Заглавная страница Избранные статьи Случайная статья Познавательные статьи Новые добавления Обратная связь FAQ Написать работу КАТЕГОРИИ: ТОП 10 на сайте Приготовление дезинфицирующих растворов различной концентрацииТехника нижней прямой подачи мяча. Франко-прусская война (причины и последствия) Организация работы процедурного кабинета Смысловое и механическое запоминание, их место и роль в усвоении знаний Коммуникативные барьеры и пути их преодоления Обработка изделий медицинского назначения многократного применения Образцы текста публицистического стиля Четыре типа изменения баланса Задачи с ответами для Всероссийской олимпиады по праву

Мы поможем в написании ваших работ! ЗНАЕТЕ ЛИ ВЫ?

Влияние общества на человека

Приготовление дезинфицирующих растворов различной концентрации Практические работы по географии для 6 класса Организация работы процедурного кабинета Изменения в неживой природе осенью Уборка процедурного кабинета Сольфеджио. Все правила по сольфеджио Балочные системы. Определение реакций опор и моментов защемления |

Financial system of Russia and USA.Содержание книги

Похожие статьи вашей тематики

Поиск на нашем сайте

VARIANT 1 Financial system of Russia and USA. The financial system of the Russian Federation - a set of different spheres of financial relations, each of which is characterized by the features in the formation and use of monetary funds, a different role in social reproduction. The head of the financial system of the Russian Federation Ministry of Finance, which is the executive body ensuring implementation of a uniform financial, budgetary, fiscal and monetary policy and carrying out general management of the organization of finance in Russia. The functions perform financial activities as public authorities Federal and regional. Central Bank is a government body and performs the state management in the field of banking. The Audit Chamber is a body of financial control over the timely implementation of all articles of the federal budget. Financial institutions: Budget funds (CF). Extra-budgetary funds ACF.Decentralized Funds (DF). Insurance funds. State and municipal loans. The currency system (VDS). Finances of enterprises of different ownership forms. USA financial system- highly organized sphere of activity, which effectively delivers cash flows distribution between economic sectors and economic agents of the country. There are banking and non-banking(insurance funds,pansion funds,stocks,exchange) Institutes: USA department of Treasury(like ministry finance) Federal Reserve System(like central bank) Explain the Crowd -Out Problem in Education. How would this "solve" with the Educational Vouchers? How vouchers will lead to excessive school specialization or to Segregation? Problem with the system of public education provision is that it may crowd out private education provision. Providing a fixed amount of public education can actually lower educational attainment in society through inducing choice of lower quality public schools over higher-quality private schools. One solution to the crowd -out problem would be the use of educational vouchers, whereby parents are given a credit of a certain value (for example, the average spending on a child of a given age in the public education system) that can be used toward the cost of tuition at any type of school, public or private. The first argument in favor of vouchers is that vouchers allow individuals to more closely match their educational choices with their tastes. The second argument in favor of vouchers is that they will allow the education market to benefit from the competitive pressures that make privatemarkets function efficiently. Supporters of vouchers note that, in fact, vouchers may serve to reduce the natural segregation that already exists in our educational system. Vouchers allow motivated students and their parents to choose a better education and end the segregation imposed on them by location. At the same time, vouchers might increase segregation by student skill level or motivation. How Are Social Security Benefits Paid Out? Ida May is a striking example of the first generation of Social Security beneficiaries who were the big winners. Social Security was to provide a means of income support for this unfortunate generation of the elderly. Full Benefits Age (FBA) The age at which a Social Security recipient receives full retirement benefits (Primary Insurance Amount). Early Entitlement Age (EEA)The earliest age at which a Social Security recipient can receive reduced benefits. The very first beneficiary of Social Security was Ida May Fuller. da May worked for only three years after the establishment of the Social Security system, and paid a total of $24.75 in Social Security taxes. Ida May went on to live for 35 more years, dying at age 100 in 1975. Ove those 35 years, she collected a total of $22,888.92 in Social Security benefits. Quite a return on her $24.75 investment! Ida May is a striking example of the first generation of Social Security beneficiaries who were the big winners under this new social program. Tests. 1-c 2-a 3-d 4-b 5-c 6-c 7-e 8-a 9-c 10-e

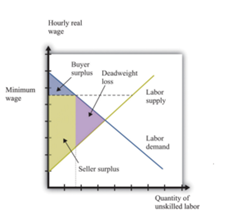

3.2 Suppose the federal government is considering raising the minimum wage to $10 per hour. An economist testifies to Congress that this plan is inefficient and causes deadweight loss. c)The selection and implementation of a proper wage policy require the government to make tradeoffs between efficiency and equity, because too much emphasis on equity in the wage distribution will undermine the economic growth for not releasing productivity thoroughly.

wage earners. The EITC subsidizes the wages of low-income earners to accomplish two goals: redistribution of resources to lower-income groups and increases in the amount of labor supplied by these groups.

VARIANT 2 Explain the problem with Insurance: Moral Hazard. The Problems with Assessing Workers’ Compensation Injuries. Why is moral hazard a problem? Even if social insurance encourages individuals to, for example, spend more time at home pretending to be injured than being at work, why is that an important cost of social insurance? When governments intervene in insurance markets, however, the analysis is one step more complicated because of another asymmetric information problem called moral hazard, which is the adverse behavior that is encouraged by insuring against an adverse event. The existence of moral hazard means that it may not be optimal for the government to provide the full insurance that is demanded by risk-averse consumers. The difficulty of assessing injuries is a problem because it can be quite attractive to qualify for the workers’ compensation program. By trying to insure against an adverse event (true injury), the insurer may encourage individuals to pretend that the adverse event has happened to them when it actually hasn’t. This scenario is a primary example of moral hazard.

