Заглавная страница Избранные статьи Случайная статья Познавательные статьи Новые добавления Обратная связь FAQ Написать работу КАТЕГОРИИ: ТОП 10 на сайте Приготовление дезинфицирующих растворов различной концентрацииТехника нижней прямой подачи мяча. Франко-прусская война (причины и последствия) Организация работы процедурного кабинета Смысловое и механическое запоминание, их место и роль в усвоении знаний Коммуникативные барьеры и пути их преодоления Обработка изделий медицинского назначения многократного применения Образцы текста публицистического стиля Четыре типа изменения баланса Задачи с ответами для Всероссийской олимпиады по праву

Мы поможем в написании ваших работ! ЗНАЕТЕ ЛИ ВЫ?

Влияние общества на человека

Приготовление дезинфицирующих растворов различной концентрации Практические работы по географии для 6 класса Организация работы процедурного кабинета Изменения в неживой природе осенью Уборка процедурного кабинета Сольфеджио. Все правила по сольфеджио Балочные системы. Определение реакций опор и моментов защемления |

Tax policy to promote labor supply: the earned income tax credit.Содержание книги

Поиск на нашем сайте

The EITC subsidizes the wages of low-income earners to accomplish two goals: redistribution of resources to lower-income groups and increases in the amount of labor supplied by these groups. The EITC (federal income tax policy that subsidizes the wages of low-income earners) holds out the promise of breaking this “iron triangle.” By redistributing income through wage subsidies, the program aims to increase vertical equity and promote work among low-income populations. Like most income tax policies, the EITC has both income and substitution effects on labor supply decisions.

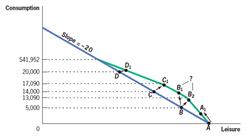

The EITC unambiguously raises the Standard consumption-leisure trade-off diagram, as in Figure 21-6 The blue line is the original budget constraint before the EITC is introduced, assuming a wage rate of $20/hour; the green line represents the new budget constraint after the EITC is added (until $41,952, at which point it reverts to the old blue budget constraintLabor supply of those not working (such as person A, who moves to point A1); has an ambiguous effect on the labor supply of those with low earnings, who receive the wage subsidy (such as person B, who may move to either point B1 or point B2); reduces the labor supply of those on the flat maximum subsidy (such as person C, who moves to point C1); and reduces the labor supply of those on the phase-out portion (such as person D, who moves to point D1). Overall, the experience with the EITC in the United States seems fairly successful. It is a powerful redistributive device that now delivers more cash to low-income families than any other welfare program in the United States. And it has done so without reducing overall labor supply, the problem with standard cash welfare; rather, this redistribution has been associated with increased labor supply among single mothers (increased labor force participation with no offsetting reduction in hours worked), no effect on fathers, and a modest reduction in labor supply among married mothers. 3.2.Suppose the federal government is considering raising the minimum wage to $10 per hour. An economist testifies to Congress that this plan is inefficient and causes deadweight loss. a) Show graphically the deadweight loss caused by the minimum wage law.

b) Suppose that you are a member of Congress and you believe in the utilitarian social welfare function. How would you determine whether to vote for or against the policy? In order to determine to vote for or against we should consider that the only acceptable way for buyer’s and seller’s surplus is the optimal balance between the labour supply and labour demand. In our case here occurs a deadweight loss, so as a Member of Congress I vote against this policy.

c) Explain why this policy choice demonstrates a trade-off between equity and efficiency. 'Equity-Efficiency Tradeoff’ appears as an economic situation in which there is a perceived tradeoff between the equity and efficiency of a given economy. This tradeoff is commonly viewed within the context of the production possibility frontier, where any additional gains in production efficiency must be offset by a reduction in the economy's equity. Within this equity and efficiency tradeoff, equity refers to the economy's financial capital, while efficiency refers to the future efficiency in the production of goods and services. This theory asserts that, in order for a nation to become wealthier, it must save its equity. However, these additional savings will hurt the development of more efficient production in the future.

d) Explain the Earned Income Tax Credit. Explain why the EITC may provide equity with small losses in efficiency. The United States federal earned income tax credit or earned income credit (EITC or EIC) is a refundable tax credit for low- to moderate-income working individuals and couples, particularly those with children. The amount of EITC benefit depends on a recipient’s income and number of children. For a person or couple to claim one or more persons as their qualifying child, requirements such as relationship, age, and shared residency must be met. The EITC exacerbates the marriage penalty by combining both spouses’ incomes to determine eligibility for the credit. Two fairly low incomes can combine to equal a total family income high enough to place the family in the phase-out portion of the EITC. In that situation, adding a second income to the first puts the second income in the range of a very high marginal tax rate. This effect could result in a labor supply reduction for secondary earners in these families. To counter this effect, the EITC could be amended so that the average of the two spouses’ salaries determined the family income, it could provide for a much longer plateau before phase-out for two-earner families, or it could be applied to individual incomes, regardless of marital status, rather than to family income. VARIANT 25

|

|||||||

|

Последнее изменение этой страницы: 2016-04-26; просмотров: 265; Нарушение авторского права страницы; Мы поможем в написании вашей работы! infopedia.su Все материалы представленные на сайте исключительно с целью ознакомления читателями и не преследуют коммерческих целей или нарушение авторских прав. Обратная связь - 18.224.52.108 (0.008 с.) |