Заглавная страница Избранные статьи Случайная статья Познавательные статьи Новые добавления Обратная связь FAQ Написать работу КАТЕГОРИИ: ТОП 10 на сайте Приготовление дезинфицирующих растворов различной концентрацииТехника нижней прямой подачи мяча. Франко-прусская война (причины и последствия) Организация работы процедурного кабинета Смысловое и механическое запоминание, их место и роль в усвоении знаний Коммуникативные барьеры и пути их преодоления Обработка изделий медицинского назначения многократного применения Образцы текста публицистического стиля Четыре типа изменения баланса Задачи с ответами для Всероссийской олимпиады по праву

Мы поможем в написании ваших работ! ЗНАЕТЕ ЛИ ВЫ?

Влияние общества на человека

Приготовление дезинфицирующих растворов различной концентрации Практические работы по географии для 6 класса Организация работы процедурного кабинета Изменения в неживой природе осенью Уборка процедурного кабинета Сольфеджио. Все правила по сольфеджио Балочные системы. Определение реакций опор и моментов защемления |

The Economics of the Welfare StateСодержание книги

Поиск на нашем сайте

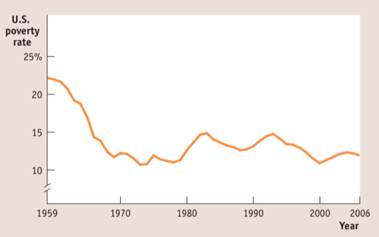

The welfare state is the collection of government programs designed to alleviate economic hardship. A government transfer is a government payment to an individual or a family. A poverty program is a government program designed to aid the poor. A social insurance program is a government program designed to provide protection against unpredictable financial distress. The poverty threshold is the annual income below which a family is officially considered poor. The poverty rate is the percentage of the population with incomes below the poverty threshold.

Mean household income is the average income across all households. Median household income is the income of the household lying at the exact middle of the income distribution. The Gini coefficient is a number that summarizes a country’s level of income inequality based on how unequally income is distributed across quintiles. The United States has seen declining and increasing income inequality. Since 1980 income inequality in the United State has increased substantially, largely due to an increase in inequality among highly educated workers. A means-tested program is a program available only to individuals or families whose incomes fall below a certain level. An in-kind benefit is a benefit given in the form of goods or services. A negative income tax is a program that supplements the income of low-income working families. Social Security, the largest program in the U.S. welfare state, is a non- means-tested program that provides retirement income for the elderly. It provides a significant share of the income of most elderly Americans. Unemployment insurance is also a key social insurance program. The American welfare state is redistributive. It increases the share of income going to the poorest 60% while reducing the share going to the richest 20%.

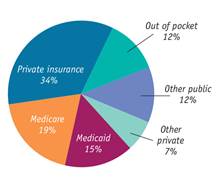

Under private health insurance, each member of a large pool of individuals pays a fixed amount to a private company that agrees to pay most of the medical expenses of the pool’s members. The majority of Americans not covered by private insurance are covered by Medicare, which is non-means-tested and applies only to those age 65 and older, and Medicaid, which is available based on income. A single-payer system is a health care system in which the government is the principal payer of medical bills funded through taxes. Intense debate on the size of the welfare state centers on philosophy and on equity-versus-efficiency concerns. The high marginal tax rates needed to finance an extensive welfare state can reduce the incentive to work. Holding down the cost of the welfare state by means-testing can also cause inefficiency through notches that create high effective marginal tax rates for benefit recipients. Politics is often depicted as an opposition between left and right; in the modern United States, that division mainly involves disagreement over the appropriate size of the welfare state.

|

|||||||

|

Последнее изменение этой страницы: 2021-07-19; просмотров: 63; Нарушение авторского права страницы; Мы поможем в написании вашей работы! infopedia.su Все материалы представленные на сайте исключительно с целью ознакомления читателями и не преследуют коммерческих целей или нарушение авторских прав. Обратная связь - 3.147.77.119 (0.008 с.) |