3.2-

VARIANT 3 Arguments for government funding of medical care rest on equity concerns. Explain how medical care can be a public good. If medical care is a public good, explain how this would lead to a market failure in that individuals would receive less medical care than is efficient. Government plays an important role in the various medical markets and either directly or indirectly influences the health of the population in a number of ways. For example, regulatory and taxing policies affect the production or consumption of certain products (such as prescription drugs, narcotics, alcohol, and tobacco) and thereby beneficially or adversely affect the population's health. E B A A B A B E E E 3.1. 3.2. a) The probability that your income next year will be $50,000 is.95; the probability that your income next year will be $20,000 is.05. Summing the expected values of the outcomes yields.95($50,000) +.05($20,000) = $47,500 + $1,000 = $48,500. This is your expected income next year. b) An actuarially fair premium would be one that exactly offset the expected value of the loss. In this case, the expected loss is $50,000 – $48,500 = $1,500, so an actuarially fair premium would be $1,500. Another (equivalent) way to determine this premium is to calculate the expected value of the claims the insurance company would pay; here it is the probability of the loss occurring times the dollar value of the loss, or.05 ($50,000 – $20,000) =.05($30,000) = $1,500. A third (equivalent) way to determine the premium is to compute the expected profits to the insurance provider for any given premium P. Since the premium is surely paid and the insurance company pays you $30,000 with a probability of 0.05, the expected profits are given by P –.05($30,000). Actuarially fair premiums are those that lead to zero expected profits; setting expected profits equal to zero and solving gives P = 0.05($30,000) = $1,500 again. VARIANT 4 VARIANT 5 Tax avoidance in practice The legendary economist John Maynard Keynes once remarked, “The avoidance of taxes is the only pursuit that still carries any reward.” His comment appears to have been taken to heart by many individuals whose elastic behavior allows them to avoid taxes. Some examples: 1. The British boat designer Uffa Fox lived in a home he constructed from a floating bridge. When the Inland Revenue (Britain’s tax collectors) attempted to collect property tax on the home, Fox began sailing it up and down the river. By the time he was done, Fox had collected so many different addresses that the Inland Revenue gave up their attempts. 2. An Englishman visiting Cyprus in the early 1980s asked a tour guide why so many of the houses seemed to have steel reinforcement bars jutting out from their top floors. The guide informed him that Cyprus had a building tax that applied only to finished structures. Owners of those houses could thus claim that they were still in the process of finishing the roof. The process, of course, never ended. 3. The Thai government levies a tax on signs in front of businesses. The tax is levied only on external signs and the rate depends on whether the sign is completely in Thai (low), in Thai and English (medium), or completely in English (very high). A walk around Bangkok thus reveals many businesses hanging English signs with a small amount of Thai writing in the upper-right-hand corner. Some businesses manage to avoid the tax entirely by printing the message on curtains that are hung in the front window, rendering the sign “internal” and thus tax-exempt.

Tests

1. a 2. c 3. b 4. e 5. a 6. a 7. e 8. b 9. b 10. c

3.1. Suppose the federal government is considering raising the minimum wage to $10 per hour. An economist testifies to Congress that this plan is inefficient and causes deadweight loss. a) Show graphically the deadweight loss caused by the minimum wage law.

b) Suppose that you are a member of Congress and you believe in the utilitarian social welfare function. How would you determine whether to vote for or against the policy? With a utilitarian social welfare function, society’s goal is to maximize the sum of individual utilities: SWF = U1 + U2 +... + UN The utilities of all individuals are given equal weight, and summed to get total social welfare. This formulation implies that we should transfer from person 1 to person 2 as long as the utility gain to person 1 is greater than the utility loss to person 2. In other words, this implies that society is indifferent between one util (a unit of well-being) for a poor person and one for a rich person. c) Explain why this policy choice demonstrates a trade-off between equity and efficiency. Under certain assumptions, efficiency and equity are two separate issues. In these circumstances, society doesn’t have just one socially efficient point, but a whole series of socially efficient points from which it can choose. Society can achieve those different points simply by shifting available resources among individuals and letting them trade freely. Indeed, this is the Second Fundamental Theorem of Welfare Economics: society can attain any efficient outcome by a suitable redistribution of resources and free trade. In practice, however, society doesn’t typically have this nice choice as society most often faces an equity–efficiency trade-off, the choice between having a bigger economic pie and having a more fairly distributed pie. Resolving this trade-off is harder than determining efficiency-enhancing government interventions. It raises the tricky issue of making interpersonal comparisons, or deciding who should have more and who should have less in society. d) Explain the Earned Income Tax Credit. Explain why the EITC may provide equity with small losses in efficiency. 3.2. In a recent study, Americans stated that they were willing to pay $70 billion to protect all endangered species and also stated that they were willing to pay $15 billion to protect a single species. Which problem with Lindahl pricing is demonstrated? Explain.

