Заглавная страница Избранные статьи Случайная статья Познавательные статьи Новые добавления Обратная связь FAQ Написать работу КАТЕГОРИИ: ТОП 10 на сайте Приготовление дезинфицирующих растворов различной концентрацииТехника нижней прямой подачи мяча. Франко-прусская война (причины и последствия) Организация работы процедурного кабинета Смысловое и механическое запоминание, их место и роль в усвоении знаний Коммуникативные барьеры и пути их преодоления Обработка изделий медицинского назначения многократного применения Образцы текста публицистического стиля Четыре типа изменения баланса Задачи с ответами для Всероссийской олимпиады по праву

Мы поможем в написании ваших работ! ЗНАЕТЕ ЛИ ВЫ?

Влияние общества на человека

Приготовление дезинфицирующих растворов различной концентрации Практические работы по географии для 6 класса Организация работы процедурного кабинета Изменения в неживой природе осенью Уборка процедурного кабинета Сольфеджио. Все правила по сольфеджио Балочные системы. Определение реакций опор и моментов защемления |

The rules of free trade apply to services as well as goodsСодержание книги

Поиск на нашем сайте IN AMERICA, in Britain, in Australia, an awful thought has gripped employees in the past six months or so: India may do for services what China already does for manufacturing. Any product can be made in China less expensively than in the rich countries. Is it merely a matter of time before any service that can be electronically transmitted is produced in India more cheaply too? As “offshoring”—a hideous word to describe work sent overseas, often outsourced—has spread from manufacturing to white-collar services, so the pressure on legislators to step in has increased. Manufacturers have used overseas suppliers for years. But now, cheaper communications allow companies to move back-office tasks such as data entry, call centres and payroll processing to poorer countries. India has three huge attractions for companies: a large pool of well-educated young workers, low wages and the English language. But plenty of other industrialising countries also handle back-office work. Moreover, given the pressure on costs in rich countries, offshore sourcing of services will grow: a much-quoted study by Forrester, a consultancy, last year predicted that 3.3m American jobs (500,000 of them in IT) would move abroad by 2015. And the quality of outsourcing will improve. No wonder politicians are under pressure to discourage companies (and public agencies) from sending service work abroad. To do so, though, would be as self-defeating as stopping the purchase of goods or components abroad. For, although the jobs killed by outsourcing abroad are easy to spot, the benefits are less visible but even greater. Like trade in goods, trade in services forces painful redistributions of employment. A study for the Institute for International Economics found that, in 1979-99, 69% of people who lost jobs as a result of cheap imports in sectors other than manufacturing found new work. But those figures are only for America, with its flexible job market, and leave a large minority who did not find new employment. Moreover, 55% of those who found new jobs did so at lower pay, and 25% took pay cuts of 30% or more. Some of the gains from free trade need to be used to ease the transition of workers into new jobs. But those gains are substantial. Some arise simply from organising work in more effective ways. A fair part of the work that moves abroad represents an attempt by companies to provide a round-the-clock service, by making use of time zones. To that extent, offshoring directly improves efficiency. In addition, a recent report on offshoring from McKinsey estimates that every dollar of costs the United States moves offshore brings America a net benefit of $1.12 to $1.14 (the additional benefit to the country receiving the investment comes on top). Part of this arises because, as low value-added jobs go abroad, labour and investment can switch to jobs that generate more economic value. This is what has happened with manufacturing: employment has dwindled, but workers have moved into educational and health services where pay is higher (and conditions often more agreeable). VOCABULARY: white-collar services – сфера высококачественных, высокооплачиваемых услуг data entry – бухгалтерская запись, ведение бухгалтерии, бухгалтерских записей flexible job market – гибкий рынок рабочей силы, труда (возможность быстро найти новую работу) estimate – оценивать, подсчитывать приблизительно, составлять смету estimates – оценочные данные low-value-added jobs – виды работ, трудовой деятельности с низкой долей добавленной стоимости

TRANSLATION NOTES: To do so, though, would be as… as… - Подобные действия при этом были бы подобны…(такими же … как)… For,… the benefits are less visible… - Поскольку (так как) … выгоды от этого менее очевидны… Перевод служебных слов часто вызывает трудности и требует грамматического анализа предложения, т.к. они могут выступать в разных качествах: союз, предлог, наречие. (См. часть Ш, раздел 3, § 9, п.9.3)

