Заглавная страница Избранные статьи Случайная статья Познавательные статьи Новые добавления Обратная связь FAQ Написать работу КАТЕГОРИИ: ТОП 10 на сайте Приготовление дезинфицирующих растворов различной концентрацииТехника нижней прямой подачи мяча. Франко-прусская война (причины и последствия) Организация работы процедурного кабинета Смысловое и механическое запоминание, их место и роль в усвоении знаний Коммуникативные барьеры и пути их преодоления Обработка изделий медицинского назначения многократного применения Образцы текста публицистического стиля Четыре типа изменения баланса Задачи с ответами для Всероссийской олимпиады по праву

Мы поможем в написании ваших работ! ЗНАЕТЕ ЛИ ВЫ?

Влияние общества на человека

Приготовление дезинфицирующих растворов различной концентрации Практические работы по географии для 6 класса Организация работы процедурного кабинета Изменения в неживой природе осенью Уборка процедурного кабинета Сольфеджио. Все правила по сольфеджио Балочные системы. Определение реакций опор и моментов защемления |

The relationship between inflation and unemploymentСодержание книги

Поиск на нашем сайте

Inflation also has a serious impact on employment. The relationship between the inflationary rise in prices and a reduction in unemployment was bred in 1958 by the English economist Phillips. Using data from the UK statistics for 1861-1956. It will be demonstrated the curve, reflecting the inverse relationship between changes in wage rates and unemployment. Dependence initially shows the relationship of unemployment with wage changes: the higher the unemployment, the lower the increase in money wages, the lower the price increases, and vice versa, lower unemployment and higher employment, the greater the increase in money wages, the higher the rate of price increase. It was subsequently transformed into the relationship between prices and unemployment. In the long run, according to Friedman it is a vertical straight line, in other words, shows no relationship between inflation and unemployment. Followers of Keynesianism, which shared the basic premise of this theory, were forced to admit that a clear inverse relationship between inflation and unemployment is not, and there may be other options.

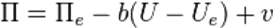

П the rate of inflation П (е) the expected level of inflation U-U(e) the deviation of unemployment from the natural rate - cyclical unemployment b>0, coefficient V supply shocks In this Figure 1: U - unemployment rate, P growth rate of commodity prices. For example, if the government considers unemployment U1 as too high, then lowering it carried out the budgetary and monetary measures to stimulate demand, which leads to the expansion of production and the creation of new jobs. The unemployment rate decreased to a value U2, but also increases the rate of inflation to P2. Arisen conditions may cause a crisis that will force the government to take measures to reduce the rate of price growth to P3 level, and the unemployment rate will rise to the level of U3. [6] Figure 1. Phillips curve (source: Library of Economics & Liberty)

Practice shows that the Phillips curve is applicable for the economic situation in the short term, since in the long term, despite the high level of unemployment, inflation continues to rise, due to a whole set of circumstances. [7]. The inflation in Kazakhstan

A characteristic feature of inflation in Kazakhstan is stable, fairly high rate of inflation, despite the efforts of the authorities. This reflects, first, the presence of certain permanent factors affecting the nature of monetary relations and secondly about the limitations and inefficiencies of operating these relations management. The main reason for the ineffectiveness of methods of regulation of inflation is the imbalance of the economy. [ 8]

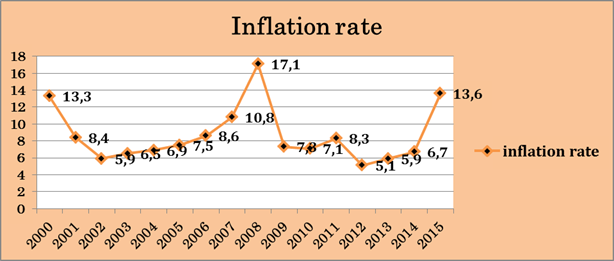

Figure 2. The dynamics of inflation 2000-2015 (source: Trading economics)