This illustrates the preference knowledge problem. Lindahl pricing requires an accurate measure of each individuals marginal willingness to pay, but people often do not have a good idea of their own marginal willingness to pay for things that are not ordinarily bought or sold in the market. Endangered species protection is an abstract concept, so it is unlikely that people had thought about their willingness to pay for it before being surveyed. At $15 billion per species, all endangered species could not be protected for $70 billion. It appears that the respondents either overstated their willingness to pay to preserve one species or understated their willingness to pay to preserve all endangered species. VARIANT 6 Most arguments for government funding of medical care rest on equity concerns. Explain how medical care can be a public good. If medical care is a public good, explain how this would lead to a market failure in that individuals would receive less medical care than is efficient. Government plays an important role in the various medical markets and either directly or indirectly influences the health of the population in a number of ways. For example, regulatory and taxing policies affect the production or consumption of certain products (such as prescription drugs, narcotics, alcohol, and tobacco) and thereby beneficially or adversely affect the population's health. 3.Explain the Crowd -Out Problem in Education. How would this "solve" with the Educational Vouchers? How vouchers will lead to excessive school specialization or to Segregation? Problem with the system of public education provision is that it may crowd out private education provision. Providing a fixed amount of public education can actually lower educational attainment in society through inducing choice of lower quality public schools over higher-quality private schools. One solution to the crowd -out problem would be the use of educational vouchers, whereby parents are given a credit of a certain value (for example, the average spending on a child of a given age in the public education system) that can be used toward the cost of tuition at any type of school, public or private. The first argument in favor of vouchers is that vouchers allow individuals to more closely match their educational choices with their tastes. The second argument in favor of vouchers is that they will allow the education market to benefit from the competitive pressures that make private markets function efficiently. Supporters of vouchers note that, in fact, vouchers may serve to reduce the natural segregation that already exists in our educational system. Vouchers allow motivated students and their parents to choose a better education and end the segregation imposed on them by location. At the same time, vouchers might increase segregation by student skill level or motivation. 1.b 2.a 3.c 4.d 5.d 6.c 7.b 8.e 9.a 10.a 3.1. Workers may work longer if their best 40 years counted rather than their best 35. Generally, you would expect earned income to increase over a worker’s lifetime; thus, the last several years are likely to yield higher income than the first several years. Being able to count 5 more high- earning years would induce some workers to remain in the workforce to increase their calculated benefits; if they did not work longer, the 40 years might include some very low or zero-earning years (when the worker was in his or her twenties, possibly still in school). The primary reason this bill would tend to increase the Social Security trust fund is because it would tend to reduce the Averaged Indexed Monthly Earnings and therefore the size of retiree benefits. Simply put, the 5 additional years of earnings history would be the lowest five years counted (or else they would have been counted in the original 35). This effect might be partially offset by workers tending to work more (high earnings) years. Of course, these additional years of work would also involve Social Security payroll taxes that would increase the trust fund. 3.2. To answer these questions, first rewrite each demand so that P is expressed as a function of Q: Alfie: P A = 11 – 0.2 Q; Bill: P B = 20 – 0.25 Q; Coco: P C = 10 – 0.1 Q. Adding each person’s willingness to pay yields P A + P B + P C = 41 – 0.55 Q. The left- hand side gives the marginal social benefit of providing the Q th unit of the good. Setting this marginal benefit equal to the marginal cost gives the socially optimum level of provision: 41 – 0.55 Q = 13.5, or Q = 50 When Q = 50, Alfie’s marginal benefit is 11 – 0.2(50) = 1. Similarly, Bill’s marginal benefit is 20 – 0.25(50) = 7.5, and Coco’s is 10 – 0.1(50) = 5. Hence, Alfie’s share of the tax burden under Lindahl pricing is 1/13.5 ≈ 7.4%, and Bill and Coco’s shares are approximately 55.6% and 37%, respectively. VARIANT 7 VARIANT 8 VARIANT 9 VARIANT 10 Health Care The USA: There are 3 types of health insurance in the US: private insurance (66% of US population; employment-based, direct purchase) Employers offer insurance to qualified employees in the firm, typically; employers also typically charge employees some share of the employers’ premium payments for insurance. 1st reason- employers provide most private insurance is the nature of insurance risk pools- is the group of individuals who enroll in an insurance plan. The goal of all insurers is to create large insurance pools with a predictable distribution of medical risk. 2d- the tax subsidy to employer -provided health insurance. Public insurance (Medicaid-a federal and state program that provides health care for the poor; Medicare-a federal program that provides health insurance to all people over age 65 and disabled persons under age 65; is financed by a payroll tax of 1.45% each on employees and employers, TRICARE/CHAMPVA-health insurance for those currently or formerly in the military and their dependents), uninsured individuals- 1- even risk-averse individuals may be unwilling to purchase insurance if it is not available at an actuarially fair price. 2-adverse selection in the health insurance market. The third one uncompensated care The costs of delivering health care for which providers are not reimbursed. Russia: • The Constitution of the Russian Federation provides all citizens the right to free healthcare under Mandatory Medical Insurance. • In Russia we have national health insurance a system whereby the government provides insurance to all its citizens, as in Canada, without the involvement of a private insurance industry • Ministry of Health Care is the head of national (public) health care system in Russia • There’s also private branch of health care. Since 1996 government health facilities have been allowed to offer private services, and since 2011 some private providers have been providing services to the state-insured. The private sector in Moscow has expanded rapidly • There are a few branches of national (governmental) system of health care: Primary Health Care, Specialized care, Obstetric and gynecological care, Medical care for children, High-tech medical care, Recreational Treatment.