Explain what is meant by “India may do for services what China already does for manufacturing”. Explain what you understand by the terms “offshoring”; “outsourcing”. Give the most common examples. Analyse why offshoring has spread from manufacturing to white-collar services. Outline the attractions of a country for a foreign company to outsource its operations. What do you think politicians might do to discourage companies from sending service work abroad? Evaluate all the benefits and drawbacks of outsourcing. What evidence is there in the article that offshoring brings a net benefit? Suggest, with reasons, why companies use offshoring and outsourcing. VOCABULARY REVISION – UNIT 2 Продукт, изделие; процесс производства; объем выпущенной продукции; производственные мощности; нехватка производственных мощностей; неиспользуемые производственные ресурсы; массовое производство; завод; сырье; поставщик; комплектующие; вертикальная интеграция; передача субподрядчикам части производственных функций; высокоэффективное производство; объем продаж; товарно-материальные запасы; поток доходов; задание по реализации продукции; расходы; издержки; накладные расходы; финансовая смета; иметь задолженность; оборотный капитал; вложение средств; коммерческий кредит; ожидаемые поступления; должник; кредитор; ссуда; краткосрочный долг; ставка процента; счета к оплате

Part 1 Unit 3 ECONOMIC CYCLE AND KEY INDICATORS

UNIT 3 ECONOMIC CYCLE AND KEY INDICATORS

SECTION 1 KEY ECONOMIC INDICATORS LEAD-IN Measures that look to the past, current and future direction of the economy are economicindicators (also referred to as numbers). Economic growth, unemployment, inflation and the balance of payments are the four key economic indicators in the economy. Growth is the rate at which the value of economic output is expanding (or not). Output may be measured and expressed in terms of gross domestic product (GDP). Gross domestic product (GDP) is calculated from the total value of goods and services produced in an economy over a specified period. Since World War II, GDP has been generally regarded as the most important indicator of the status of an economy. In the United States, the economy is considered to be in recession if there are two consecutive quarters of decrease in GDP. GDP per capita is the total output of a particular country divided by the number of people living there. High national income can mean high living standards – high levels of wealth for people – but it depends on income distribution – the way that money is divided among the people of the country. Prosperity can also be measured in terms of GNI (Gross National Income). This includes money coming into a country from investments abroad, minus money leaving the country to go to investors from abroad. This is the new name for what used to be called GNP (Gross National Product). Real GDP means that the figures have been adjusted for inflation. This is important in comparing present economic conditions with the economy of previous years. If the GDP is reported before adjustment for inflation, it is called a nominal GDP. Obviously, it will be much higher than the real GDP. Unemployment is the number of jobless or people without work. The unemployment rate is a powerful indicator. When the various indicators are mixed, many analysts look to the unemployment rate as being the most important. Inflation is defined as a sustained increase in the general level of prices for goods and services. It is measured as an annual percentage increase. There are several variations of inflation. Deflation is when the general level of prices is falling. This is the opposite of inflation. Hyperinflation is unusually rapid inflation. In extreme cases, this can lead to the breakdown of a nation's monetary system. One of the most notable examples of hyperinflation occurred in Germany in 1923, when prices rose 2,500% in one month! Stagflation is the combination of high unemployment and economic stagnation with inflation. This happened in industrialized countries during the 1970s, when a bad economy was combined with OPEC raising oil prices. There are two main price indexes that measure inflation: the Consumer Price Index (CPI) (in the United Kingdom the main measure of inflation is done through the Retail Price Index or RPI) is considered the most widely used measure of inflation and is regarded as an indicator of the effectiveness of government policy. The CPI is an index that measures the quarterly changes in the prices of a selected weighted “basket” of consumer goods and services. The basket includes a wide range of goods and services such as food, clothing and footwear, housing, health, transport, recreation and education. The rate at which the prices of goods and services rise over a period of time, including costs which are likely to change, such as food and fuel and, in the UK, the cost of mortgages is known as the headline inflation, or headline rate of inflation. Headline inflation rates can be volatile, often because of substantial movements in commodity or food prices. Such volatility in a key price index can make it difficult for policymakers to accurately judge the underlying state of, and prospects for, inflation. A measure of inflation that excludes certain items which face volatile price movements is core inflation. Core inflation eliminates products that can have temporary price shocks because these shocks can diverge from the overall trend of inflation and give a false measure of inflation. Core inflation is thought to be an indicator of underlying long-term inflation. The rate at which the prices of goods and services rise over a period of time, measured without considering prices that go up and down frequently, especially the costs of mortgages is underlying inflation. The Producer Price Index is not as widely used as the CPI, but it is still considered to be a good indicator of inflation. Formerly known as the "Wholesale Price Index", the PPI is a basket of various indexes covering a wide range of areas affecting domestic producers. The PPIincludes industries such as goods manufacturing, fishing, agriculture, and other commodities. Balance of payments is a systematic record of a country’s receipts from, or payments to, other countries. In a way, it is like the balance sheets for businesses, only on a national level. There are three primary accounts in the balance of payments: thecurrent account, the capital account, and theofficial settlements account. The current account of the balance of payments records trade balance - international flows of goods and services - and other net income from abroad. Current account figures also include transfers of money between countries, for example debt interest, or foreign workers sending money home. Thetrade balanceis part of a current account balance. Trade balance consists of visible trade (physical goods of export and import) and invisible trade (payments for services such as insurance and tourism). If exports exceed imports there is a trade surplus. If not, there is a trade deficit or trade gap. The capital account records international transactions in financial assets.

