Заглавная страница Избранные статьи Случайная статья Познавательные статьи Новые добавления Обратная связь FAQ Написать работу КАТЕГОРИИ: ТОП 10 на сайте Приготовление дезинфицирующих растворов различной концентрацииТехника нижней прямой подачи мяча. Франко-прусская война (причины и последствия) Организация работы процедурного кабинета Смысловое и механическое запоминание, их место и роль в усвоении знаний Коммуникативные барьеры и пути их преодоления Обработка изделий медицинского назначения многократного применения Образцы текста публицистического стиля Четыре типа изменения баланса Задачи с ответами для Всероссийской олимпиады по праву

Мы поможем в написании ваших работ! ЗНАЕТЕ ЛИ ВЫ?

Влияние общества на человека

Приготовление дезинфицирующих растворов различной концентрации Практические работы по географии для 6 класса Организация работы процедурного кабинета Изменения в неживой природе осенью Уборка процедурного кабинета Сольфеджио. Все правила по сольфеджио Балочные системы. Определение реакций опор и моментов защемления |

Different fiscal systems complicate reserve valuesСодержание книги

Поиск на нашем сайте

The value of hydrocarbon reserves in-the-ground varies dramatically worldwide because of the existence of numerous reserve categories and diverse fiscal systems.

For a company’s survival in the petroleum industry, value replacement is more important than reserve replacement. But unfortunately, when it comes to international reserve values, nobody seems to speak the same language. Discoveries are often measured in terms of gross recoverable reserves. But, reserve and financial transaction reporting differ widely.

Term uncertainty In the U.S. during 1994, $4.50/bbl was the average price paid for proved developed producing reserves. In other words, reserves in-the-ground were worth about $4.50/bbl. Unfortunately, some of the confusion begins right here. Quoted U.S. reserve transaction values are based usually, but not always, on net-revenue-interest barrels. In fact, it is often impossible to determine from published sources whether working-interest barrels or net-revenue-interest barrels are quoted.

Some published U.S. reserve/production transaction data include working interest barrels while others record net-revenue-interest barrels. Unless the terms are defined, uncertainty will exist.

The U.S. Security and Exchange Commission (SEC) 10-K reporting requires net-revenue-interest barrels. But unfortunately outside the U.S., this consistent treatment disappears. In fact, the net-revenue-interest concept is almost nonexistent in countries with contractual systems.

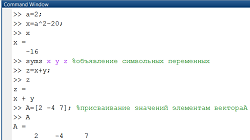

Fiscal systems Fig. 1 groups the world’s petroleum fiscal systems. • Under royalty/tax systems, oil companies take title to produced hydrocarbons at the wellhead and then pay the appropriate royalties and taxes. The royalties are paid either in cash or in kind. • In contractual systems, oil companies receive a fee for exploration, development, and production operation services. • With a production sharing contract (PSC), the fee is a share of production so that ultimately the oil company takes title to a share of hydrocarbons—usually at the point of export. • Service or risk service agreements are similar to PSCs except the fee is in cash. The company does not take title to any hydrocarbons. This fact creates the confusion: How can a company book reserves it does not own? Exercise 8. Study the figures 1, 2 and discuss. 1. The difference between definitions of reserves “booked” (fig.1) 2. Classification of petroleum fiscal systems (fig.2)

Words and expressions

Exercise 9. Discuss

1. Have you ever heard or read that a particular company has problems with revenue authorities? What company was it? What was the problem? 2. Do all businesses in Russia pay taxes in full? Why do you think some of them try to avoid taxes? What should the authorities do with such companies? Do you know what the auditors deal with? Auditors and their reports Auditors are usually independent certified accountants who review the financial records of a company. These reviews are called audits. They are usually performed at fixed intervals - quarterly, semiannually or annually. Auditors are employed either regularly or on a part-time basis. Some large companies maintain a continuous internalaudit by their own accounting departments. These auditors are called internal auditors. Not so many years ago the presence of an auditor suggested that a company was having finacial difficulties or that irregularities had been discovered in the records.

Currently, however, outside audits are a normal and regular part of business practice. Auditor's see that current transactions are recordered promptly and completely. Their duty is to reduce the possibility of misappropriation, to identify mistakes or detect fraudulent transactions. Then they are usually requested to propose solutions for these problems. Thus auditors review financial records and report to the management on the current state of the company's fiscal affairs in the form of Auditor's Report or Auditor's Opinion. Words and expressions

|

||||||||||

|

Последнее изменение этой страницы: 2017-02-08; просмотров: 519; Нарушение авторского права страницы; Мы поможем в написании вашей работы! infopedia.su Все материалы представленные на сайте исключительно с целью ознакомления читателями и не преследуют коммерческих целей или нарушение авторских прав. Обратная связь - 13.58.103.70 (0.005 с.) |