of-day operations were introduced to allow the use of later and more accurate ________ of the market's liquidity position. Finally, the Bank ended the requirement that its money market counterparties should be separately capitalised, specialised intermediaries subject to a special ______ _____. At the same time, the requirement of separate capitalisation was dropped for the gilt-edged market makers (GEMMs), the Bank's counterparties in the gilt market, opening the way for group restructuring and a more effective use of ______ during 1997. Several changes were effected in the gilt market to build on the more structured auction programme introduced in 1995 and the open gilt repo market inaugurated in January 1996. The GEMMs ______ ______ to make more bids at auctions in the last moments before bidding closed, and to bid non-competitively for up to 0.5% each of the stock on offer. Both facilities were widely used, and contributed to an increase in ______ _______. In July 1996, the Bank opened its "Shop Window" for sales to GEMMs of residual official holdings of stocks.

IV. Summarize the following text in English in about 50 words:

Проведення монетарної політики, тобто визначення, головним чином, рівня процентних ставок, що забезпечують досягнення інфляційної мети, покладене на Банк Англії і Казначейство (Банк Англії на відміну від інших банків не може діяти незалежно від уряду). Прийнятий в 1946 році Акт Банку Англії дає Казначейству право випускати вказівки Банку Англії і хоч Казначейство ніколи це право не використало, відносини між ними такі, що фінальне рішення зприводу процентних ставок приймає Міністр Фінансів. Проте, Банк Англії грає дуже важливу роль в прийнятті рішення. Тепер Банк Англії публікує квартальний Звіт по інфляції (Inflation Report), який містить докладний аналіз інформації, а також протокол зустрічі Міністра і Керівника публікується через 6 тижнів після їх зустрічі з приводу процентних ставок. При підготовці Звіту по інфляції і процентним ставкам Банк Англії бере до уваги внутрішні і зовнішні економічні і монетарні чинники, які будуть стосуватися інфляції майбутніх двох років. Порада Банку по процентних ставках містить інформацію про зміни, що впливають на промисловість і торгівлю в різних регіонах Англії, що надається агентами Банк Англії.

V. Join the halves.

On the left there are six halves of the sentences. On the right there are the other halves of the sentences, though not in the same order. You are required to make complete sentences.

VI. Meanings. Read the passage below and explain the meanings of the words and phrases, which have been underlined.

The collaborative development with the Association for Payment Clearing Services (APACS) of a Real-Time Gross Settlement system (RTGS) for sterling payments, an evolution from the previous CHAPS system, was referred to in last year's report. This work came to fruition in April 1996 when the new arrangements were inaugurated. RTGS involves the final settlement in central bank funds of each payment passing through CHAPS at the time it is made, rather than on a net basis at the end of each day. At the end of November 1996, a record 127,000 payments passed through CHAPS on a single day. The project to develop RTGS was one of a series of initiatives to reduce systemic risks in the operation of the payment and settlement systems in the United Kingdom. In the first half of 1996, the Division took part in a strategic-review, carried out by the Bank, to identify how best to progress these initiatives.Some key elements of strategy to emerge from this review, upon which work has continued, were as follows:- First, to complete the work on upgrading the Central Gilts Office (CGO) gilt settlement system. This system was originally implemented in 1986, at the time of Big Bang, and although it has worked satisfactorily for ten years it is in need of enhancement. Following a period of consultation with the market, it was announced, in 1995, that the system would be upgraded using the software designed for CREST, the equity settlement system.

VII. Complete the sentences using your own words:

1. The first objective of any central bank is …… 2. Monetary policy operates in the UK mainly through ….. 3. Setting monetary policy - deciding on the level of interest rates necessary to meet the inflation target - …… 4. As part of the Government's move to increase public scrutiny of policy making, ……… 5. The minutes, which include the Governor's advice, are now ……. 6. Although the decision on whether, and by how much, to change interest rates is the Chancellor's, …….. 7. When more money flows from the banks to the government than vice versa, the banks' holdings of liquid assets are run down and ………. 8. Interest rates affect …………. 9. The reserves are held in a government account called the Exchange Equalization Account, which was set up in …………. 10. Short-term interest rates and foreign exchange market intervention are ……

UNIT II

THE UK MONEY AND BANKING MARKETS

TEXT A THE UK BANKING MARKET

The banking and money markets in the UK, like their respective markets in the United States, are not two distinctive mutually exclusive markets. Rather, they overlap each other substantially. We define the banking market in terms of major market participants — banks in this case — whereas we define the money market in terms of financial instruments traded. Since banks are also important dealers of money market instruments, it is natural that the two markets overlap. First we examine the characteristics of the British banking market, focusing our attention on the type of banks and their major activities. We will also point out the mode of operation should it be significantly different from those in other markets.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Последнее изменение этой страницы: 2016-08-26; просмотров: 395; Нарушение авторского права страницы; Мы поможем в написании вашей работы! infopedia.su Все материалы представленные на сайте исключительно с целью ознакомления читателями и не преследуют коммерческих целей или нарушение авторских прав. Обратная связь - 13.59.69.109 (0.012 с.) |

Report & Accounts

Report & Accounts