VOCABULARY

COMPREHENSION QUESTIONS: 1) What are the four key economic indicators? 2) What is the difference between gross domestic and gross national product? 3) What is the difference between real and nominal GDP? 4) What can hyperinflation lead to? 5) How can inflation be measured? 6) What method of measuring inflation is known as the headline inflation rate? 7) Is core or headline inflation considered more accurate in representing the economy's underlying inflationary pressures? 8) What is the balance of payments? What are its three primary accounts? 9) What does the trade balance consist of? 10) Which account records international transactions in financial assets?

VOCABULARY PRACTICE The sustainable growth rate is a measure of how much a firm can grow without borrowing more money. After the firm has passed this rate, it must borrow funds from another source to facilitate growth. While the latest figure for GDP in the October-to-December period was indeed anemic and marked the worst performance in three years, the new reading actually turned out to be slightly better than the 1.6 percent growth rate estimated a month ago, according to the Commerce Department's report released today. A price index measures the change in price of a fixed basket of goods and services between two time periods. This change in prices over time is often called inflation. The U.S. trade deficit increased 17% in 2005, and 9% in the fourth quarter alone. Rapidly rising oil prices and imports explained about two-thirds of the increase. Timothy Geithner, president of the New York Federal Reserve, on Monday dismissed the view that the US current account deficit was sustainable, suggesting the risk of a sudden fall in the dollar would grow the longer the trade gap widened. TEXTS TO TRANSLATE: 25. Eurozone Recovery Boosts Confidence The eurozone's economic recovery has pushed confidence to a fresh five-year high while core inflation has tumbled, according to data released yesterday. But the generally upbeat picture provided by the European Commission's sentiment survey was marred by Spain, which has been one of the 12-nation euro-zone's best performing economies but where the mood has darkened dramatically. The survey is the latest evidence that the general economic pick-up in the eurozone over the past six months is gaining momentum, without any serious inflationary impact so far. Core inflation - excluding energy prices - fell unexpectedly sharply in January, according to detailed figures released by Eurostat, the European Union's statistical unit. Inflation excluding energy, food, alcohol and tobacco -a measure watched closely by financial markets - fell from 1.4 per cent in December to 1.2 per cent last month, - the lowest since February 2001. The core inflation figures compared with a headline inflation rate of 2.4 per cent in January, up from 2.2 per cent in December. But the Commission's economic sentiment index for Spain plunged in February to the lowest level since February 1994, largely because of a collapse of confidence in the construction and retail sectors. Although the country has for many years outperformed the eurozone average, worries have mounted recently about its expanding current account deficit and vulnerability to a house price collapse. Spain's January inflation rate of 4.2 per cent was the highest in the eurozone. The harsh winter might also have hit Spanish confidence, analysts said. The data come as the European Central Bank is almost certain to raise its main interest rate tomorrow by a quarter percentage point to 2.5 per cent. Unlike the US Federal Reserve, the ECB dislikes core inflation measures. As such it is likely to express concern about long-run inflation pressures created by high oil prices. But the still modest underlying inflation pressures, and continuing doubts about the sustainability of the upswing, provided ammunition for those urging the ECB not to rush subsequent interest rate increases. Labour market figures also took some of the gloss off yesterday's economic news. France's unemployment rate in January nudged higher, and Germany saw a much smaller-than-expected fall of 5,000 in its seasonally adjusted unemployment total to 4.695m in February. But the Commission's survey showed manufacturing and service companies have become more optimistic about their employment expectations. The Commission's euro-zone economic sentiment index rose from 101.5 in January to 102.7 in February, the highest since June 2001. Economic sentiment improved in Germany. VOCABULARY: recovery - подъем, оживление consumer confidence - потребительское доверие, ожидания потребителей (степень уверенности потребителей в том, что экономика развивается успешно и какие-л. потрясения маловероятны) business confidence – уверенность со стороны предпринимателей Consumer Confidence Index - индекс потребительского доверия, индекс потребительского оптимизма Business Confidence Index - индекс делового доверия, индекс предпринимательской уверенности European Commission's sentiment survey - индекс ожиданий потребителей, в сочетании с индексом делового оптимизма, рассчитываемый для стран Еврозоны, образует общий индекс доверия экономике gain momentum (gather momentum) - усиливаться, расти; наращивать темп, скорость interest rate – процентная ставка seasonally adjusted – с учетом сезонных колебаний economic sentiment index - общий индекс доверия экономике, индекс экономических настроений, индекс ожиданий производителей и потребителей, индекс делового и потребительского оптимизма

