Заглавная страница Избранные статьи Случайная статья Познавательные статьи Новые добавления Обратная связь FAQ Написать работу КАТЕГОРИИ: ТОП 10 на сайте Приготовление дезинфицирующих растворов различной концентрацииТехника нижней прямой подачи мяча. Франко-прусская война (причины и последствия) Организация работы процедурного кабинета Смысловое и механическое запоминание, их место и роль в усвоении знаний Коммуникативные барьеры и пути их преодоления Обработка изделий медицинского назначения многократного применения Образцы текста публицистического стиля Четыре типа изменения баланса Задачи с ответами для Всероссийской олимпиады по праву

Мы поможем в написании ваших работ! ЗНАЕТЕ ЛИ ВЫ?

Влияние общества на человека

Приготовление дезинфицирующих растворов различной концентрации Практические работы по географии для 6 класса Организация работы процедурного кабинета Изменения в неживой природе осенью Уборка процедурного кабинета Сольфеджио. Все правила по сольфеджио Балочные системы. Определение реакций опор и моментов защемления |

The implementation of Basel IIIСодержание книги

Поиск на нашем сайте

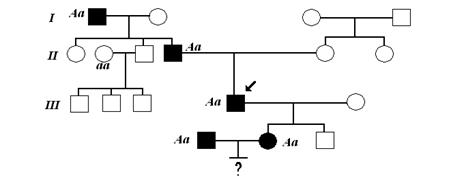

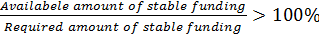

This document presents the liquidity portion of the Basel Committee’s 1 reforms to strengthen global capital and liquidity regulations with the goal of promoting a more resilient banking sector. The objective of the reforms is to improve the banking sector’s ability to absorb shocks arising from financial and economic stress, whatever the source, thus reducing the risk of spillover from the financial sector to the real economy. This document sets out the rules text and timelines to implement the liquidity portion of the Basel III framework. During the early “liquidity phase” of the financial crisis that began in 2007, many banks despite adequate capital levels still experienced difficulties because they did not manage their liquidity in a prudent manner. The crisis again drove home the importance of liquidity to the proper functioning of financial markets and the banking sector. Prior to the crisis, asset markets were buoyant and funding was readily available at low cost. The rapid reversal in market conditions illustrated how quickly liquidity can evaporate and that illiquidity can last for an extended period of time. The banking system came under severe stress, which necessitated central bank action to support both the functioning of money markets and, in some cases, individual institutions. The difficulties experienced by some banks were due to lapses in basic principles of liquidity risk management. In response, as the foundation of its liquidity framework, the Committee in 2008 published Principles for Sound Liquidity Risk Management and Supervision (“Sound Principles”). The Sound Principles provide detailed guidance on the risk management and supervision of funding liquidity risk and should help promote better risk management in this critical area, but only if there is full implementation by banks and supervisors. As such, the Committee will coordinate rigorous follow up by supervisors to ensure that banks adhere to these fundamental principles. To complement these principles, the Committee has further strengthened its liquidity framework by developing two minimum standards for funding liquidity. These standards have been developed to achieve two separate but complementary objectives. The first objective is to promote short-term resilience of a bank’s liquidity risk profile by ensuring that it has sufficient high-quality liquid assets to survive a significant stress scenario lasting for one month. The Committee developed the Liquidity Coverage Ratio to achieve this objective. The second objective is to promote resilience over a longer time horizon by creating additional incentives for banks to fund their activities with more stable sources of funding on an ongoing basis. The Net Stable Funding Ratio (NSFR) has a time horizon of one year and has been developed to provide a sustainable maturity structure of assets and liabilities. These two standards are comprised mainly of specific parameters which are internationally “harmonized” with prescribed values. Certain parameters, however, contain elements of national discretion to reflect jurisdiction-specific conditions. In these cases, the parameters should be transparent and clearly outlined in the regulations of each jurisdiction to provide clarity both within the jurisdiction and internationally. It should be stressed that the standards establish minimum levels of liquidity for internationally active banks. Banks are expected to meet these standards as well as adhere to the Sound Principles. Consistent with the Committee’s capital adequacy standards, national authorities are free to require higher minimum levels of liquidity. To further strengthen and promote global consistency in liquidity risk supervision, the Committee has also developed a set of monitoring tools to be used in the ongoing monitoring of the liquidity risk exposures of banks, and in communicating these exposures among home and host supervisors. To promote more medium and long-term funding of the assets and activities of banking organizations, the Committee has developed the Net Stable Funding Ratio (NSFR). This metric establishes a minimum acceptable amount of stable funding based on the liquidity characteristics of an institution’s assets and activities over a one year horizon. This standard is designed to act as a minimum enforcement mechanism to complement the LCR and reinforce other supervisory efforts by promoting structural changes in the liquidity risk profiles of institutions away from short-term funding mismatches and toward more stable, longer-term funding of assets and business activities. In particular, the NSFR standard is structured to ensure that long term assets are funded with at least a minimum amount of stable liabilities in relation to their liquidity risk profiles. The NSFR aims to limit over-reliance on short-term wholesale funding during times of buoyant market liquidity and encourage better assessment of liquidity risk across all on- and off-balance sheet items. In addition, the NSFR approach offsets incentives for institutions to fund their stock of liquid assets with short-term funds that mature just outside the 30-day horizon for that standard. NSFR can be calculated by the formula 3:

The NSFR builds on traditional “net liquid asset” and “cash capital” methodologies used widely by internationally active banking organizations, bank analysts and rating agencies. In computing the amount of assets that should be backed by stable funding, the methodology includes required amounts of stable funding for all illiquid assets and securities held, regardless of accounting treatment (eg trading versus available-for-sale or held-to-maturity designations). Additional funding stable sources are also required to support at least a small portion of the potential calls on liquidity arising from off-balance sheet (OBS) commitments and contingencies. The NSFR is defined as the amount of available amount of stable funding to the amount of required stable funding. This ratio must be greater than 100%.28 “ Stable funding ” is defined as the portion of those types and amounts of equity and liability financing expected to be reliable sources of funds over a one-year time horizon under conditions of extended stress. The amount of such funding required of a specific institution is a function of the liquidity characteristics of various types of assets held, OBS contingent exposures incurred and/or the activities pursued by the institution. The Committee will continue to consider whether to apply some amount of recognition to matched funding within the one-year time frame and will gather data to allow analysis as well as some other structural changes to the proposal. Available stable funding (ASF) is defined as the total amount of a bank’s: a) capital; b) preferred stock with maturity of equal to or greater than one year; c) liabilities with effective maturities of one year or greater; d) that portion of non-maturity deposits and/or term deposits with maturities of less than one year that would be expected to stay with the institution for an extended period in an idiosyncratic stress event; and e) the portion of wholesale funding with maturities of less than a year that is expected to stay with the institution for an extended period in an idiosyncratic stress event. The objective of the standard is to ensure stable funding on an ongoing, viable entity basis, over one year in an extended firm-specific stress scenario where a bank encounters, and investors and customers become aware of: a) A significant decline in profitability or solvency arising from heightened credit risk, market risk or operational risk and/or other risk exposures; b) A potential downgrade in a debt, counterparty credit or deposit rating by any nationally recognized credit rating organization; c) A material event that calls into question the reputation or credit quality of the institution. d) For the purposes of this standard, extended borrowing from central bank lending facilities outside regular open market operations are not considered in this ratio, in order not to create a reliance on the central bank as a source of funding. The available amount of stable funding is calculated by first assigning the carrying value of an institution’s equity and liabilities to one of five categories as presented in Table 20 below. The amount assigned to each category is to be multiplied by an ASF factor and the total ASF is the sum of the weighted amounts. Table 20 below summarizes the components of each of the ASF categories and the associated maximum ASF factor to be applied in calculating an institution’s total amount of available stable funding under the standard.

