Заглавная страница Избранные статьи Случайная статья Познавательные статьи Новые добавления Обратная связь FAQ Написать работу КАТЕГОРИИ: ТОП 10 на сайте Приготовление дезинфицирующих растворов различной концентрацииТехника нижней прямой подачи мяча. Франко-прусская война (причины и последствия) Организация работы процедурного кабинета Смысловое и механическое запоминание, их место и роль в усвоении знаний Коммуникативные барьеры и пути их преодоления Обработка изделий медицинского назначения многократного применения Образцы текста публицистического стиля Четыре типа изменения баланса Задачи с ответами для Всероссийской олимпиады по праву

Мы поможем в написании ваших работ! ЗНАЕТЕ ЛИ ВЫ?

Влияние общества на человека

Приготовление дезинфицирующих растворов различной концентрации Практические работы по географии для 6 класса Организация работы процедурного кабинета Изменения в неживой природе осенью Уборка процедурного кабинета Сольфеджио. Все правила по сольфеджио Балочные системы. Определение реакций опор и моментов защемления |

Price ceiling/floor, deadweightСодержание книги

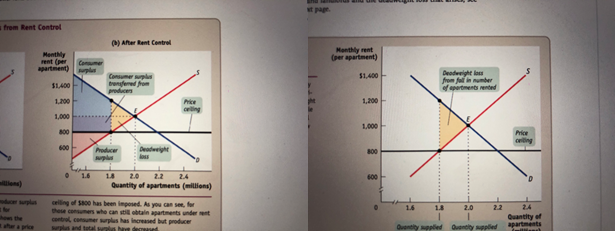

Поиск на нашем сайте Price controls are legal restrictions on how high or low a market price may go. They can take two forms: a price ceiling, a maximum price sellers are allowed to charge for a good or service, or a price floor, a minimum price buyers are required to pay for a good or service. Deadweight loss is the loss in total surplus that occurs whenever an action or a policy reduces the quantity transacted below the efficient market equilibrium Price ceilings often lead to inefficiency in the form of inefficient allocation to consumers: people who want the good badly and are willing to pay a high price don’t get it, and those who care relatively little about the good and are only willing to pay a low price do get it. Price ceilings typically lead to inefficiency in the form of wasted resources: people expend money, effort, and time to cope with the shortages caused by the price ceiling. Price ceilings often lead to inefficiency in that the goods being offered are of inefficiently low quality: sellers offer low-quality goods at a low price even though buyers would prefer a higher quality at a higher price. A black market is a market in which goods or services are bought and sold illegally—either because it is illegal to sell them at all or because the prices charged are legally prohibited by a price ceiling. The minimum wage is a legal floor on the wage rate, which is the market price of labor. Price floors lead to inefficient allocation of sales among sellers: those who would be willing to sell the good at the lowest price are not always those who actually manage to sell it. Price floors often lead to inefficiency in that goods of inefficiently high quality are offered: sellers offer high-quality goods at a high price, even though buyers would prefer a lower quality at a lower price. The demand price of a given quantity is the price at which consumers will demand that quantity. The supply price of a given quantity is the price at which producers will supply that quantity.

A quantity control, or quota, drives a wedge between the demand price and the supply price of a good; that is, the price paid by buyers ends up being higher than that received by sellers. The difference between the demand and supply price at the quota limit is the quota rent, the earnings that accrue to the license-holder from ownership of the right to sell the good. It is equal to the market price of the license when the licenses are traded.

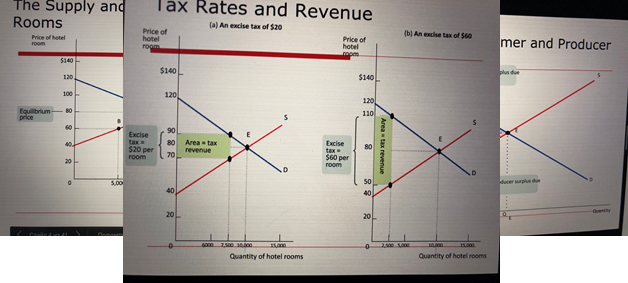

Taxes Supply curve shifts upwards by the amount of the tax Demand curve shifts downwards by the amount of the tax So there is no real difference who pays the tax, price change will be same The incidence of a tax is a measure of who really pays it