26. Is the U.S. Current Account Deficit Sustainable? The U.S. current account deficit, driven by the United States' widening trade deficit, is the largest it has ever been, both as a share of the U.S. economy and in dollar terms. How much longer can the United States continue to spend more than it earns and support the resumption of global growth? The United States is enjoying an economic boom that is fueling the growth of its trade deficit. At current exchange rates, the strength of the U.S. economy, combined with slow growth in demand in many other parts of the world, will lead to further widening of the U.S. trade deficit. How long can the trade deficit continue on that trajectory without disrupting the U.S. economy or the world economy? Absent structural reforms in the United States and abroad, a large devaluation of the dollar, or significant changes in the business cycle, both the trade and the current account deficits will continue to widen until they become unsustainable, perhaps two or three years out. Changing the trajectory will be difficult. The U.S. trade deficit is now so large that even if world economic growth were to pick up and boost U.S. exports, U.S. imports would have to slow dramatically for the gap to narrow. To shrink the trade deficit significantly, say, over a two-year period, exports would have to grow twice as fast as they did in the 1990s, when growth averaged 7.5 percent a year, and the growth rate of imports would have to be halved, from 11 percent to 51/2 percent a year. Moreover, following twenty years as a net recipient of capital inflows, the United States will soon be confronted with much larger service payments. At some point, either the United States' negative net international investment position and the associated servicing costs will become too great a burden on the U.S. economy or, more likely, global investors will decide that U.S. assets account for a big enough share of their portfolios and so will stop acquiring more of them. At that point, asset prices, including interest rates and the exchange value of the dollar, will adjust, reflecting the change of sentiment in the markets. A change in the value of the dollar alone would narrow the trade gap for a while, but the deficit would soon begin to widen again. To put the U.S. current account and trade deficits back on a sustainable path will require structural reforms in the United States and its trading partners that encourage faster global growth, boost U.S. household saving rates, better prepare U.S. workers for technological changes in the global economy, and open up markets for U.S. exports, particularly of services. VOCABULARY: fuel – усиливать; способствовать росту; подстегивать, стимулировать Это слово имеет широкий синонимический ряд: to boost, to foster, to spur, to stimulate, to fan. service payments – обслуживание долга, погашение % по долгам. portfolio - (инвестиционный) портфель boost – повышать, поднимать; ускорять, увеличивать to boost prices – повышать цены boost household saving rates – способствовать росту уровня сбережений американских домашних хозяйств

