Заглавная страница Избранные статьи Случайная статья Познавательные статьи Новые добавления Обратная связь FAQ Написать работу КАТЕГОРИИ: ТОП 10 на сайте Приготовление дезинфицирующих растворов различной концентрацииТехника нижней прямой подачи мяча. Франко-прусская война (причины и последствия) Организация работы процедурного кабинета Смысловое и механическое запоминание, их место и роль в усвоении знаний Коммуникативные барьеры и пути их преодоления Обработка изделий медицинского назначения многократного применения Образцы текста публицистического стиля Четыре типа изменения баланса Задачи с ответами для Всероссийской олимпиады по праву

Мы поможем в написании ваших работ! ЗНАЕТЕ ЛИ ВЫ?

Влияние общества на человека

Приготовление дезинфицирующих растворов различной концентрации Практические работы по географии для 6 класса Организация работы процедурного кабинета Изменения в неживой природе осенью Уборка процедурного кабинета Сольфеджио. Все правила по сольфеджио Балочные системы. Определение реакций опор и моментов защемления |

The position of building societies relative to retail banksСодержание книги

Поиск на нашем сайте

The rationale for the 1986 Building Societies Act was that the building societies should be allowed to engage in a wider range of Financial services, including forms of lending and sources of funds. This was perceived as being necessary because if they were restricted to their original activities they would not be able to compete with other financial institutions and hence their share of the retail financial services market would inevitably decline. The changes brought about by the 1986 Act have caused the majority of building societies to become much more generalised retail financial services organisations. However, as we noted above, restrictions remain on what building societies can do, and some of these — particularly the restrictions on the extent of lending other than as Class 1 assets and the extent of wholesale funding - are seen by some as being prejudicial to the future prosperity of building societies. As a consequence of the 1986 Act there has been a substantial convergence of the retail banks and the building societies in the field of retail financial services for the personal sector. Several of the larger building societies are members of the clearing house system, offer interest-bearing current accounts, personal loans, overdraft facilities and credit cards, as well as several of the non-banking services permitted under the 1986 Act. One society (the Alliance & Leicester) bought Girobank - although it is highly likely to become a bank itself in 1997. Also, the Cheltenham & Gloucester still operates as a separate entity to that of its owner - Lloyds Bank. Outside the personal sector, however, this convergence of retail hanks and building societies has been very much less. A significant proportion of retail banks' lending is to the corporate sector, compared with only a tiny proportion for building societies. In addition, the retail banks offer a diverse set of services to the corporate sector. The retail banks are also involved in international activities to a substantial degree, whereas the building societies have virtually no involvement. Part of the remaining differences between building societies and retail banks is, of course, due to the different regulatory frameworks involved. Given that the convergence of activities of separate institutions over time tends to identify anomalies in the regulatory frameworks, it is likely that increased harmonisation of these frameworks will occur, and that further convergence of activities will result.

1. What is the primary purpose of building societies? 2. What was the importance of the Building Societies Act 1986 to building societies' lending activities? 3. State the advantages to a building society of converting to pie status. 4. Examine the disadvantages to a building society of converting to pie status. 5. How did the Building Societies Act 1986 affect the range of financial services which building societies are allowed to offer? 6. List the ways in which building societies have converged with retail banks in recent years. 7. Describe the areas of activity in which building societies and retail banks are still markedly different.

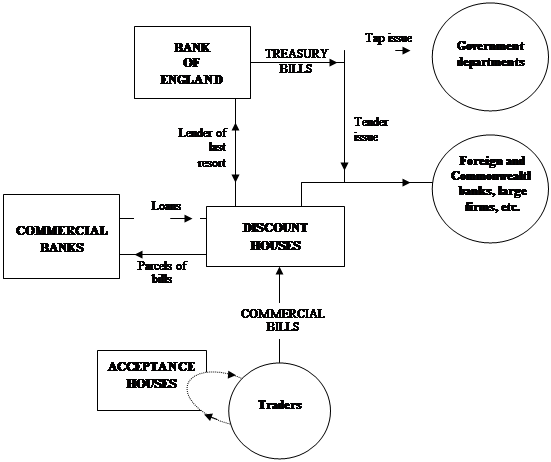

VIII. Analyse the following charter:

IX. Make an overview of the following text in English:

Other deposit-taking intermediaries Finance houses These are hybrid financial intermediaries, many of them having evolved from hire purchase (HP) companies. HP companies financed themselves by raising share capital, taking deposits from the general public and borrowing from banks. These funds were used to buy assets, which were paid for by companies and people borrowing on TIP': after the last payment was made (usually It was £ 1 more than the others), the ownership of the machine or car passed to the company or individual concerned. Most HP companies later broadened (heir activities into the products mentioned in the next paragraph and became known as finance houses. Today, most finance houses do not accept deposits from the public, although some are owned by retail banks which offer deposits with their finance house subsidiaries as a ‘home' for larger sums of money. Moreover, they have moved into other activities, so that their lending activities comprise: - Traditional HP business; - Factoring of book debts; - Leasing - 'small-ticket' business on machinery and equipment of up to say, £50,000 per item; - Second mortgage finance for double glazing, conservatories, kitchens, bathrooms and the like. Credit unions These are, in general, very small scale savings and lending societies. Members are usually linked by neighbourhood, religion or employment, with members saving regular amounts each week: interest is paid gross of tax. The other main activity is lending, with a statuary maximum interest rate of 1% per month. Members may borrow up to £5,000 plus another £5,000 providing that they have £5.000 in savings with the union. The membership of a credit union may not exceed 5,000. Credit unions are supervised by the Registrar of Friendly Societies, under the Credit Union Act 1979. They are fairly important in Northern Ireland, but die of very limited significance in Great Britain. However, they are more important in Ireland, Canada. USA and Australia. (They are mentioned here only for the sake of completeness.)

|

|||||||

|

Последнее изменение этой страницы: 2016-08-26; просмотров: 385; Нарушение авторского права страницы; Мы поможем в написании вашей работы! infopedia.su Все материалы представленные на сайте исключительно с целью ознакомления читателями и не преследуют коммерческих целей или нарушение авторских прав. Обратная связь - 3.128.94.112 (0.006 с.) |