2. Income distribution and Welfare program. Absolute deprivation and poverty rates. Redistribution may be concerned with either relative income inequality or absolute deprivation, where the latter is measured by the poverty line. Income inequality is high in the United States both relative to other nations and to historical standards.

3. Moral hazard effects of a means- tested transfer system. 1-a 2-c3-b 4-e 5-a 6-a 7-e 8-b 9-b 10-c VARIANT 11 Problems 3.1 3.2. If the tax is on the sale of rutabagas, the buyer bears the statutory incidence, since the “sticker price” of rutabagas does not include the tax. Economic incidence is determined by relative elasticities. In this case, the quantity supplied is more responsive to a change in price, so the less elastic consumers will bear most of the economic incidence. To calculate the relative burdens, solve the equilibrium condition with and without the tax. Without the tax: 2,000 – 100 P = – 100 + 200 P. Price = $7.00. With the tax, the price the supplier receives is reduced by $2.00. The equilibrium condition is 2,000 – 100 P = - 100 + 200(P – 2) (The firm keeps $2 less per rutabaga) 2,000 – 100 P = 200 P – 500 2,500 = 300 P, Price = $8.33. The consumers’ tax burden = (posttax price – pretax price) + tax payments by consumers, here $8.33 – $7.00 + 0 ≈ $1.33. (Used to pay $7.00 now pay $8.33) The producers’ tax burden = (pretax price – posttax price) + tax payments by producers, here $7.00 – $8.33 + $2.00 ≈ $.67. In this case the consumer bears a larger share of the tax burden than the producer. (Used to receive $7, now keep 8.33 – 2 = 6.33 or.67 less.) VARIANT 12 2.1 The effect of a corporate tax on corporate investment. The effect of depreciation allowance and the investment tax credit on corporate investment. Effective corporate tax rate. The Effects of a Corporate Tax on Corporate InvestmentWhat happens if we introduce taxes into this story? Imagine first that the corporate tax is simply a tax at a rate t on cash earnings minus labor costs (there are no tax deductions of any type for investment spending). The cash earnings per dollar spent on the machine per period is MPK, so once this tax is imposed, the earnings per dollar spent on the machine drop to MPK 3 (1 2 t) (since the new tax must be paid on each dollar of earnings). This reduction in actual return causes the marginal benefit curve to shift down to MB 2, as shown in Figure 24-5: the taxation of corporate earnings has reduced the marginal benefit of investing. The costs per dollar of investment remain at d 1 r, so the marginal cost curve remains at its initial level. The new optimal investment choice is at point B, and investment falls to K 2. Firms invest less when the government takes some of their return through corporate taxation. This is because the firm’s after-tax actual rate of return on the investment must be large enough to meet the required rate of return, d 1 r. As a result, the pre-tax rate of return must be higher than it is without taxation, and that only occurs if the firm is investing less. For example, with a tax rate of 50%, the firm must earn $0.40 of return on a dollar of investment to pay back its $0.20 of cost in depreciation and financing. Thus, the firm must invest less: it should stop investing at the point where the marginal dollar of investment has a $0.40 return rather than continuing to invest until that marginal dollar of investment has a $0.20 return. In this scenario, corporate taxation leads to less investment. The Effects of Depreciation Allowances and the Investment Tax Credit on Corporate Investment This description of the effect of taxes on corporate investment does not include the influence of tax deductions for investment such as depreciation allowances or investment tax credits. These tax deductions act as discounts off the price of investments, lowering the marginal cost by offsetting some of the costs of financing and depreciation. Recall that depreciation allowances are typically spread out over the purchase year and future years and that to value such streams of benefits we need to consider their present discounted value (PDV). The value of any given depreciation allowance schedule, z, is the PDV of the stream of depreciation allowances associated with a new machine purchase, as a fraction of the purchase price of the machine. If the firm could expense the machine (deduct its full value in the year of purchase), z would be 1.0 because the deduction allowance is 100% of the purchase price. As depreciation allowances are spread out over future years, z falls because the PDV of the depreciation allowances falls as the allowances become more distant. Effective Corporate Tax Rate Now that we understand how taxes affect a firm’s investment decisions, we can summarize mathematically the net impact of the tax system on investment decisions. The effect of taxes is summarized by the effective corporate tax rate, the percentage increase in the rate of pretax return to capital that is necessitated by taxationThe rate of return earned by the firm on its investments must rise to finance the tax payments. How much it must rise is a function of the tax rate, the treatment of depreciation, and the presence of the ITC. These factors therefore come together to determine the overall effect of taxation on investment decisions 1.2 Tax incentives for retirement savings. Limitations on tax – subsidized retirement savings. Tax incentives for retirement savings. some economists and policy makers argue that we save too little in the United States and that our economic growth suffers as a result. Moreover, despite the existence of the Social Security program, some remain concerned that worker shortsightedness may cause workers to undersave for retirement. As a result of these concerns, the U.S. government has introduced a series of tax subsidies to encourage retirement savings. In this section, we review the structure and effects of these subsidies. pension plan A n employersponsored plan through which employers and employees save on a (generally) tax-free basis for the employees’ retirement. defined benefit pension plans Pension plans in whichworkers accrue pension rightsduring their tenure at the firm,and when they retire, the firmpays them a benefit that is afunction of that workers’ tenureat the firm and of their earnings. defined contribution pension plans Pension plans in whichemployers set aside a certainproportion of a worker’s earnings(such as 5%) in an investmentaccount, and the workerreceives this savings and anyaccumulated investment earnings when she retires. Limitations on Tax-Subsidized Retirement Savings Most of the vehicles for tax-subsidized retirement savings that we reviewed earlier feature a limit on annual contributions, such as the $5,000 limit for IRAs. These limits complicate the theoretical analysis. Suppose that Andrea is making savings decisions in a world with and without an IRA available. Her original after-tax budget constraint, BC 2, between consumption in period one and period two is the line AB, with a slope of 2(1 1 r 3 [1 2 t]), where r is the interest rate earned on her savings and t is the tax rate paid on interest earnings. Without the IRA, the price of first-period consumption, in terms of forgone second-period consumption, is 1 1 r 3 (1 2 t), since that is how much second-period consumption she could have if she consumed one dollar less today. 1.3 Explain the Crowd -Out Problem in Education. How would this "solve" with the Educational Vouchers? How vouchers will lead to excessive school specialization or to Segregation? Crowd-out problem: As the government provides more of a public good, the private sector will provide less. Education is a public good that is provided to some extent by the private sector. As such, an important problem with the system of public education provision is that it may crowd out private education provision. Indeed, it is possible that providing a fixed amount of public education can actually lower educational attainment in society through inducing choice of lower quality public schools over higher-quality private schools Vouchers might increase segregation by student skill level or motivation. As the motivated and high-skilled students flee poor-quality public schools for higher-quality private schools, the students left behind willbe in groups that are of lower motivation and skill. That is, school choice is likely to reduce segregation along some dimensions but increase it along others. Vouchers might solve this crowd-out problem by allowing people to choose the optimal level of education for themselves, as well as interjecting competition into the education market. At the same time, vouchers may lead to increased educational stratification, and the education market may face difficulties in implementing competition.Existing evidence suggests that private school choice through vouchers can move students to better schools, but a much richer evaluation of the total social effects of vouchers is needed before policy conclusions can be drawn. 1 E 2 B 3 А 4 А 5 B 6 A 7 B 8 E 9 E 10 E 3.1 a.What is the price of an additional dollar of local spending in each case? The “price” of spending $1 on road construction is reduced to 50¢ by the matchinggrant. The other 50¢ of the $1 spent comes from the matching grant. The block grantwould not change the relative price of road construction. Since block grant money can beused to purchase anything, the price, or opportunity cost, of $1 worth of road construc-tion is still a $1.