27. Data Show Europe's Economies Are on Separate Paths The European Union's economy sent mixed signals Tuesday, with France reporting that consumers are in a record buying mood but with unemployment in Germany rising and both Italy and Belgium fretting about stagnant growth prospects. Although the EU economy is likely to grow by up to 2.8 percent next year, according to the International Monetary Fund, the signals indicated that the growth will be unevenly spread between buoyant economies like France and slower-moving countries like Belgium. A French government index for September measured the highest degree of consumer confidence since it was first used 12 years ago. Too sharp a divergence in economic growth rates could pose problems for the 11-nation European single currency area, which, unlike the United States, has few built-in correcting mechanisms. In the United States, workers often simply move to other parts of the country in search of jobs; this is not the case in the EU. In Germany, for example, the unemployment rate has shot up in the formerly Communist East as government job creation programs have come to an end. This was the main cause of an increase in the national unemployment rate, to 10.6 percent in September from 10.5 percent a month earlier, that left 4.13 million Germans in search of a job. While unemployment in the former East stood at its highest level since May 1998, the number of people out of work declined in the West, which accounts for 90 percent of the output in Europe's biggest economy. Government figures showed that unemployment rose by 15,000 in the East but declined by 9.000 in the West. Analysts said the overall rise in Germany's unemployment rate would damp expectations for an increase in the cost of borrowing money in the European single currency zone. The European Central Bank was due to make its regular pronouncement on interest rates Thursday. The benchmark refinancing rate has remained at 2.5 percent since April, while inflation in the euro zone, which rose slightly to an annual rate of 1.2 percent in August, has remained well below the ECB' s ceiling of 2 percent. In Rome, Prime Minister Massimo D'Alema warned that Italy's economy, the most sluggish in the EU, might grow less the 1.3 percent that the government had forecast for this year. VOCABULARY: fret about – беспокоиться

growth prospects – перспективы роста экономики

buoyant economy – страна, экономика которой находится на подъеме buoyant – оживленный buoyancy – оживление buoyant prices – высокие цены

single currency zone - еврозона benchmark – база, ориентир, эталон, стандарт для сопоставлений, отправная точка benchmark refinancing rate – исходная, базовая ставка рефинансирования

TRANSLATION NOTES: which has few built-in-correcting mechanisms – где практически отсутствует собственные корректирующие механизмы. Правильный перевод зависит от правильной передачи оттенков значения few, little, a few,a little few, little – мало (имеют несколько негативный оттенок, подчеркивают почти полное отсутствие чего-либо) a few, a little – несколько, немного (См. часть Ш, раздел 3, § 10 п.10.2)

inflation has remained well below… – инфляция остается значительно ниже… Слово well в сочетании с наречием или союзом переводится как вполне, совершенно, значительно, очень. (См. часть Ш, раздел 3, § 9, п.9.6)

28. Dormant for Now, Inflation Shows Signs of Awakening WASHINGTON - Is inflation beginning to awaken from its long slumber? At first glance, most U.S. government data seems to say no. Last week, two key gauges painted a fairly benign inflation picture in the U.S., suggesting that a surge in energy costs hasn't yet been enough to spark widespread price increases. But beneath the calm, some economists are beginning to detect signs of strain. They worry that the inflation reports were pushed down by unusually large price decreases in certain areas, which buck recent trends and are unlikely to recur. Absent those drops, the overall inflation numbers would have edged higher. For now, inflation remains the dog that hasn't barked. In the U.S., the consumer price index, a closely watched inflation measure, inched up just 0.2% in January, the Labor Department said Friday. The core component of the index, which excludes the volatile food and energy components, also rose just 0.2%. For the year, the overall index rose 2.7%, with the core component climbing 1.9%. Confirming earlier reports, the survey found that energy costs rose sharply for the month, jumping 1%. and are up a whopping 14.7% for the year. Gasoline costs climbed 1.6% in January and are up 32.4% for the year. Falling prices for air fares, new cars and apparel goods - which declined 1.1%, their sharpest decrease in 11 years - helped offset the higher energy costs, the survey found. Computer prices also fell, dropping 1.7% in January and 24.4% for the year. In the CPI report, meanwhile, a sharp drop in apparel prices due to postholiday discounting helped keep the overall measure fairly flat. The increase in cigarette prices also wasn't fully reflected in the CPI numbers, and should push the February figure higher. Friday's release of the CPI was the first since the U.S. Federal Reserve Bank announced plans to base its inflation measurements on the Personal Consumption Expenditures index, or PCS, rather than the CPI, which Fed officials have long complained overstates inflation. The CPI is still very important to financial markets around the world, however. VOCABULARY: inflation reports – данные о состоянии инфляции