Inflation in annual terms from 2001 to 2004 remained relatively stable in the range of 6-7-8%. However, since 2002, there has been a strengthening of inflationary processes in the economy of Kazakhstan. In 2005 the inflation was at 7.5% [9] The actual inflation rate in Kazakhstan for three years more than the official forecast of the National Bank and the government. 2005 was no exception. According to the Kazakh Statistics Agency, inflation in December 2005 compared to December 2004 was 6.9 %, while National Bank of the Republic predicted annual inflation of 5.2-6.9%, and the Ministry of Economy and Budget planning in the corridor of 5-7%. [10] The main reasons for exit of inflation over the forecast level of featured external factors - high oil and metal prices (the basis of Kazakhstan's exports), as well as internal - social payments from the budget, aimed at increasing the salaries, pensions, stipends, allowances, price growth energy, services and fruit and vegetables. However, 2005 was marked by high levels of socio-economic development. According to preliminary data of the Statistics Agency, GDP growth amounted to 9.2% in 2005, investment in fixed capital increased by almost a quarter, the positive balance of foreign trade turnover exceeded $ 9 billion. The measures taken by the National Bank to tighten monetary policy in early 2006 had a dampening impact on inflation, which in annual terms fell from 9.0% in May 2007 to 8.6% in September 2007 Among the main factors affecting inflation in 2007 should be allocated to the increase in aggregate demand, inflow of foreign currency, a significant increase in wages, the growth of budget expenditures, the growth of production costs, as well as the low level of competition in some markets of goods and services. [11]

In early 2008, National Bank of Kazakhstan has promised to keep inflation at around 10%, despite the fact that at the end of 2007, annual inflation stood at 17.1%, while the Prime Minister Karim Masimov has promised that the government will strengthen the monitoring of inflationary processes. In 2008, inflationary processes were multidirectional nature. In January-August, the situation on the consumer market was characterized by a high degree of inflationary pressures, the main factor which served as the influence of external factors. Since September 2008 the inflation was decreasing. This was due to a decline in prices on world commodity markets, a slowdown in economic growth, limited consumer demand, stagnation of credit activity of the banking sector, low growth of money supply in the economy. As a result, annual inflation slowed more than 2 times from August to December 2008. (picture above) 2014-2015 Annual inflation at the end of December 2014 was 6.7 %. Gain compared with 2013 year (4.8%) contributed to inflation increase in prices for non-food and food products due to seasonal factors, as well as rising prices of imported goods in the domestic market. The rate of growth of tariffs for paid services continued zamedlenie. Inflow of money, the main indicator of the money supply in the economy decreased by 4.8% for October-December 2014. Overall, the annualized money supply corresponds to the needs of the economy and the current economic conditions, its volume is sufficient to maintain the business. At the same time, real GDP growth in 2014, according to preliminary data of the Committee on Statistics of the Ministry of National Economy of the Republic of Kazakhstan, was 4.3%. Within the framework of the implementation of monetary policy in the 4th quarter of 2014 the National Bank continued to conduct operations aimed at regulating short-term tenge liquidity in the money market. [12]

Since the beginning of 2015 there was a slowdown of inflationary processes in Kazakhstan. Since the second quarter of 2015, annual inflation is below the target range of 6-8% for 2015 year. One of the factors reducing the rate of inflation in 2015 was the low business activity, accompanied by a slowdown in output growth in the main sectors of the economy of Kazakhstan. Against the background of low economic activity and limited consumer demand is observed decline in domestic lending and money supply growth remains low. The influence of external factors also contributed to the reduction of inflationary background in the economy. In particular, the drop in world prices for oil, metals and food were the main factors slowing inflation. In early 2015 a deterrent inflation in Kazakhstan was the imbalance between the Russian ruble and Kazakh tenge, when the ruble has weakened significantly in late 2014. The weakening of the ruble against the tenge has led to cheaper Russian goods to the Kazakh market. Relatively cheap goods from Russia increased price competition in the market of Kazakhstan. This has had an impact on the growth in demand among domestic consumers for products produced in Russia, Kazakhstan producers were forced to reduce the prices of their products, which influenced the decline in inflation. In September 2015, annual inflation was 4.4%, an increase compared to August (3.8%). The main factor accelerating inflation is the effect of the transfer of weakening exchange rate of KZT. [13] At the end of 2015 the inflation was 13.6 %, because of the weakening exchange rate of KZT.

|

||||

|

Последнее изменение этой страницы: 2016-08-06; просмотров: 538; Нарушение авторского права страницы; Мы поможем в написании вашей работы! infopedia.su Все материалы представленные на сайте исключительно с целью ознакомления читателями и не преследуют коммерческих целей или нарушение авторских прав. Обратная связь - 18.191.67.90 (0.008 с.) |

(source: Wikipedia) where:

(source: Wikipedia) where: