Заглавная страница Избранные статьи Случайная статья Познавательные статьи Новые добавления Обратная связь FAQ Написать работу КАТЕГОРИИ: ТОП 10 на сайте Приготовление дезинфицирующих растворов различной концентрацииТехника нижней прямой подачи мяча. Франко-прусская война (причины и последствия) Организация работы процедурного кабинета Смысловое и механическое запоминание, их место и роль в усвоении знаний Коммуникативные барьеры и пути их преодоления Обработка изделий медицинского назначения многократного применения Образцы текста публицистического стиля Четыре типа изменения баланса Задачи с ответами для Всероссийской олимпиады по праву

Мы поможем в написании ваших работ! ЗНАЕТЕ ЛИ ВЫ?

Влияние общества на человека

Приготовление дезинфицирующих растворов различной концентрации Практические работы по географии для 6 класса Организация работы процедурного кабинета Изменения в неживой природе осенью Уборка процедурного кабинета Сольфеджио. Все правила по сольфеджио Балочные системы. Определение реакций опор и моментов защемления |

Functions of Financial Markets and Financial IntermediariesСодержание книги

Похожие статьи вашей тематики

Поиск на нашем сайте

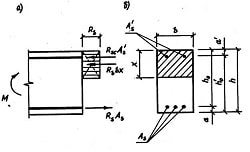

Figure 1. Flows of funds through the financial system

Now that we understand the basic function of financial markets, let’s look at their structure. There are several categorizations of financial markets: - debt and equity markets, - primary and secondary markets, - exchanges and over-the-counter markets, - money and capital markets. A firm or an individual can obtain funds in a financial market in two ways. The most common method is to issue a debt instrument, such as a bond or a mortgage, which is a contractual agreement by the borrower to pay the holder of the instrument fixed dollar amounts at regular intervals (interest and principal payments) until a specified date (the maturity date), when a final payment is made. The second method of raising funds is by issuing equities, such as common stock, which are claims to share in the net income (income after expenses and taxes) and the assets of the business. Equities often make periodic payments (dividends) to their holders and are considered long-term securities because they have no maturity date. The size of the debt market is often substantially larger than the size of the equity market: The value of debt instruments in the US debt market was $43.4 trillion at the end of 2006, while the value of equities was $19.3 trillion at the end of 2006. A primary market is a financial market in which new issues of a security, such as a bond or a stock, are sold to initial buyers by the corporation or government agency borrowing funds. A secondary market is a financial market in which securities that have been previously issued can be resold. Secondary markets can be organized in two ways. One method is to organize exchanges, where buyers and sellers of securities meet in one central location to conduct trades. The New York and American Stock Exchanges for stocks are examples of organized exchanges. The other method is to have an over-the-counter (OTC) market, in which dealers at different locations who have an inventory of securities stand ready to buy and sell securities “over the counter” to anyone who comes to them and is willing to accept their prices. Because over-the-counter dealers are in computer contact and know the prices set by one another, the OTC market is very competitive and not very different from a market with an organized exchange.

Another way of distinguishing between markets is on the basis of the maturity of securities traded in each market. The money market is a financial market in which only short-term (less than one year maturity) debt instruments are traded. The capital market is the market in which longer-term debt and equity instruments are traded. As shown in Fig.1, funds also can move from lenders to borrowers by a second route called indirect finance because it involves a financial intermediary that stands between the lender-savers and the borrower-spenders and helps transfer funds from one to the other. A financial intermediary does this by borrowing funds from the lender-savers and then using these funds to make loans to borrower-spenders. Financial intermediation is the primary route for moving funds from lenders to borrowers. Transaction costs, risk sharing, and information costs in financial markets are very important. Financial intermediaries can substantially reduce transaction costs, investors’ exposure to risk and eliminate problems caused by asymmetric information which is in fact a lack of information about contracting parties in financial markets. Financial intermediaries can be classified into: - depositary institutions (banks) which include commercial banks and thrifts; - contractual savings institutions (insurance companies and pension funds); - investment intermediaries (finance companies, mutual funds, money market mutual funds, investment banks).

Comprehension 5.4.1 Answer the questions using the active vocabulary. 1. What is the essential economic function of financial markets? 2. What are the principal lender-savers and borrower-spenders on financial markets? 3. What are the two major routes of funds in the financial system? 4. What is a financial instrument? 5. What are the main reasons for which financial markets are very important? 6. How can financial markets be classified? 7. What is the difference between debt markets and equity markets? 8. What is the difference between primary markets and secondary markets? 9. How can secondary markets be categorized? 10. Why are the over-the-counter markets very competitive and not very different from a market with an organized exchange? 11. What is the difference between money markets and capital markets? 12. Why is the indirect financial route considered the primary route for moving funds from lenders to borrowers? 13. How does a financial intermediary function? 14. What is financial intermediation? 15. What are the advantages of getting funds from a financial intermediary rather than from a financial market? 16. What is asymmetric information? How can it affect the efficiency of financial operations? 17. What are the main categories of financial intermediaries?

5.4.2 Mark these statements T(true) or F(false) according to the information in the text. If they are false say why. 1. Financial markets channel funds from households, firms, and governments that have a shortage of funds because they wish to spend more than their income to those that have saved surplus funds by spending less than their income. (F) 2. Those who have saved and are lending funds, are the lender-savers.T 3. Those who must borrow funds to finance their spending, are the lender-spenders. F 4. Households, business enterprises and the government, as well as foreigners and their governments can be both lender-savers and borrower-spenders in different occasions on financial markets. T

5. Common stocks, which are claims to share in the net income and the assets of the business, often make periodic payments (interest plus principal) to their holders. F 6. Debt instruments periodically make payments (dividends) to their holders. F 7. Bonds, stocks, and mortgages are both securities and debt instruments. F 8. Exchanges and over-the-counter markets have very much in common. T 9. There is no difference between exchanges and OTCs. F 10. Equity instruments are traded on the money markets. F 11. Financial intermediation involves financial intermediaries. T 12. Banks, exchanges, insurance companies and pension funds are financial intermediaries. F 13. Money markets are the same as money market mutual funds. F 14. Life Insurance Companies and Fire and Casualty Insurance Companies, Pension Funds and Government Retirement Funds are the contractual savings institutions. T 15. Savings and Loan Associations, Mutual Savings Banks, and Credit Unions are thrift institutions (thrifts). T

Language practice 5.5.1 Match the English terms in the left-hand column with the definition in the right-hand column.

5.5.2 Complete the following text using suitable words or phrases from the box below.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Последнее изменение этой страницы: 2017-01-26; просмотров: 2755; Нарушение авторского права страницы; Мы поможем в написании вашей работы! infopedia.su Все материалы представленные на сайте исключительно с целью ознакомления читателями и не преследуют коммерческих целей или нарушение авторских прав. Обратная связь - 3.147.53.163 (0.01 с.) |