Заглавная страница Избранные статьи Случайная статья Познавательные статьи Новые добавления Обратная связь FAQ Написать работу КАТЕГОРИИ: ТОП 10 на сайте Приготовление дезинфицирующих растворов различной концентрацииТехника нижней прямой подачи мяча. Франко-прусская война (причины и последствия) Организация работы процедурного кабинета Смысловое и механическое запоминание, их место и роль в усвоении знаний Коммуникативные барьеры и пути их преодоления Обработка изделий медицинского назначения многократного применения Образцы текста публицистического стиля Четыре типа изменения баланса Задачи с ответами для Всероссийской олимпиады по праву

Мы поможем в написании ваших работ! ЗНАЕТЕ ЛИ ВЫ?

Влияние общества на человека

Приготовление дезинфицирующих растворов различной концентрации Практические работы по географии для 6 класса Организация работы процедурного кабинета Изменения в неживой природе осенью Уборка процедурного кабинета Сольфеджио. Все правила по сольфеджио Балочные системы. Определение реакций опор и моментов защемления |

Read the article and answer these questions.Содержание книги

Поиск на нашем сайте 1. How are tax rates being changed from 2018 through 2025? 2. What is the reason of tax brackets changes? 3. What will people have if there are tax brackets changes? 4. What is the main advantage of tax brackets in marriage? 5. How do tax brackets work if we speak about high-income households, middle-income households and low-income households? That depends. Tax rates are changing from 2018 through 2025 across the income spectrum. In 2026, the changes will expire and current rates will return, absent further legislation, though the tax brackets will have changed slightly due to inflation. The individual cuts were not made permanent. The reason given: their effect on increasing the budget deficit. The Tax Policy Center projects that everyone, on average, will save money from the tax-bracket changes. In 2018, the fourth quintile and the top 80%–95% of income earners will receive an average tax cut of about 2%. The top 95%–99% are the biggest winners, with an average tax cut of about 4%. The top 1% will see an average tax cut of a little less than 3.5%, while the top 0.1% will receive an average tax cut of a little more than 2.5%. The new tax brackets eliminate the marriage penalty. The income brackets that apply to each marginal tax rate for married couples filing jointly are exactly double those for singles. Previously, some couples found themselves in a higher tax bracket after marriage. High-Income Households The Tax Policy Center’s analysis shows that the biggest benefits will go to households earning $308,000 to $733,000. And those who earn more than $733,000 can expect a $50,000 tax cut. Note that the top 20% pay nearly 87% of all the federal income tax the government collects, according to the Tax Policy Center. The top 1% pay more than 43% of it, and the top 0.1% pay more than 20% of it. Middle-Income Households In 2018, according to the Tax Policy Center, the second quintile of income earners will get an average tax cut of a little over 1%. The third quintile will get an average tax cut of about 1.5%. Overall, middle income families can expect to save an average of $900 in taxes. The Tax Policy Center says about 90% of middle-income households will have a lower tax bill, while 7% will have a higher one. Households in the third and fourth quintiles pay about 17% of all federal income taxes. Low-Income Households The Tax Policy Center estimates that almost half of low-income households will not see their tax liability changed under the tax bill. And it estimates that in 2018, the lowest quintile of income earners would get an average tax cut of less than 0.5%, while the second quintile will get an average tax cut of a little over 1%. Note that many in the lowest brackets don’t earn enough to owe federal income tax. The Tax Policy Center says that the lowest 20% of income earners get 2.2% back in total federal income taxes paid each year, with an average tax bill of –$643. The second lowest 20% are in a similar situation. However, lower-income workers still pay Social Security and Medicare taxes, even if they don’t always pay federal income taxes.

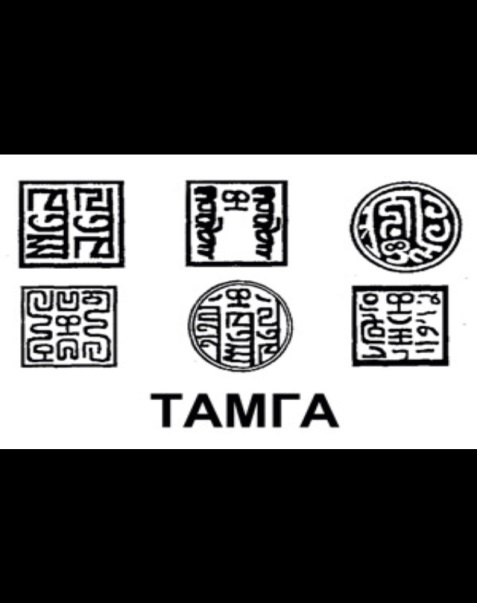

By Amy Fontinelle | Updated February 14, 2018 INVESTOPEDIA https://www.investopedia.com/taxes/how-gop-tax-bill-affects-you/?utm_source=personalized&utm_campaign=www.investopedia.com&utm_term=12160023&utm_medium=email Taxes throughout Russian history The tamga tax With their tax system, the Mongols introduced several new words into the Russian language.

The place at the fair where the duty was levied, i.e. where "customs clearing" was performed, became known as Customs and the person collecting the duty was named “a customs official”. By this time, high customs duties levied in every independent principality as well as the lack of uniform rates provoked the desire of people to trade illegally. To cope with contraband trade, a system of punishment for smuggling of goods and illegal trade was developed. The penalty for failure to pay duty amounted to 2 rubles (one ruble went to the state and another one went to the customs officers). Special penalties were provided for transportation of goods without payment of duties and for failing to report to Customs. The Russian word tamozhnia, or customs house, derives from tamga. The tamga evolvedinto the ruble tax which formed the keystone of indirect tax collection. READING COMPREHENSION Make up the summary of the text using the questions to organize your answer: 1. When did the tamga tax appear? 2. Who paid the tamga tax? On what was the tamga tax imposed? 3. What was the name of the place at the fair where the duty was levied? 4. What provoked smuggling of goods and illegal trade? 5. How was the penalty for failure to pay duty shared between the state and the customs officers?

Vocabulary notes artisans ремесленники item for sale предмет для продажи visiting merchants приезжие купцы paying the duty уплата пошлины token знак khan’s seal печать хана customs clearing таможенная очистка customs official таможенник customs duties таможенные сборы principality княжество penalties штрафы indirect tax collection сбор косвенного налога UNIT 6 PART 1

|

||

|

Последнее изменение этой страницы: 2021-04-04; просмотров: 157; Нарушение авторского права страницы; Мы поможем в написании вашей работы! infopedia.su Все материалы представленные на сайте исключительно с целью ознакомления читателями и не преследуют коммерческих целей или нарушение авторских прав. Обратная связь - 216.73.216.102 (0.006 с.) |

During the conquest of Ancient Russia by the Golden Horde t amga was the name of a tax imposed on merchants, artisans, hunters, fishermen, and others. It was a tax levied on an item for sale. Local merchants usually were not charged at all or paid a tax that was smaller than one paid visiting merchants. Upon paying the duty the merchants received the token bearing the khan’s seal that showed that merchants had paid a tax on their goods.

During the conquest of Ancient Russia by the Golden Horde t amga was the name of a tax imposed on merchants, artisans, hunters, fishermen, and others. It was a tax levied on an item for sale. Local merchants usually were not charged at all or paid a tax that was smaller than one paid visiting merchants. Upon paying the duty the merchants received the token bearing the khan’s seal that showed that merchants had paid a tax on their goods.