b.Which of the two methods do you think would lead to higher levels of local spend-ing on roads? Explain your answer. Both grants will increase spending through the income effect: Minnegan is wealthierwith either and is likely to spend more money on several projects, including roads. Thematching grant reduces the relative cost of road construction, however, so in addition tothe income effect, the substitution effect will induce more road building. The matchinggrant is more likely to lead to higher levels of spending on roads. VARIANT 13 Most arguments for government funding of medical care rest on equity concerns. Explain how medical care can be a public good. If medical care is a public good, explain how this would lead to a market failure in that individuals would receive less medical care than is efficient. The foundation for all medical care would be based on public health planning. Health policy would reflect health education, nutrition, and regulations which support healthy lifestyles and preventive screenings. Registries would be created where all immunizations and diseases would be reported under a common regional database. All communicable diseases would be reported. As Medical care is a public good, it’s available for everyone so the budgeted money on health care would be distributed evenly between all the people what will reduce amount of medical care for one particular individual. That doesn’t work in case when we talk about commercial hospitals where individual pays directly to the hospital making his or her treatment a private good. VARIANT 15 Most arguments for government funding of medical care rest on equity concerns. Explain how medical care can be a public good. If medical care is a public good, explain how this would lead to a market failure in that individuals would receive less medical care than is efficient. Public goods would not be produced through the market, because they are indivisible and are not subject to the exclusion principle. National defense is a public good that is there for all of the U.S. people. Government paid for that through tax revenue. Those who receive benefits without paying are part of the so-called free-rider problem. Private producers would not be able to find enough paying buyers for public goods because of the free-rider problem. Therefore, public goods are not produced voluntarily through the market but must be provided by the public sector and financed by compulsory taxes. Quasi-public goods are those that have large positive externalities, so government will sponsor their provision. Otherwise, they would be underproduced. Medical care, education, and public housing are examples. A market failure is any feature of the market that reduces allocative efficiency. Incomplete markets. An incomplete market is one in which consumers would be willing to pay more than the cost of a good or service but it is not provided. Insurance markets are clearly incomplete. Today, there are millions of people who are denied participation in the market (due to medical underwriting) who might be willing to pay a fair premium. Given the low level of competition in insurance markets, it is very likely that products that would be profitable are not offered (because they’re less profitable than what is offered). 2015.

VARIANT 16 VARIANT 17 1. 1. The effect of a corporate tax on corporate investment. The effect of depreciation allowance and the investment tax credit on corporate investment. Effective corporate tax rate.