…which buck recent trends – которые искажают реальные тенденции, наметившиеся в последнее время buck the trend – двигаться против течения; выступать против основной тенденции

apparel goods - одежда personal consumption expenditures - личные потребительские расходы

TRANSLATION NOTES: a fairly benign inflation picture – уровень инфляции достаточно низкий (ситуация с инфляцией достаточно благоприятная) Это выражение является хорошим примером антонимического перевода. (См. часть Ш, раздел 2, § 4, п.4.4)

the Labor Department - Министерство труда США

29. Will This Slowdown Be Satisfactory? After its robust growth in the first half of the year, the Canadian economy appears to be slowing, andinflation seems well-contained. However, in a surprisingly hawkish Aug. 16 policy report, the Bank of Canada isn't convinced that it can relax its guard. The bank now expects growth this year between 4.25% to 4.75%, up from the 4% to 4.5% range in its May policy report. In the most recent three quarters, the economy grew at an annual rate of 5.5%. That means the bank's projection implies a slowdown for the second quarter and beyond. However, the boc made it clear that it expects growth to remain strong enough to push against the economy's capacity limits, and that it would remain vigilant against inflationary pressures. The boc projects core inflation— excluding energy and food— to rise only slightly, from 1.5% in June to 2% next year. The boc's target range for inflation is 1% to 3%. The bank appears unconvinced that the US economy will slow enough to ease price pressures in the US's biggest trading partner. Exports, consumer spending, and capital outlays powered the first half’s stronger-than-expected growth. Solid US demand is fueling exports, pushing Canada's June trade surplus to a record. Household spending remains firm, given the 0.8% jump in June retail sales. And businesses continue to invest heavily in high-tech equipment. Indeed, the boc is intensely studying the degree to which such investments have lifted productivity and expanded Canada's ability to grow faster than it has in the past without sparking inflation. The bank recently surveyed 140 companies, and the results suggest that investment in new technologies and a wave of corporate restructurings in the 1990s are bearing fruit. Further studies aimed at pinning down the economy's new speed limit are expected to be released in November. Still, whatever room for additional growth there may be appears to be rapidly shrinking. If the Federal Reserve hikes US rates again later this year, look for Canada to follow suit. VOCABULARY: hawkish - зд. жесткий target range for inflation - установленный правительством целевой ориентир роста уровня инфляции target (range) - целевой ориентир роста денежной массы в обращении, установленный властями

TRANSLATION NOTES: Canadian economy appears to be slowing, and inflation seems well-contained – Похоже, что экономический рост Канады замедляется, а инфляция находится под жестким контролем. В предложениях, содержащих конструкцию «именительный падеж с инфинитивом», глаголы-сказуемые to seem, to appear переводятся как по-видимому. Сравните: The market seems to be hesitant. – На рынке, по-видимому, наблюдается выжидательное настроение. (См. часть Ш, раздел 3, § 4) VOCABULARY CHECK 1) Темпы экономического роста, безработица, инфляция и платежный баланс – ключевые показатели развития экономики. 2) Инфляция – это постоянный рост цен на товары и услуги. 3) По словам министра, ожидается, что в августе инфляция составит либо 0%, либо будет зафиксирована дефляция. 4) В 1970-х годах в промышленно развитых странах мира имела место стагфляция, сопровождаемая стагнацией производства и высоким уровнем безработицы. 5) Потребительская инфляция – это инфляция, измеряемая на основании индекса потребительских цен. 6) Базовая инфляция не включает цены, подверженные резким сезонным колебаниям. 7) Во втором квартале текущего года дефицит текущего платежного баланса США составил 166, 2 миллиарда долларов, сообщается на сайте британского делового издания Financial Times. 8) Аналитики отмечают, что размер дефицита (платежного баланса) приближается в настоящее время к 6 процентам ВВП, а столь значительная диспропорция должна неизбежно привести, по их мнению, к обесцениванию доллара. 9) Активное сальдо торгового баланса - превышение товарного экспорта страны над ее товарным импортом. 10) Положительное сальдо торгового баланса РФ за июнь 2006г. составило 11 млрд 822 млн долл. против 9 млрд 312 млн долл. годом ранее (рост на 26,9%). 11) Министерство финансов РФ прогнозирует снижение базовой инфляции