Table 20 Components of Available Stable Funding and Associated ASF Factors

In Kazkomertsbank on the basis of the analysis of the volume of deposit sources of short-term deposits prevails over the long term. This is also an unreliable source because investors can withdraw their deposits back. The amount of stable funding required by supervisors is to be measured using supervisory assumptions on the broad characteristics of the liquidity risk profiles of an institution’s assets, off-balance sheet exposures and other selected activities. The required amount of stable funding is calculated as the sum of the value of the assets held and funded by the institution, multiplied by a specific required stable funding (RSF) factor assigned to each particular asset type, added to the amount of OBS activity (or potential liquidity exposure) multiplied by its associated RSF factor. The RSF factor applied to the reported values of each asset or OBS exposure is the amount of that item that supervisors believe should be supported with stable funding. Assets that are more liquid and more readily available to act as a source of extended liquidity in the stressed environment identified above receive lower RSF factors (and require less stable funding) than assets considered less liquid in such circumstances and, therefore, require more stable funding. The RSF factors assigned to various types of assets are parameters intended to approximate the amount of a particular asset that could notbe monetized through sale or use as collateral in a secured borrowing on an extended basisduring a liquidity event lasting one year. Under this standard such amounts are expected to be supported by stable funding. For secured funding arrangements that are assets of a bank maturing within the one-year horizon, a bank should look through the secured funding transaction to see what asset will be used to settle the transaction at the maturity date, and use the corresponding RSF factor for that asset. If the bank will receive cash, then the RSF of the transaction would be 0%. If the bank will receive another asset, the RSF factor of that asset would be used. Encumbered assets on the balance sheet receive a 100% RSF, unless there is less than a year remaining in the encumbrance period. In that case, the assets are treated as “unencumbered”. Table 21 summarizes the specific types of assets to be assigned to each asset category and their associated RSF factor. For amortizing loans, the portion that comes due within the one-year horizon can be treated in the “less than a year” residual maturity category. Definitions mirror those outlined in the LCR, unless specified otherwise.

Table 21 Detailed Composition of Asset Categories and Associated RSF Factors

Assets and liabilities with a remaining maturity of less than one year:the Committee will gather data to allow analysis on buckets of both assets and liabilities maturing within the one-year horizon during the observation period, to further consider the treatment of these instruments in the NSFR. Buckets will be from 0-3 months, 3-6 months, 6-9 months, and 9-12 months. This is to evaluate the treatment of matched funded assets and liabilities, and to provide incentives for terming out funding within a year e.g. to recognize that 9 month funding is preferential to 3 month funding. Off-balance sheet exposures:Many potential OBS liquidity exposures require little direct or immediate funding but can lead to significant liquidity drains in times of market or idiosyncratic stress. As a result, the application of an RSF factor to various OBS activities results in a requirement for the institution to establish a “reserve” of stable funding that would be expected to fund existing assets that might not otherwise be funded with stable funds as defined in other parts of this standard. While funds are indeed fungible within a financial institution, this requirement could be viewed as promoting the stable funding of the stock of liquid assets that could be used to meet liquidity requirements arising from OBS contingencies in times of stress. Consistent with the LCR, the NSFR identifies OBS exposure categories based broadly on whether the commitment is a credit or liquidity facility or some other contingent funding liability. Table 22 identifies the specific types of off-balance sheet exposures to be assigned to each OBS category and their associated RSF factor.

