Заглавная страница Избранные статьи Случайная статья Познавательные статьи Новые добавления Обратная связь FAQ Написать работу КАТЕГОРИИ: ТОП 10 на сайте Приготовление дезинфицирующих растворов различной концентрацииТехника нижней прямой подачи мяча. Франко-прусская война (причины и последствия) Организация работы процедурного кабинета Смысловое и механическое запоминание, их место и роль в усвоении знаний Коммуникативные барьеры и пути их преодоления Обработка изделий медицинского назначения многократного применения Образцы текста публицистического стиля Четыре типа изменения баланса Задачи с ответами для Всероссийской олимпиады по праву

Мы поможем в написании ваших работ! ЗНАЕТЕ ЛИ ВЫ?

Влияние общества на человека

Приготовление дезинфицирующих растворов различной концентрации Практические работы по географии для 6 класса Организация работы процедурного кабинета Изменения в неживой природе осенью Уборка процедурного кабинета Сольфеджио. Все правила по сольфеджио Балочные системы. Определение реакций опор и моментов защемления |

To practice price discrimination you need to be able to (1) distinguish between at least two sets of buyers and (2) prevent one set of buyers from reselling the product to another set.Содержание книги

Поиск на нашем сайте

Monopolistic competitors do compete with respect to price, but they compete still more vigorously with respect to ambience, service, and the rest of the intangibles that go along with attracting customers. To the degree that they're successful, they have gotten you to differentiate their product from all the others. That is what monopolistic competition is all about. LECTURE 6: OLIGOPOLY 1.Oligopoly Definition 2.Concentration ratios 3.The competitive spectrum 4.The kinked demand curve 5.Administered prices

Oligopoly Definition An oligopoly is an industry with just a few sellers. The crucial factor under oligopoly is the small number of firms in the industry. Because there are so few firms, every competitor must think continually about the actions of his rivals, since what each does could make or break him. Thus there is a kind of interdependence among oligopolists. Because the graph of the oligopolist is similar to that of the monopolist, we will analyze it in exactly the same manner with respect to price, output, profit, and efficiency. Price is higher than the minimum point of the ATC curve, and output is somewhat to the left of this point. And so, just like the monopolist, the oligopolist has a higher price and a lower output than the perfect competitor. The oligopolist, like the monopolist and unlike the perfect competitor, makes a profit. With respect to efficiency, since the oligopolist does not produce at the minimum point of its ATC, it is not as efficient as the perfect competitor. Concentration ratios One way of measuring how concentrated an industry is, is to look at the percentage share of sales of the leading firms. This is called the industry's concentration ratio. Economists use concentration ratios as a quantitative measure of oligopoly. The total percentage share of industry sales of the four leading firms is the industry concentration ratio. Industries with high ratios are very oligopolistic. Two key shortcomings of concentration ratios should be noted. 1. They don't include imports. 2. The concentration ratios tell us nothing about the competitive structure of the rest of the industry. A second way is to calculate the Herfindahl-Hirschman index, which, it turns out, is a lot easier to do than to say. The Herfindahl-Hirschman Index (HHI). The Herfindahl-Hirschman index (HHI) is the sum of the squares of the market shares of each firm in the industry. Find the HHI of an industry with just two firms, both of which have 50 percent market shares. Work it out right here: 502 + 502 = 2,500 + 2,500 = 5,000

The Competitive Spectrum

Cartel An extreme case of oligopoly is a cartel, where the firms behave as a monopoly in a manner similar to that of the Organization of Petroleum Exporting Countries (OPEC) in the world oil market.

Figure 1. Cartel Open Collusion. Slightly less extreme than a cartel would be a territorial division of the market among the firms in the industry. This would be a division similar to that of the Mafia, if indeed there really is such an organization. An oligopolistic division of the market might go something like this.

Figure 2. The Colluding Oligopolist

Figure 3. The Competitive Spectrum The Kinked Demand Curve

Now we deal with the extreme case of oligopolists who are cutthroat competitors, firms that do not exchange so much as a knowing wink. Each is out to maximize its profits. These oligopolists are ready to cut the throats of their competitors, figuratively speaking, of course. The uniqueness of this situation leads us to the phenomenon of the kinked demand curve, pictured in Figure 4. For the first time in this course, we have a firm's demand curve that is not a straight line.

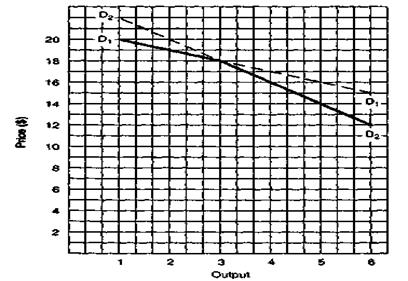

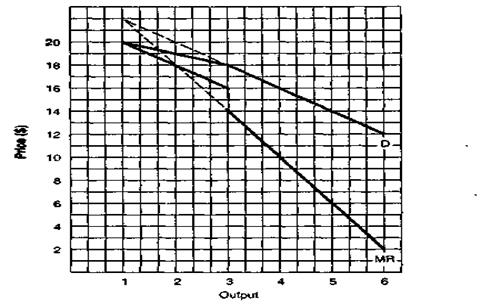

Figure 4. The kinked demand curve Let's examine the kinked demand curve a little more closely. It's really two demand curves in one, the left segment being relatively elastic (or horizontal) and the right less elastic (more vertical). In Figure 5, both segments of the demand curve have been extended. This was done to set up the next step, the MR curves of Figure 6. Before we can figure out the oligopolist's actual MR curve, we'll have to see how each of the MR curves in Figure. 6 is drawn.

Figure 5

Figure 6

Figure 7 Using the data from Table 1, draw the firm's demand and MR curves. A very tricky part comes when we do the MR curve at its discontinuity (when it drops straight down). This part always lies directly below the kink in the demand curve. Table 1 Hypothetical Demand Schedule for Competing Oligopolist

Figure 8 How much are output, price, and total profit (table 2, figure 9)? Output, which is directly under the kink, is 4. Price, which is at the kink, is$27. Remember that price is always read off the demand curve. And now, total profit: Total profit = (Price - ATC) x Output= ($27 - $24) x 4 = $3x4 = $12 Table 2 Hypothetical Demand and Cost Schedule for Competitive Oligopolist

Figure 9 Can you come up with an easier way of finding the firm’s total profit? Look at Table 2 again. Just subtract total cost from total revenue at an output of 4 ($108 — $96 = $12). Once you know the output, all you need to do is subtract TC from TR.

Administered Prices

Administered prices are set by large corporations for relatively long periods of time, without responding to the normal market forces, mainly, changes in demand. Summary

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Последнее изменение этой страницы: 2016-09-13; просмотров: 309; Нарушение авторского права страницы; Мы поможем в написании вашей работы! infopedia.su Все материалы представленные на сайте исключительно с целью ознакомления читателями и не преследуют коммерческих целей или нарушение авторских прав. Обратная связь - 3.145.166.223 (0.008 с.) |