Заглавная страница Избранные статьи Случайная статья Познавательные статьи Новые добавления Обратная связь FAQ Написать работу КАТЕГОРИИ: ТОП 10 на сайте Приготовление дезинфицирующих растворов различной концентрацииТехника нижней прямой подачи мяча. Франко-прусская война (причины и последствия) Организация работы процедурного кабинета Смысловое и механическое запоминание, их место и роль в усвоении знаний Коммуникативные барьеры и пути их преодоления Обработка изделий медицинского назначения многократного применения Образцы текста публицистического стиля Четыре типа изменения баланса Задачи с ответами для Всероссийской олимпиады по праву

Мы поможем в написании ваших работ! ЗНАЕТЕ ЛИ ВЫ?

Влияние общества на человека

Приготовление дезинфицирующих растворов различной концентрации Практические работы по географии для 6 класса Организация работы процедурного кабинета Изменения в неживой природе осенью Уборка процедурного кабинета Сольфеджио. Все правила по сольфеджио Балочные системы. Определение реакций опор и моментов защемления |

Factor Markets and the Distribution of IncomeСодержание книги

Поиск на нашем сайте

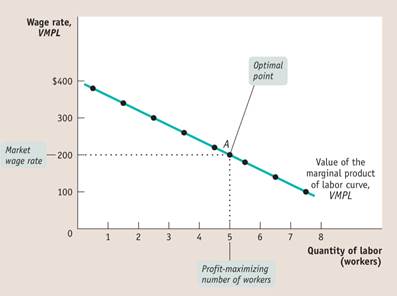

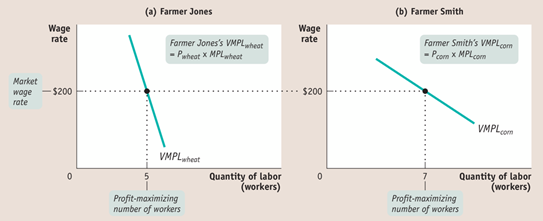

Physical capital – consist of manufactured productive resources such as equipment, buildings, tools, and machines. Human capital is the improvement in labour created by education and knowledge that is embodied in the workforce. The factor distribution of income is the division of total income among labor, land, and capital. In a perfectly competitive market economy, the price of the good multiplied by the marginal product labor is equal to the value of the marginal product of labor: VMPL = P × MPL. A profit-maximizing producer hires labor up to the point at which the value of the marginal product of labor is equal to the wage rate: VMPL = W. The value of the marginal product of labor curve slopes downward due to diminish- ing returns to labor in production. The value of the marginal product of a factor is the value of the additional output generated by employing one more unit of that factor. The value of the marginal product curve of a factor shows how the value of the marginal product of that factor depends on the quantity of the factor employed.

The market demand curve for labor is the horizontal sum of all the individual demand curves of producers in that market. There are three main aspects that causes factor demand curves to shift: 1) Changes in prices of goods 2) Changes in supply of other factors 3)

Changes in technology

As in the case of labor, producers will employ land or capital until the point at which its value of the marginal product is equal to its rental rate. According to the marginal productivity theory of income distribution, in a perfectly competitive economy each factor of production is paid its equilibrium value of the marginal product.

The rental rate of either land or capital is the cost, explicit or implicit, of using a unit of that asset for a given period of time. Existing large disparities in wages both among individuals and across groups lead some to question the marginal productivity theory of income distribution.

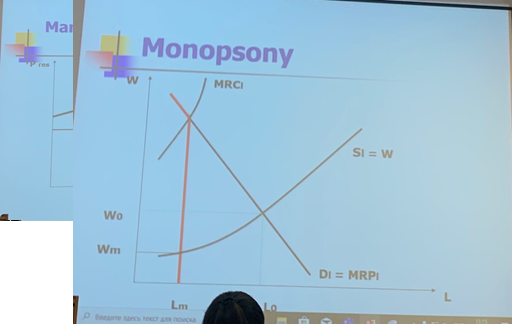

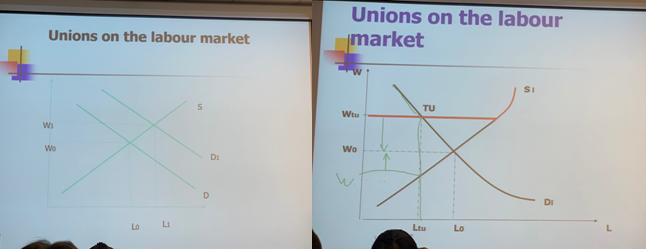

Compensating differentials, as well as differences in the values of the marginal products of workers that arise from differences in talent, job experience, and human capital, account for some wage disparities. Market power, in the form of unions or collective action by employers, as well as the efficiency-wage model, also explain how some wage disparities arise.

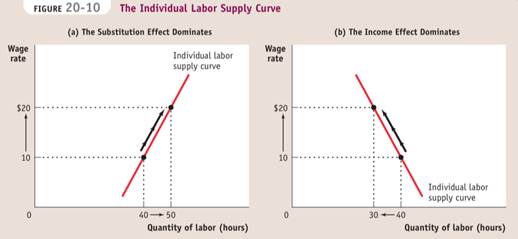

The choice of how much labor to supply is a problem of time allocation: a choice between work and leisure. A rise in the wage rate causes both an income and a substitution effect on an individual's labor supply. The substitution effect of a higher wage rate induces longer work hours, other things equal. This is countered by the income effect: higher income leads to a higher demand for leisure, a normal good. If the income effect dominates, a rise in the wage rate can actually cause the individual labor supply curve to 66 slope the "wrong" way: downward.

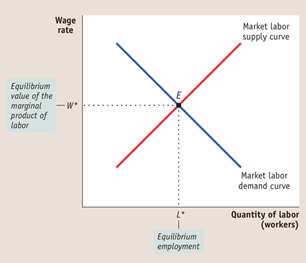

The market labor supply curve is the horizontal sum of the individual labor supply curves of all workers in that market. It shifts for four main reasons: changes in prefer ences and social norms, changes in population, changes in opportuni ties, and changes in wealth.

|

|||||||

|

Последнее изменение этой страницы: 2021-07-19; просмотров: 154; Нарушение авторского права страницы; Мы поможем в написании вашей работы! infopedia.su Все материалы представленные на сайте исключительно с целью ознакомления читателями и не преследуют коммерческих целей или нарушение авторских прав. Обратная связь - 18.226.187.224 (0.005 с.) |

The equilibrium value of the marginal product of a factor is the additional value produced by the last unit of that factor employed in the factor market as a whole.

The equilibrium value of the marginal product of a factor is the additional value produced by the last unit of that factor employed in the factor market as a whole.