Заглавная страница Избранные статьи Случайная статья Познавательные статьи Новые добавления Обратная связь FAQ Написать работу КАТЕГОРИИ: ТОП 10 на сайте Приготовление дезинфицирующих растворов различной концентрацииТехника нижней прямой подачи мяча. Франко-прусская война (причины и последствия) Организация работы процедурного кабинета Смысловое и механическое запоминание, их место и роль в усвоении знаний Коммуникативные барьеры и пути их преодоления Обработка изделий медицинского назначения многократного применения Образцы текста публицистического стиля Четыре типа изменения баланса Задачи с ответами для Всероссийской олимпиады по праву

Мы поможем в написании ваших работ! ЗНАЕТЕ ЛИ ВЫ?

Влияние общества на человека

Приготовление дезинфицирующих растворов различной концентрации Практические работы по географии для 6 класса Организация работы процедурного кабинета Изменения в неживой природе осенью Уборка процедурного кабинета Сольфеджио. Все правила по сольфеджио Балочные системы. Определение реакций опор и моментов защемления |

Ex. 16. Go to the library and study regulations (constitutions and rules) that govern securities markets. Present your findings in class.Содержание книги

Поиск на нашем сайте

READING PRACTICE Ex. 17. a) Look through the text below and say what the figures in the text stand for. b) Reread the text carefully and explain what the Fourth Market implies and what prompted its emergence. Third and Fourth Markets

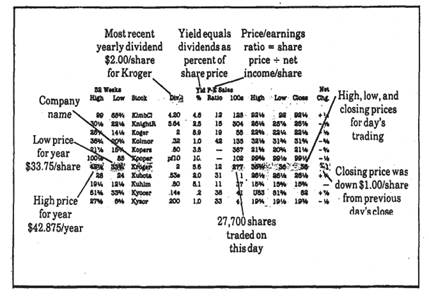

Until the 1970s the New York Stock Exchange required its member firms to trade all NYSE-listed stocks at the exchange and to charge fixed commissions. For large institutions this was expensive. In particular, the existence of a required minimum commission rate created a serious problem since it exceeded the marginal cost of arranging large trades. Brokerage firms that were not members of the exchange faced no restrictions on the commissions they could charge and thus could compete effectively for large trades in NYSE-listed stocks. Such transactions were said to take place in the third market. More generally, the term "third market" now refers to the trading of any exchange-listed security in the over-the-counter market. The existence of such a market is enhanced today by the fact that its trading hours are not fixed (unlike exchanges), and that it can continue to trade securities even when trading is halted on an exchange. On average 18 million shares were traded in the third market during each day of 1992. Until 1976 NYSE member firms were prohibited by Rule 394 from either acting as dealers in the third market or executing orders involving NYSE-listed securities for their customers in the third market. In 1976, Rule 394 was replaced by Rule 390, which permits the execution of these orders in the third market but still prohibits member firms from acting as dealers in the third market. However, the Securities and Exchange Commission has issued a rule that permits member firms to act as dealers in securities that became listed on the NYSE after April 26, 1979. Controversy still exists over Rule 390, as some people argue that it should be abolished completely to spur competition between the NYSE and the over-the-counter market, whereas others argue that having all orders funnelled to the NYSE will lead to the most competitive marketplace possible. Many institutions have dispensed with brokers and exchanges altogether for transactions in exchange-listed stocks and other securities. Trades of this type, where the buyer and seller deal directly with each other, are sometimes said to take place in the fourth market. In the United States some of these transactions are facilitated by an automated computer/communications system called Instinet, which provides quotations and execution automatically. A subscriber can enter a limit order in the computerized "book", where it can be seen by other subscribers who can, in turn, signal their desire to take it. Whenever two orders are matched, the system automatically records the transaction and sets up the paperwork for its completion. Subscribers can also use the system to find likely partners for a trade, then conduct negotiations by telephone. In recent years automated electronic facilities have been developed to permit institutional investors to trade portfolios of stocks directly with each other. Words you may need: third market «третий рынок» (торговля ценными бумагами, зарегистрированными на фондовой бирже или на внебиржевом рынке брокерами, не являющимися членами биржи, и другими инвесторами) fourth market «четвертый рынок» (торговля ценными бумагами между инвесторами без участия брокера/дилера) funnel v (зд.) направлять, пропускать dispense (with) v обходиться (без чего-л.) limit order лимитный приказ (приказ клиента брокеру с ограничительным условием, например, максимальной или минимальной ценой) Ex. 18. a) Read the text below quickly and name organizations involved in the issues, b) Reread the text more carefully to find the answer to the question: What can guarantee the success of the issue? The New Issue Market