Tax revenue = $40 per room x 5,000 rooms = 200.000 The revenue collected by an excise tax is equal to the area of the rectangle choose height is the tax wedge between the supply and demand curve and choose width is the quantity transacted under the tax The deadweight loss is caused by the tax represents the total surplus lost to society because of the tax - that is the amount of surplus that would have been generated by transactions that now do not take place. The administrative costs of a tax are the resources used by govern to collect the tax, and by taxpayers to pay it, over and above the amount of tax The total inefficiency, caused by tax is the sum of deadweight loss and its administrative costs. Govern should choose to tac only demand only on those goods for which dam and sup or both is inelastic (cigarets) Income Tax: a tax that depends on the income of an individual or a family from wages and investments Payroll tax: a tax that depends on the earnings an ampler pays to an employee Sales Tax: a tax that depends on on the value of goods sold (excise tax) Profit tax: a tax that depends on a firms profits Property tax: a tax that depends on the value of property, such as the value of a home Wealth tax: a tax that depends on the individuals wealth A progressive tax takes a large share of the income of high-income taxpayers than low-income taxpayers A regressive tax takes a smaller share of the income of high-income taxpayers than low-income taxpayer. The marginal tax rate is the percentage of an increase in income that is taxed away Excise taxes - takes on the purchase or sale of a good. Raise the price paid by consumers and reduce the price received by producers. The incident of the tax - how the burden of the tax is divided between consumers and producers - does not depend on who officially pays the tax.

International trade Goods and services purchased from other countries are imports; goods and services sold to other countries are exports. Globalization is the phenomenon of growing economic linkages among countries. The Ricardian model of international trade analyzes international trade under the assumption that opportunity costs are constant. Autarky is a situation in which a country does not trade with other countries. The factor intensity of production of a good is a measure of which factor is used in relatively greater quantities than other factors in production. According to the Heckscher–Ohlin model, a country has a comparative advantage in a good whose production is intensive in the factors that are abundantly available in that country.

The domestic demand curve shows how the quantity of a good demanded by domestic consumers depends on the price of that good. The domestic supply curve shows how the quantity of a good supplied by domestic producers depends on the price of that good. The world price of a good is the price at which that good can be bought or sold abroad.

Exporting industries produce goods and services that are sold abroad. Import-competing industries produce goods and services that are also imported. An economy has free trade when the government does not attempt either to reduce or to increase the levels of exports and imports that occur naturally as a result of supply and demand.

Policies that limit imports are known as trade protection or simply as protection. A tariff is a tax levied on imports.

An import quota is a legal limit on the quantity of a good that can be imported. International trade agreements are treaties in which a country promises to engage in less trade protection against the exports of other countries in return for a promise by other countries to do the same for its own exports. The North American Free Trade Agreement, or NAFTA, is a trade agreement among the United States, Canada, and Mexico. The European Union, or EU, is a customs union among 27 European nations. The World Trade Organization, or WTO, oversees international trade agreements and rules on disputes between countries over those agreements. Offshore outsourcing takes place when businesses hire people in another country to perform various tasks. 1. International trade is of growing importance to the United States and of even greater importance to most other countries. International trade, like trade among individuals, arises from comparative advantage: the opportunity cost of producing an additional unit of a good is lower in some countries than in others. Goods and services purchased abroad are imports; those sold abroad are exports. Foreign trade, like other economic linkages between countries, has been growing rapidly, a phenomenon called globalization. 2. The Ricardian model of international trade assumes that opportunity costs are constant. It shows that there are gains from trade: two countries are better off with trade than in autarky. 3. The Heckscher–Ohlin model shows how differences in factor endowments determine comparative advantage. 4. The domestic demand curve and the domestic supply curve determine the price of a good in autarky. When international trade occurs, the domestic price is driven to equality with the world price, the price at which the good is bought and sold abroad. 5. If the world price is below the autarky price, a good is imported. This leads to an increase in consumer surplus, a fall in producer surplus, and a gain in total surplus. If the world price is above the autarky price, a good is exported. This leads to an increase in producer surplus, a fall in consumer surplus, and a gain in total surplus. 6. International trade leads to expansion in exporting industries and contraction in import-competing industries. 7. Most economists advocate free trade, but in practice many governments engage in trade protection. 8. A tariff is a tax levied on imports. An import quota is a legal limit on the quantity of a good that can be imported. 9. Although several popular arguments have been made in favor of trade protection, in practice the main reason for protection is probably political: import-competing industries are well organized and well informed about how they gain from trade protection, while consumers are unaware of the costs they pay. 10. Many concerns have been raised about the effects of globalization.