What happens if we introduce taxes into the story? Imagine first that the corporate tax is simply a tax at a rate t on cash earnings minus labor costs (there are no tax deductions of any type for investment spending). The cash earnings per dollar spent on the machine per period is MPK, so once this tax is imposed, the earnings per dollar spent on the machine drop to MPK 3 (1 2 t) (since the new tax must be paid on each dollar of earnings). This reduction in actual return causes the marginal benefit curve to shift down to MB2, as shown in Figure 24-5: the taxation of corporate earnings has reduced the marginal benefit of investing. The costs per dollar of investment remain at d 1 r, so the marginal cost curve remains at its initial level. The new optimal investment choice is at point B, and investment falls to K2. Firms invest less when the government takes some of their return through corporate taxation. This is because the firm’s after-tax actual rate of return on the investment must be large enough to meet the required rate of return, d 1 r. As a result, the pre-tax rate of return must be higher than it is without taxation, and that only occurs if the firm is investing less. For example, with a tax rate of 50%, the firm must earn $0.40 of return on a dollar of investment to pay back its $0.20 of cost in depreciation and financing. Thus, the firm must invest less: it should stop investing at the point where the marginal dollar of investment has a $0.40 return rather than continuing to invest until that marginal dollar of investment has a $0.20 return. In this scenario, corporate taxation leads to less investment. The Effects of Depreciation Allowances and the Investment Tax Credit on Corporate Investment This description of the effect of taxes on corporate investment does not include the influence of tax deductions for investment such as depreciation allowances or investment tax credits. These tax deductions act as discounts off the price of investments, lowering the marginal cost by offsetting some of the costs of financing and depreciation. Recall that depreciation allowances are typically spread out over the purchase year and future years and that to value such streams of benefits we need to consider their present discounted value (PDV). The value of any given depreciation allowance schedule, z, is the PDV of the stream of depreciation allowances associated with a new machine purchase, as a fraction of the purchase price of the machine. If the firm could expense the machine (deduct its full value in the year of purchase), z would be 1.0 because the deduction allowance is 100% of the purchase price. As depreciation allowances are spread out over future years, z falls because the PDV of the depreciation allowances falls as the allowances become more distant. Effective Corporate Tax Rate Now that we understand how taxes affect a firm’s investment decisions, we can summarize mathematically the net impact of the tax system on investment decisions. The effect of taxes is summarized by the effective corporate tax rate, the percentage increase in the rate of pretax return to capital that is necessitated by taxationThe rate of return earned by the firm on its investments must rise to finance the tax payments. How much it must rise is a function of the tax rate, the treatment of depreciation, and the presence of the ITC. These factors therefore come together to determine the overall effect of taxation on investment decisions

2.Explain the Crowd -Out Problem in Education. How would this "solve" with the Educational Vouchers? How vouchers will lead to excessive school specialization or to Segregation?

Crowd-out problem: As the government provides more of a public good, the private sector will provide less. Education is a public good that is provided to some extent by the private sector. As such, an important problem with the system of public education provision is that it may crowd out private education provision. Indeed, it is possible that providing a fixed amount of public education can actually lower educational attainment in society through inducing choice of lower quality public schools over higher-quality private schools Vouchers might increase segregation by student skill level or motivation. As the motivated and high-skilled students flee poor-quality public schools for higher-quality private schools, the students left behind will be in groups that are of lower motivation and skill. That is, school choice is likely to reduce segregation along some dimensions but increase it along others.

Vouchers might solve this crowd-out problem by allowing people to choose the optimal level of education for themselves, as well as interjecting competition into the education market. At the same time, vouchers may lead to increased educational stratification, and the education market may face difficulties in implementing competition. Existing evidence suggests that private school choice through vouchers can move students to better schools, but a much richer evaluation of the total social effects of vouchers is needed before policy conclusions can be drawn. In Russia Spending on education will go down from 649.8 billion roubles to 618.9 billion roubles in 2015-2017

3.How Are Social Security Benefits Paid Out? Ida May is a striking example of the first generation of Social Security beneficiaries who were the big winners.

Social Security was to provide a means of income support for this unfortunate generation of the elderly. Full Benefits Age (FBA) The age at which a Social Security recipient receives full retirement benefits (Primary Insurance Amount). Early Entitlement Age (EEA)The earliest age at which a Social Security recipient can receive reduced benefits. The very first beneficiary of Social Security was Ida May Fuller. da May worked for only three years after the establishment of the Social Security system, and paid a total of $24.75 in Social Security taxes. Ida May went on to live for 35 more years, dying at age 100 in 1975. Ove those 35 years, she collected a total of $22,888.92 in Social Security benefits. Quite a return on her $24.75 investment! Ida May is a striking example of the first generation of Social Security beneficiaries who were the big winners under this new social program.

Test section 1-e 2-b 3-a 4-a 5-b 6-a 7-b 8-e 9-e 10-e

3.1.Explain the Crowd -Out Problem in Education. How would this "solve" with the Educational Vouchers? How vouchers will lead to excessive school specialization or to Segregation?

Crowd-out problem: As the government provides more of a public good, the private sector will provide less. Education is a public good that is provided to some extent by the private sector. As such, an important problem with the system of public education provision is that it may crowd out private education provision. Indeed, it is possible that providing a fixed amount of public education can actually lower educational attainment in society through inducing choice of lower quality public schools over higher-quality private schools Vouchers might increase segregation by student skill level or motivation. As the motivated and high-skilled students flee poor-quality public schools for higher-quality private schools, the students left behind will be in groups that are of lower motivation and skill. That is, school choice is likely to reduce segregation along some dimensions but increase it along others.