The mere buying of securites traded on the Stock Exchange does not create new capital. The stock exchange does not itself issue new shares to the public. Fresh capital is provided through the mechanism known as the New Issue Market. The Market has no outward formal organization or fixed place of business. Nevertheless it functions efficiently on the basis of a number of institutions working together: issuing houses, joint-stock banks, merchant bankers, insurance companies, stockbrokers, underwriters and others. Issuing houses have become very active in the New Issue Market recently. An issuing house is a financial firm specializing in the issuing or floating of new securities for governments, municipalities and companies. Although this activity is not directly connected with the Stock Exchange, the Exchange is vitally interested in the activities of issuing houses; and the people who own and operate issuing houses have often been members of stock exchanges. The issuing house undertakes that the whole of a new issue of securities should be sold and makes all necessary arrangements for it. It is charged with the entire "handling" procedure of the issue: this includes the arrangements for banks, other financial houses to share in the underwriting (only in a few cases do issuing houses underwrite the entire amount themselves); arrangements for the drawing up and publication of the prospectus. Yet, even the most careful and competent handling will not guarantee the success of an issue. This depends on the attitude of the investing public, who will be guided very much by the reputation of the issuing house itself. Issuing houses make arrangements with underwriters, who guarantee, for a commission, that if the public does not subscribe fully to the new issue the underwriters take up the remaining shares or stock. Underwriting is a process whereby a group of investment bankers agree to purchase a new security issue at a set price and then offer it for sale to the general public. Words you may need: new issue market рынок новых эмиссий mere adj простой outward adj внешний issuing house эмиссионный дом underwriter n гарант размещения ценных бумаг floating n выпуск (акций через биржу) "handling" procedure (зд.) выполнение всех формальностей Ex. 19. Study the financial section from a newspaper, which includes information about the stock prices of listed companies, and explain how to read stock quotations:

UNIT 10.INVESTMENT ACTIVITY A. TEXT INVESTMENTS

In economic science, investment is capital expenditure on physical productive assets, e.g. machinery, factory buildings, roads, bridges, houses, and stocks. Real investments generally involve some kind of tangible asset. As a financial term investment embraces purchases of stock exchange securities or deposits of money in banks, building societies, or other financial institutions, with a view to income and, in appropriate cases, capital gains. Users of capital, from governments to every kind of industrial or commercial joint-stock company, all depend for the supply of their financial resources on those who are willing to invest their funds, on investors. Investment is closely associated with other aspects of economic order such as the role of financial centres, labour migration, and the regime of international trade prevailing at the time. Technological advances, the removal of exchange controls and financial deregulation have all contributed to the expansion of international capital flows. As a result foreign investment has become a fundamental feature of international economic development. There are two main channels for international investment: foreign direct investment (FDI) and foreign indirect investment, or portfolio investment. Foreign direct investment (FDI) occurs when citizens of one nation (the "home" nation) acquire managerial control of economic activities in some other nation (the "host" nation). Setting up a foreign operation through a joint venture, establishment of a foreign branch or the purchase or formation of a foreign subsidiary are examples of foreign direct investment. Firms controlling activities in several nations have become known as "multinational enterprises" (MNSs), "transnational corporations" (TNCs) and, more recently, "global corporations". The reasons why effects of FDI are generally assessed as positive can be summarized as follows: first, FDI speeds the international diffusion of new technologies and other efficiency enhancing intangible assets, such as organizational skills. Then, FDI in many national markets will stimulate competition among firms. The process of supplying capital to a foreign institution, through a loan or purchase of stock, without sharing in the institutions management is foreign indirect investment. In financial circles, individuals or households that own securities are known as individual investors. Along with them, there are institutional investors. Institutional investors are a group of investors who have funds to invest as a consequence of the conduct of their business. The group includes insurance companies, banks, investment trusts, financial and industrial companies. The past 30 years have witnessed a concentration of financial power in the hands of institutional investors. In 1990 they controlled over $6 trillion hi assets, the majority invested in common stock and corporate and government bonds. An investor, when confronted with a list of investment possibilities, will want to assess the risks and general advantages and disadvantages connected with putting his or her money into this or that security. To receive higher return, investors must be prepared to accept a higher level of risk. Trying to limit or minimize the risk investors construct and diversify portfolios and spread their foreign investments among a number of different countries. Institutional investors have contributed to development of new types of investment management techniques, sophisticated portfolio monitoring, have pioneered the application of quantitative security valuation techniques, such as dividend discount models. In spite of the existing obstacles, recent years have seen a growing interest of foreign investors in the Russian market. B. DIALOGUE INVESTMENT CLIMATE Russian: How do you assess the investment climate in your country? Foreigner. As quite favourable. Foreign investments have been flowing into our country at an accelerating rate since we started our transition to a market economy. R.: Who invests capital in your country? F.: Both foreign companies and individuals. The US heads the list of the major investors. The investment policy pursued by the government focuses on foreign direct investments, I mean setting up joint ventures and establishing foreign branches or subsidiaries. R.: What is the major reason for this striking growth of foreign investments? F.: Investors are willing to invest because of two reasons: increase in the middle class that is driving economic development, and the decrease in politically motivated interference in the free market. R.: Do you think the situation will continue? F.: Definitely, the government have announced plans to privatize the banking, insurance, power, oil, steel and telecommunications industries, which is sure to encourage still more capital inflows. R.: We know that your investment policy envisages setting up special economic zones as an additional vehicle for attracting foreign funds. Has anything been done in this direction yet? F.: Our National Technology Park has been designated for this purpose. There are highly trained workers, scientific and production facilities in this locality. R.: Will the local companies benefit from this? F.: Of course. The benefits will include exemptions from all real estate taxes, as well as several options for the reduction of income taxes. R.: It's been very interesting, thank you. VOCABULARY LIST A. investment activity инвестиционная деятельность capital expenditure physical real investment инвестиции в реальный (основной) капитал tangible embrace capital gains прирост капитала user п пользователь investor n инвестор labour migration prevailing exchange control financial deregulation international capital flows движение иностранного капитала international investment иностранные инвестиции foreign direct investment (FDI) прямые иностранные инвестиции foreign indirect investment непрямые иностранные инвестиции portfolio investment портфельные инвестиции managerial operation n (зд.) организация, хозяйствующая единица joint venture foreign branch заграничное отделение multinational enterprise многонациональная компания transnational "global" corporation «глобальная» корпорация speed v ускорять diffusion skill(s) n навык(и) sharing individual institutional investor институциональный инвестор investment management управление портфелем ценных бумаг technique(s) quantitative dividend discount obstacle В. investment climate flow v течь at an accelerating middle class interference envisage designate real estate tax option n выбор, право выбора EXERCISES Ex. 1. Answer these questions:

A. 1. What is investment? 2. Define the difference between real investment and financial investment. 3. In what ways can financial resources be raised? 4. Why does FDI take place? 5. What institutions handle investment in stocks and shares? 6. What role do institutional investors play? 7. How do investors make their choice of investment possibilities? B. 1. How does the foreigner characterize the investment climate in his country? 2. What country heads the list of the major investors? 3. Why are foreign investors willing to invest in the country? 4. What are the focal points of the country's investment policy? Ex. 2. Give derivatives of:

Ex. 3. Find English equivalents for the following Russian phrases from the text:

A. инвестиции представляют собой вложение капитала; реальные инвестиции связаны с материальными активами; финансовые инвестиции связаны с приобретением ценных бумаг; депонирование средств в банках; пользователи; миграция рабочей силы; режим международной торговли, существующий в определенный момент; успехи в области технологии; отмена валютных ограничений; сокращение объема вмешательства государства в финансовую сферу; расширение международных финансовых потоков; основная черта международного экономического развития; прямые иностранные инвестиции; портфельные инвестиции; приобретать управленческий контроль; организация совместных предприятий; иностранное отделение фирмы; организация иностранного филиала фирмы; многонациональная компания; ускорять распространение новых технологий; организационные навыки; участвовать в управлении; частные и институциональные инвесторы; способы управления портфелем ценных бумаг; B. переход к рыночной экономике; в центре инвестиционной политики, проводимой правительством, находится...; рост среднего класса; политическое вмешательство; объявить о планах проведения приватизации; политика предусматривает; быть освобожденным от налогов.

|

||||||||||||||||||||||||

|

Последнее изменение этой страницы: 2016-04-19; просмотров: 377; Нарушение авторского права страницы; Мы поможем в написании вашей работы! infopedia.su Все материалы представленные на сайте исключительно с целью ознакомления читателями и не преследуют коммерческих целей или нарушение авторских прав. Обратная связь - 3.22.79.165 (0.007 с.) |

капиталовложения, вложение капитала

капиталовложения, вложение капитала productive assets

productive assets  материальные, производственные фонды

материальные, производственные фонды assets материальные активы

assets материальные активы v охватывать

v охватывать миграция рабочей силы

миграция рабочей силы adj превалирующий, преобладающий

adj превалирующий, преобладающий валютный контроль

валютный контроль сокращение объема вмешательства государства в финансовую сферу

сокращение объема вмешательства государства в финансовую сферу control административный контроль

control административный контроль совместное предприятие

совместное предприятие corporation транснациональная корпорация

corporation транснациональная корпорация n распространение

n распространение (in) участие (в)

(in) участие (в) investor частный инвестор

investor частный инвестор прием(ы), технологии

прием(ы), технологии security valuation количественная оценка инвестиционных активов

security valuation количественная оценка инвестиционных активов models модели дисконтирования финансовых потоков (дивидендов)

models модели дисконтирования финансовых потоков (дивидендов) n преграда, препятствие

n преграда, препятствие инвестиционный климат

инвестиционный климат rate все увеличивающимися темпами

rate все увеличивающимися темпами средний класс

средний класс n (зд.) вмешательство

n (зд.) вмешательство v предусматривать

v предусматривать v определять, обозначать

v определять, обозначать налог на недвижимость

налог на недвижимость