Making decisions All economic decisions involve the allocation of scarce resources. Some decisions are “either–or” decisions, in which the question is whether or not to do something. Other decisions are “how much” decisions, in which the question is how much of a resource to put into a given activity. The cost of using a resource for a particular activity is the opportunity cost of that resource. Some opportunity costs are explicit costs; they involve a direct payment of cash. Other opportunity costs, however, are implicit costs; they involve no outlay of money but represent the inflows of cash that are forgone. Both explicit and implicit costs should be taken into account in making decisions. Companies use capital and their owners’ time. So companies should base decisions on economic profit, which takes into account implicit costs such as the opportunity cost of the owners’ time and the implicit cost of capital. The accounting profit, which companies calculate for the purposes of taxes and public reporting, is often considerably larger than the economic profit because it includes only explicit costs and depreciation, not implicit costs. A “how much” decision is made using marginal analysis, which involves comparing the benefit to the cost of doing an additional unit of an activity. The marginal cost of producing a good or service is the additional cost incurred by producing one more unit of that good or service. The marginal benefit of producing a good or service is the additional benefit earned by producing one more unit. The marginal cost curve is the graphical illustration of marginal cost, and the marginal benefit curve is the graphical illustration of marginal benefit. In the case of constant marginal cost, each additional unit costs the same amount to produce as the unit before; this is represented by a horizontal marginal cost curve. However, marginal cost and marginal benefit typically depend on how much of the activity has already been done. With increasing marginal cost, each unit costs more to produce than the unit before and is represented by an upward-sloping marginal cost curve. In the case of decreasing marginal benefit, each additional unit produces a smaller benefit than the unit before and is represented by a downward-sloping marginal benefit curve. The optimal quantity is the quantity that generates the maximum possible total net gain. According to the principle of marginal analysis, the optimal quantity is the quantity at which marginal benefit is equal to marginal cost. It is the quantity at which the marginal cost curve and the marginal benefit curve intersect. A cost that has already been incurred and that is nonrecoverable is a sunk cost. Sunk costs should be ignored in decisions about future actions because they have no effect on future benefits and costs. In order to evaluate a project in which costs or benefits are realized in the future, you must first transform them into their present values using the interest rate, r. The present value of $1 realized one year from now is $1/(1 + r), the amount of money you must lend out today to have $1 one year from now. Once this transformation is done, you should choose the project with the highest net present value.

The rational consumer

Consumers maximize a measure of satisfaction called utility. Each consumer has a utility function that determines the level of total utility generated by his or her consumption bundle, the goods and services that are consumed. We measure utility in hypothetical units called utils.

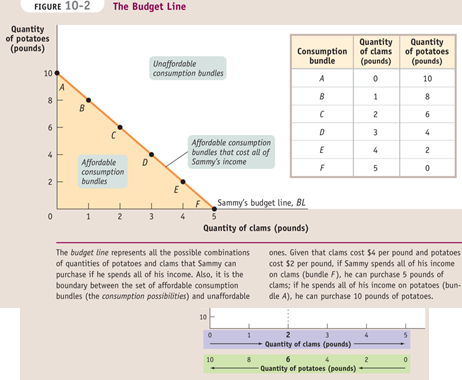

A good’s or service’s marginal utility is the additional utility generated by consuming one more unit of the good or service. We usually assume that the principle of diminishing marginal utility holds: consumption of another unit of a good or service yields less additional utility than the previous unit. As a result, the marginal utility curve slopes downward. A budget constraint limits a consumer’s spending to no more than his or her income. It defines the consumer’s consumption possibilities, the set of all affordable consumption bundles. A consumer who spends all of his or her income will choose a consumption bundle on the budget line. An individual chooses the consumption bundle that maximizes total utility, the optimal consumption bundle. The substitution effect of a change in the price of a good is the change in the quantity of that good consumed as the consumer substitutes the good that has become relatively cheaper in place of the good that has become relatively more expensive. The income effect of a change in the price of a good is the change in the quantity of that good consumed that results from a change in the consumer’s purchasing power due to the change in the price of the good.

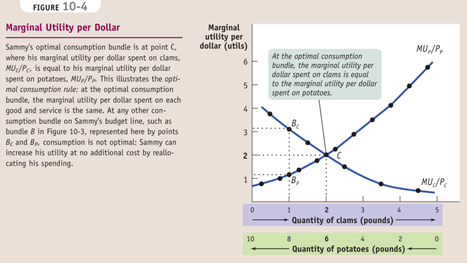

We use marginal analysis to find the optimal consumption bundle by analyzing how to allocate the marginal dollar. The optimal consumption rule says that at the optimal consumption bundle the marginal utility per dollar spent on each good and service – the marginal utility of a good divided by its price – is the same.

Changes in the price of a good affect the quantity consumed in two possible ways: the substitution effect and the income effect. Most goods absorb only a small share of a consumer’s spending; for these goods, only the substitution effect – buying less of the good that has become relatively more expensive and more of the good that has become relatively cheaper–is significant. It causes the individual and the market demand curves to slope downward. When a good absorbs a large fraction of spending, the income effect is also significant: an increase in a good’s price makes a consumer poorer, but a decrease in price makes a consumer richer. This change in purchasing power makes consumers demand more or less of a good, depending on whether the good is normal or inferior. For normal goods, the substitution and income effects reinforce each other. For inferior goods, however, they work in opposite directions.

|

||||||||||||||||||||||||||||

|

Последнее изменение этой страницы: 2021-07-19; просмотров: 96; Нарушение авторского права страницы; Мы поможем в написании вашей работы! infopedia.su Все материалы представленные на сайте исключительно с целью ознакомления читателями и не преследуют коммерческих целей или нарушение авторских прав. Обратная связь - 216.73.216.214 (0.006 с.) |