Vouchers might solve this crowd-out problem by allowing people to choose the optimal level of education for themselves, as well as interjecting competition into the education market. At the same time, vouchers may lead to increased educational stratification, and the education market may face difficulties in implementing competition. Existing evidence suggests that private school choice through vouchers can move students to better schools, but a much richer evaluation of the total social effects of vouchers is needed before policy conclusions can be drawn. In Russia Spending on education will go down from 649.8 billion roubles to 618.9 billion roubles in 2015-2017

3.2 Suppose the federal government is considering raising the minimum wage to $10 per hour. An economist testifies to Congress that this plan is inefficient and causes deadweight loss.

a)Show graphically the deadweight loss caused by the minimum wage law.

b)Suppose that you are a member of Congress and you believe in the utilitarian social welfare function. How would you determine whether to vote for or against the policy?

The Rawlsian social welfare function is consistent with redistribution from the rich to the poor whenever utility is increasing in wealth (or income). The utilitarian social welfare function can also be consistent with a government that redistributes from the rich to the poor, for example, if utility depends only on wealth and exhibits diminishing marginal utility. However, the Rawlsian social welfare function weights the least-well-off more heavily, so it will generally prescribe more redistribution than the utilitarian social welfare function. If utility depends only on wealth and exhibits diminishing marginal utility, and if effi- ciency losses from redistribution are small, then both the utilitarian and Rawlsian social welfare functions can be consistent with government redistribution. A simple example can illustrate this point. Suppose that utility as a function of wealth is expressed as v = √w, and that a rich person has wealth of $100 (yielding utility of 10) and a poor person has wealth of $25 (yielding utility of 5). The sum of utilities is 10 + 5 = 15. Tax the wealthy person $19; their remaining wealth is $81, yielding utility of 9. Give $12 of the $19 to the poor person; this yields wealth of 25 + 12 = $37. The square root (utility) of 37 is greater than 6, so total utility is now greater than 15, even with the effi- ciency loss of $7 ($19 – $12). Under the Rawlsian function, which considers only the least-well-off person’s utility, social welfare has increased from 5 to greater than 6.

c)Explain why this policy choice demonstrates a trade-off between equity and efficiency

Efficiency is not the only goal of government policy. Equity concerns induce govern- ment to intervene to help people living in poverty, even when there are efficiency losses. In economic terms, a society that willingly redistributes resources has determined that it is will- ing to pay for or give up some efficiency in exchange for the benefit of living in a society that cares for those who have fewer resources. Social welfare functions that reflect this willingness to pay for equity or preference for equity may be maximized when the government intervenes to redistribute resources.

d)Explain the Earned Income Tax Credit. Explain why the EITC may provide equity with small losses in efficiency.

The United States federal earned income tax credit or earned income credit (EITC or EIC) is a refundable tax credit for low- to moderate-income working individuals and couples, particularly those with children.

The EITC increases wages for some, increasing their return to working and thus increas- ing the cost of leisure; not only do these workers earn a wage, but they receive a bonus, in the form of the EITC, on top of that wage. Because the EITC is available only as a subsidy for earned income, it specifically rewards work effort, thus tending to increase it for those who qualify for the benefit. Offsetting this effect is an income effect that tends to reduce work effort. The EITC programs increases the total income of any worker with positive earn- ings less than $33,700. This increase in income will tend to lead them to enjoy more leisure time—to reduce their labor supply. A similar effect is possible for workers who would earn slightly more than $33,700 in the absence of the EITC. These workers may choose to work slightly less when the EITC is put in place so that they can qualify for some EITC benefits and enjoy more leisure. An increase in the EITC compensation rate is likely to increase labor supply. In prin- ciple, there are offsetting substitution and income effects. The higher compensation rate makes leisure relatively more expensive for workers, so the substitution effect leads work- ers to supply more labor. Offsetting this, the higher compensation rate makes workers richer, leading them to consume more leisure and supply less labor. Since the EITC ap- plies only to low-income workers, however, the substitution effect is likely to dominate. In particular, some workers might not choose to work at all with the 30% compensation rate. They would face only the substitution effect, and it might be strong enough to induce some of them to enter the labor force. The low- income individual finds himself or herself in the phase-out portion of the EITC and is sub- jected to a high effective marginal tax rate. VARIANT 18 VARIANT 19 Taxes on Earnings The first type of taxation is the payroll tax, a tax levied on the earnings of workers. Payroll taxes are the primary means of financing social insurance programs, such as those discussed in the preceding chapters (Social Security, unemployment insurance, Medicare, and so on). Taxes on Individual Income The second type of taxation is the individual income tax, a tax paid by individuals on income accrued during the year. Income for income tax purposes includes labor earnings, but the tax is distinguished from the payroll tax by (a) applying to a broader set of income sources (such as interest earnings from household savings as well), and (b) applying in many cases to the entire income of a family, not just to the income of one individual worker. A form of income taxation that is of particular interest is the taxation of capital gains, the earnings from selling capital assets, such as stocks, paintings, and houses. Taxes on Corporate Income In addition to taxing individual income, many countries also separately tax the earnings of corporations through the corporate income tax. The purpose of the separate taxation of corporations, above and beyond taxes on individuals, is to tax earnings of owners of capital that otherwise might escape taxation by the individual-based income tax system. Тесты 1e 2b 3a 4a 5b 6a 7b 8e 9e 10e

