Заглавная страница Избранные статьи Случайная статья Познавательные статьи Новые добавления Обратная связь FAQ Написать работу КАТЕГОРИИ: ТОП 10 на сайте Приготовление дезинфицирующих растворов различной концентрацииТехника нижней прямой подачи мяча. Франко-прусская война (причины и последствия) Организация работы процедурного кабинета Смысловое и механическое запоминание, их место и роль в усвоении знаний Коммуникативные барьеры и пути их преодоления Обработка изделий медицинского назначения многократного применения Образцы текста публицистического стиля Четыре типа изменения баланса Задачи с ответами для Всероссийской олимпиады по праву

Мы поможем в написании ваших работ! ЗНАЕТЕ ЛИ ВЫ?

Влияние общества на человека

Приготовление дезинфицирующих растворов различной концентрации Практические работы по географии для 6 класса Организация работы процедурного кабинета Изменения в неживой природе осенью Уборка процедурного кабинета Сольфеджио. Все правила по сольфеджио Балочные системы. Определение реакций опор и моментов защемления |

You're Buying (or Selling) OneСодержание книги

Поиск на нашем сайте Under current law, homeowners can deduct the interest on a mortgage of up to $1,000,000, or $500,000 for married taxpayers filing separately. Now, anyone who takes out a mortgage between December 15, 2017, and December 31, 2025, can only deduct interest on a mortgage of up to $750,000, or $375,000 for married taxpayers filing separately. Taxpayers who continue to itemize need to be aware of changes beginning with the 2018 tax year. • Casualty and Theft Losses. These are no longer tax deductible unless they are related to a loss in a federally declared disaster area – think hurricane, flood and wildfire victims. • Medical Expenses. The threshold for deducting medical expenses temporarily goes back to 7.5% from 10%, and that change applies to 2017 taxes, unlike the bill’s other changes, which mostly don’t kick in until 2018. But the change only applies through 2019. After that, the 10% threshold returns. This change particularly helps those with low incomes and high medical expenses. • State and local taxes. Taxpayers can deduct a maximum of $10,000 from the total of their state and local income taxes or sales taxes, and their property taxes (added together), a measure that might hurt itemizers in high-tax states such as California, New York and New Jersey. The $10,000 cap applies whether you are single or married filing jointly; if you are married filing separately, it drops to $5,000.

By Amy Fontinelle | Updated February 14, 2018 INVESTOPEDIA

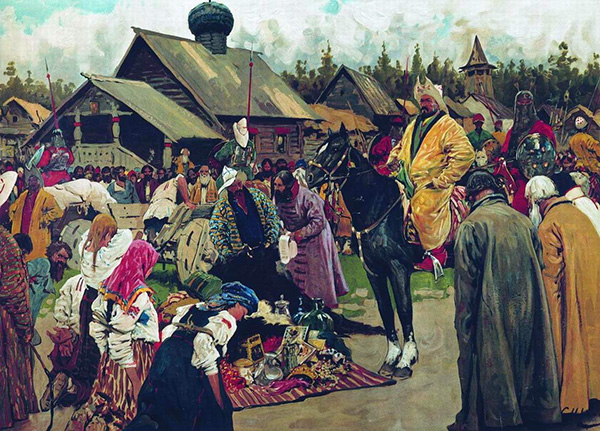

https://www.investopedia.com/taxes/how-gop-tax-bill-affects-you/?utm_source=personalized&utm_campaign=www.investopedia.com&utm_term=12160023&utm_medium=email Taxes throughout Russian history Tribute to the Golden Horde In the XIII century after the conquest of Russia by the Golden Horde, the tribute to the foreign ruler became a hard burden that Russian people had to bear. The collection of tributes began after the population census conducted in 1257-1259. Mongols levied tribute on the conquered lands: they took a tenth of the clothing, footwear, utensils, livestock, oil, grain and other supplies as well as men or women.

As unit of taxation, the Mongol Khan established a yard in cities and a farm in rural areas. As a whole, there were 14 types of "Horde burdens" of which the most important were: the tax directly to the Mongol Khan ("Tsar tribute"); trading fees ("strangles"); transportation taxes ("carts"); contributions to the Mongol ambassadors ("food"), and others. Every year a huge amount of silver was sent from the Russian lands as tribute. Moscow city amounted to 5-7 thousand silver rubles, the taxes from Novgorod city were worth 1.5 thousand rubles. These levies sapped the economy of Russia, hindered the development of commodity-money relations. Political unification of Russia around Moscow created the conditions for the elimination of foreign dependence. In 1476 Grand Prince Moscow, Ivan III (1440-1505) completely abandoned the payment of tribute. Although the Golden Horde brought violence, Russians saw some economic benefits. With Mongol protection, Russian merchants could travel to the Caspian and Black seas to trade with Persian and Turks. The Russians offered furs and grains, and the fur trade helped turn Moscow into a major city. Goods also flowed through the Golden Horde’s lands on their way to Egypt. The commerce included glass, pottery, and slaves. The Mongols encouraged international trade since they collected taxes on it. Starting in the 14th century, Moscow developed into the center of Russian military and political power. Even after the princes of Moscow were able to throw off Golden Horde, they kept some of the Mongol methods for collecting taxes, organizing the government, and running the army. In fact, the Russians borrowed the commercial tax ( tamga ), the tribute (vykhod, later called the dan'), and other levies. The Mongol influence lasted until the late 17th century, when Peter the Great eliminated systems that were based on Mongol practices and replaced them with European methods of government.

READING COMPREHENSION Make up the summary of the text using the questions to organize your answer: 1. When did the collection of tributes by the Golden Horde begin? 2. How much did the Russians have to pay as a tribute? 3. Did the Mongols’ levies hinder the development of Russia? 4. Were there any economic benefits brought by the Golden Horde? 5. When were the Mongol practices of government completely eliminated?

Vocabulary notes tribute дань foreign ruler иностранный правитель census перепись contribution налог, взнос ambassador посол sap подрывать hinder препятствовать commodity-money товарно-денежные pottery керамика throw off сбрасывать UNIT 5 PART 1

|

||

|

Последнее изменение этой страницы: 2021-04-04; просмотров: 141; Нарушение авторского права страницы; Мы поможем в написании вашей работы! infopedia.su Все материалы представленные на сайте исключительно с целью ознакомления читателями и не преследуют коммерческих целей или нарушение авторских прав. Обратная связь - 216.73.216.102 (0.005 с.) |