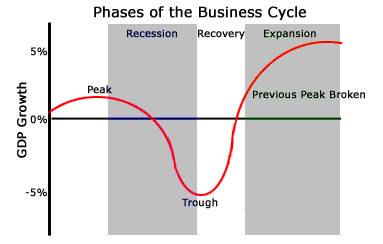

SECTION 2 BOOM AND BUST LEAD-IN The business cycle or economic cycle refers to the ups and downs seen somewhat simultaneously in most parts of an economy. The cycle involves shifts over time between periods of relatively rapid growth of output (recovery and prosperity), alternating with periods of relative stagnation or decline (contraction or recession). These fluctuations are often measured using the real gross domestic product. The stages of the business cycle are growth (expansion), peak, recession (contraction), trough and recovery. At one time, business cycles were thought to be extremely regular, with predictable durations. But today business cycles are widely known to be irregular - varying in frequency, magnitude and duration. In an economy where the pattern is extreme, it is referred to as the boom-bust cycle. An economic boom withbooming economic growth (increasing demand and production), inevitably peaks. At its peak, the economy is running at full steam. Employment is at or near maximum levels; GDPoutput is at its upper limit; and income levels are increasing. In this period, prices tend to increase due to inflation; however, most businesses and investors are having an enjoyable and prosperous time. After experiencing a great deal of growth and success, income and employment begin to decline. As our wages and the prices of goods in the economy are inflexible to change, they will most likely remain near the same level as that found in the peak period unless the recession is prolonged. The result of these factors is negative growth in the economy. Following the peak there is a slowdown, turndown, downturn, or downswing (periods of slower or negative growth), when the economy slows down, turns down, or weakens. A slowdown in demand, the amount of goods and services that are bought, may be the first sign of a recession: a period with little growth, no growth, or even negative growth. A severe recession is a slump. When a recession is extremely severe and prolonged, commentators talk about economic collapse and depression. The Depression, with a capital D, usually refers to the years following the Wall Street crash of 1929. Also sometimes referred to as a depression, troughis the section of the business cycle when output and employment bottom out and remain in waiting for the next phase of the cycle to begin. Or there may be a double-dip recession. The recession reaches its trough and bottoms out: the economy starts to improve, but then turns down again into a second trough.

During a recession people impatiently look for signs of a recovery or an upturn: signs that the economy is recovering, strengthening, picking up, or turning up and that things are getting better. Commentators then talk about a pick-up, turn-up, upturn, or upswing in the economy. In a recovery the economy is growing once again and moving away from the bottoms experienced at the trough. Employment, production, and income all undergo a period of growth, and, overall, the economic climate is good.

When a recession is over, and there is steady growth, the economy is said to take off. Soft landing is a term describing a growth rate high enough to keep the economy out of recession, but also slow enough to prevent high inflation. When the economy is growing at strong rate, the central banks try to engineer a soft landing by raising interest rates enough to slow the economy down without putting it into recession. When the economy goes directly from a period of expansion to a recession as the government attempts to slow down inflation a term hard landing is used. This might happen if a government or monetary authorities are more restrictive in their fiscal or monetary policy than what is appropriate for the economy. It is opposite of soft landing.

VOCABULARY

COMPREHENSION QUESTIONS: 1) What are the five stages of a business cycle? 2) Are business cycles regular today? 3) What may be the first sign of a recession? a recovery? 4) What happens when a recession reaches its trough? a recovery reaches its peak? 5) When do commentators talk about a soft landing? 6) When is the term hard landing used?