2. Explain the Crowd -Out Problem in Education. How would this "solve" with the Educational Vouchers? How vouchers will lead to excessive school specialization or to Segregation? Crowd - out means that as the government provides more of a public good, the private sector will provide less. Crowd-out is a classic example of the unintended consequences of government action The government intended to do the right thing by increasing fireworks to the social optimum. But, in fact, it ended up having no effect because its actions were totally offset by changes in individual actions. Full crowd-out is rare. Partial crowd-out is much more common and can occur in two different cases: when noncontributors to the public good are taxed to finance provision of the good, and when individuals derive utility from their own contribution as well as from the total amount of public good. One solution to the crowd-out problem is the use of educational vouchers. Educational vouchers – is a fixed amount of money given by the government to families with school-age children, who can spend it at any type of school, public or private. The Voucher has the same effect as a conditional lump-sum grant to local governments: it raises incomes but forces the families to spend a minimum amount on education. Vouchers might solve this crowd-out problem by allowing people to choose the optimal level of education for themselves, as well as interjecting competition into the education market. Many of the arguments in favor of public financing of education relate to the externalities that come from having a common educational program, particularly at the elementary school level. The first argument made here for vouchers, that schools will tailor themselves to meet individual tastes, threatens to undercut the benefits of a common program. So, Vouchers May Lead to Excessive School Specialization. Critics envision a world where children of motivated parents move to higher-quality private schools, while children of disinterested or uninformed parents end up in low-quality public schools. If the children of interested and motivated parents differ along the lines of race, income, or child ability from those of uninterested and unmotivated parents, segregation could worsen. Vouchers also might increase segregation by student skill level or motivation. As the motivated and high-skilled students flee poor-quality public schools for higher-quality private schools, the students left behind will be in groups that are of lower motivation and skill.

1. Suppose the federal government is considering raising the minimum wage to $10 per hour. An economist testifies to Congress that this plan is inefficient and causes deadweight loss. a) Show graphically the deadweight loss caused by the minimum wage law. b) Suppose that you are a member of Congress and you believe in the utilitarian social welfare function. How would you determine whether to vote for or against the policy? c) Explain why this policy choice demonstrates a trade-off between equity and efficiency. d) Explain the Earned Income Tax Credit. Explain why the EITC may provide equity with small losses in efficiency. 2 a) b)social welfare function (SWF) A function that combines the utility functions of all individuals into an overall social utility function. With a utilitarian social welfare function, society’s goal is to maximize the sum of individual utilities: SWF= U1+ U2+...+Un The utilities of all individuals are given equal weight, and summed to get total social welfare. This formulation implies that we should transfer from person 1 to person 2 as long as the utility gain to person 1 is greater than the utility loss to person 2. In other words, this implies that society is indifferent between one util (a unit of well-being) for a poor person and one for a rich person.

c) 'Equity-Efficiency Tradeoff' An economic situation in which there is a perceived tradeoff between the equity and efficiency of a given economy. This tradeoff is commonly viewed within the context of the production possibility frontier, where any additional gains in production efficiency must be offset by a reduction in the economy's equity. d) The Earned Income Tax Credit, EITC or EIC, is a benefit for working people with low to moderate income. To qualify, you must meet certain requirements and file a tax return, even if you do not owe any tax or are not required to file. EITC reduces the amount of tax you owe and may give you a refund.

VARIANT 20 Most arguments for government funding of medical care rest on equity concerns. Explain how medical care can be a public good. If medical care is a public good, explain how this would lead to a market failure in that individuals would receive less medical care than is efficient. Government plays an important role in the various medical markets and either directly or indirectly influences the health of the population in a number of ways. For example, regulatory and taxing policies affect the production or consumption of certain products (such as prescription drugs, narcotics, alcohol, and tobacco) and thereby beneficially or adversely affect the population's health.

|

|||||||||||||||||||||||||||||||

|

Последнее изменение этой страницы: 2016-04-26; просмотров: 670; Нарушение авторского права страницы; Мы поможем в написании вашей работы! infopedia.su Все материалы представленные на сайте исключительно с целью ознакомления читателями и не преследуют коммерческих целей или нарушение авторских прав. Обратная связь - 18.188.227.108 (0.015 с.) |

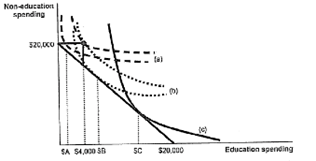

3.1 The family with indifference curves labeled was consuming very little education prior to the education program(When the public education program is introduced, they move into public education system,their consumption of education increases to 4000 and on goods up to 20000. B) family was consuming more than 4000. When the system is introduced family also moves into the public education system. Reduction in spendings on education,increase on consumption.C)is unaffected by introducing the program. (а-сверху,с-снизу)

3.1 The family with indifference curves labeled was consuming very little education prior to the education program(When the public education program is introduced, they move into public education system,their consumption of education increases to 4000 and on goods up to 20000. B) family was consuming more than 4000. When the system is introduced family also moves into the public education system. Reduction in spendings on education,increase on consumption.C)is unaffected by introducing the program. (а-сверху,с-снизу) d)Earned Income Tax Credit (EITC), an income tax policy aimed specifically at low-income

d)Earned Income Tax Credit (EITC), an income tax policy aimed specifically at low-income

(график справа)

(график справа)