VOCABULARY PRACTICE The Fed will try to avoid a hard landing by raising interest rates only enough to slow the economy down without putting it into recession (a soft landing). Since the Second World War, most business cycles have lasted three to five years from peak to peak. The average duration of an expansion is 44.8 months and the average duration of a recession is 11 months. As a comparison, the Great Depression - which saw a decline in economic activity from 1929 to 1933 - lasted 43 months from peak to trough. Chinese Finance Minister expressed confidence on Tuesday that China's economy could maintain strong growth this year despite a global economic turndown. However he admitted a world slump would affect China. "The contribution of exports to our GDP is over 40 percent, therefore the slowing down of the global economy, including the slowdown in the US economy, stagnation in Japan's economy and a slowdown of European economies is having some bearing on China's growth," he said. In 2004, the global economy enjoyed buoyant growth on the back of economic expansion in the U.S. In 2005, however, a slowdown in the U.S., engine room of the global economy, will trigger slowdowns in Asia and the EU as well, causing growth in real GDP to fall to 3.0%. Despite this, adjustment in the U.S. economy will be moderate and not turn into a recessio n, and the global economy is projected to return to recovery and achieve real GDP growth of 3.3% in 2006. There are still good reasons to expect a pickup in growth in the period ahead, and it is encouraging that the global financial system has proved remarkably resilient to the substantial shocks of the last year.

TEXTS TO TRANSLATE: 30. Losing Balance and Monentum? The smooth scenario where the recovery was expected to spread more evenly across the OECD has not materialised. While some elements of this scenario, such as a relatively successful soft landing in the United States and a rebound of activity in Japan may be in place, what is badly lacking is sustained momentum in the euro area. Indeed, as time passes it is becoming increasingly evident that circumstantial arguments (Iraq war, oil and commodity price shocks, exchange rate fluctuations) are not sufficient to explain the string of aborted recoveries in Continental Europe. As a result, and looking ahead, growth prospects seem bound to differ widely across the OECD and the world economy, ranging from solid in Asia to back on trend in the United States, and weak and uncertain in Europe. Such contrasting economic perspectives will not contribute to reducing current account imbalances and may be reflected in slower aggregate world demand. These growth outcomes are not carved in stone, however: as always, they are contingent on the effectiveness of macroeconomic and structural policies and their capacity to adapt to a more globalised environment. In the United States the economy is likely to continue to grow in line with potential. Several years into the recovery, activity is still largely driven by domestic demand, with little help yet in sight from net exports. Notwithstanding a somewhat accidental fall in imports during the first quarter of the year, the contribution of net exports to growth has indeed been rather weak despite a substantial depreciation of the real effective exchange rate of the dollar. In Continental Europe, after an encouraging upswing during the first half of 2004, growth weakened in the second half of last year, in parallel with sagging consumer and business confidence. Although on the surface recorded growth picked up somewhat in early 2005, it is flagging anew and no decisive upturn is in the offing before late this year. This abrupt weakening stems in large part from a stronger euro and higher oil prices. But it has been considerably amplified in countries such as Italy and Germany by a distinct and recurrent lack of resilience to outside shocks, in contrast with smaller economies such as Spain and the Nordic countries, which have held out well. The euro area's susceptibility to shocks makes short-term forecasting a highly contingent exercise: for a gradual recovery to materialise, as expected in this Outlook, a modicum of external stability will be needed for some time. VOCABULARY: rebound –начало роста после спада;оживление, оздоровление rebound in orders – рост числа заказов rebound of the economy – оздоровление экономики sustained momentum – устойчивый, стабильный рост aborted recovery – краткосрочное, нестабильное оживление

aggregate - совокупный

TRANSLATION NOTES: OECD - Ogranization for Economic Cooperation and Development -Организация экономического сотрудничества и развития (ОЭСР) (См. часть Ш, раздел 2, § 1, п.1.5)

31.The Next Downturn Will a New Economy bust follow the New Economy boom? Five years ago, BUSINESS WEEK led the way in writing about what was later called the New Economy. The idea was that

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Последнее изменение этой страницы: 2016-06-26; просмотров: 408; Нарушение авторского права страницы; Мы поможем в написании вашей работы! infopedia.su Все материалы представленные на сайте исключительно с целью ознакомления читателями и не преследуют коммерческих целей или нарушение авторских прав. Обратная связь - 216.73.216.108 (0.017 с.) |