Table 22 Composition of Off-balance Sheet Categories and Associated RSF Factors

According to the Board of JSC Kazkommertsbank, according to the consolidated financial statements for 2012, the bank increased its profit before deductions for reserves and taxes by 28% (to 125 billion tenge). But in the end the bank's net loss reached 130.9 billion tenge (against a net profit of 23.5 billion tenge a year earlier). Net interest margin increased to 3.9%, while corporate lending is partly offset by the growth of retail. In the board was told that the net loss associated with the formation of one-time additional specific provisions for IFRS (International Financial Reporting Standards). Of the bank's capital reserve was created in 196 billion tenge loan portfolio. This was done in order to reduce the potential negative consequences for the bank in respect of regulatory capital, the volume of foreign exchange exposure and the amount of liquid assets. Thus, the amount of reserves under IFRS equal to the volume of reserves on regulatory requirements and capital adequacy was well above the regulatory requirements. Regulatory requirements for banks to part of the capital increase in connection with the transition to the third "Basel", and are expressed in the revision of methods of calculation of provisions. Some banks reserves under IFRS higher, and others - less. And in fact, the same loan portfolio during the transition to IFRS in "KKB" appeared more risky assets, which also puts pressure on capital. Also plays an important foreign currency position of the bank (the equivalent of loans and deposits attracted in the same currency). Recently, the rating agency Fitch, said in a special press release that it considers the impact of this factor is neutral on the creditworthiness of the bank. Many analysts agree with this opinion, and even reported an increase in profitability of the bank. According to kursiv.kz, VTB-Capital analysts noted the bank's annual results as positive, with the increase in the interest margin from 3.3% to 3.9%. And a one-time allocation to provisions - a positive step in the bank. Operating profit at all exceeded analysts' expectations CityBank due to high interest income - by 9.7% (to 124.3 billion tenge), and good cost control business. In the segment of the volume of net lending to the corporate sector loans reached 1.7 trillion tenge (compared with 1.87 trillion at the end of 2011). The total share of loans to the corporate sector in the total amount of loans to customers (net) amounted to 88.9% (at the end of 2011 - 90%). The retail sector bank, on the contrary, compared with the previous year, increased by almost 11% (65.3 billion tenge) and reached 659.4 billion tenge. Since the beginning of 2012 the share of retail customer funds in the total rose to 42.4% (at the end of 2011 - only 40.6%). The total retail sector loans grew by 2.1% - to 213.2 billion tenge mainly due to growth in total consumer loans. The share of net loans to the retail sector in the total amount of loans to customers increased to 11.1% (at the end of 2011 - 10.0%). Overall, the bank's retail sector is growing rapidly. Therefore, some analysts (Standard & Poor's) are afraid of a "credit bubble" in the retail segment. Managing Director of "KKB" Andrey Timchenko, confirmed that the appearance of the "credit bubble" can be avoided by not issuing loans in which the monthly payment is more than 50-60% of the salary man. Basel III has emerged as a response to the global financial crisis in 2008. Analyzing the reasons for the experts as one of the main reasons for the failures were isolated prudential regulation of financial intermediaries. In response to the deepening financial globalization, national standards organization, operation and regulation of financial intermediaries are no longer meet modern requirements. In order to save the backbone of financial institutions («too big to fail» - Northern Rock, Merrill Lynch, Lehman Brothers), have been adopted and implemented program of entering the state in their capital. Therefore, the governments of developed countries are concerned that in the future these investments have brought adequate benefits./25/ The emergence of standards, Basel III began with the introduction of additional capital requirements of banks (equity capital, tier 1 capital, tier 2 capital, capital buffers, and the total capital). The agreement represented by two documents published December 15, 2010 on the official website of the Bank for International Settlements. The international system of assessment of liquidity risks, standards and monitoring global regulatory system, enhances the stability of banks and banking systems. The new agreement tightens the requirements for the composition of tier 1 capital due to the exclusion of the deferred tax assets and securitized. In addition, Basel III recommends an increase in the proportion of tier 1 capital and the proportion of the share capital. Basel III establishes the need for credit organizations from net profit optional backup buffer. Capital buffers will allow banks in the event of a systemic crisis and to reduce the capital adequacy ratio below the minimum to obtain additional liquidity without the approval of the regulator. However, after the crisis, lenders are required to restore this capital. Simultaneously, Basel III introduces regulations aimed at limiting the financial leverage (leverage ratio - the ratio of debt and equity), which is valid for financial intermediaries. In particular, it would be a revision of the standards current and long-term liquidity. New current liquidity will enter in 2015, and an updated long-term liquidity - three years later. The first suggests that short-term bank liabilities for a period of 30 days should be covered by liquid assets by 100%. The second standard regulates the risk of loss of bank liquidity as a result of placing funds in long-term assets, which should be covered by liability also stable for at least 100%. There is a concept not only to back bank capital, but capital, which may introduce additional control for counter-cyclical regulation. If the regulator believes that the country is experiencing a credit boom or overheating of the economy, it can raise the capital adequacy requirements, according to which banks in times of a potential credit "bubbles" will be required to form a special "counter-cyclical" reserve. Basel III provides that in the event of non-compliance lenders do not have to pay dividends to shareholders, as well as bonuses and other bonuses to their executives. The gradual transition to the new standards will begin in 2013 and will continue for the next six years (until 1 January 2019).

Table 23 Basel III phase-in arrangements (All dates are as of 1 January):

The effective implementation of the requirements of Basel III will demonstrate to regulators, customers and shareholders that the bank steadily recovering from the global banking crisis of 2008, the operational implementation of Basel III will also help increase the competitiveness of the bank, as it will give management a more complete vision of the business, and this, in turn, will enterprise to leverage future opportunities. Although many organizations implementing Basel III will be just the next step on the path of development, we should not underestimate the impact of the standard for many banks and banking. In fact, Basel III will cause significant problems, which need to be sorted out and to be solved. For each bank is extremely important task will be to develop the most cost-push model of Basel III. Basel III is changing the approach of banks to risk management, and financial management. The new regime requires a higher degree of integration of the functions of financial management and risk management. This is likely to lead to the interpenetration of the duties of financial officer and chief risk-manager on the way to achieving the strategic goals of the business. However, the transition to more rigorous regulatory requirements may be complicated by the dependence of a large number of disparate data stores and the division of powers between those responsible for finance, and those who manage risk. Particular emphasis placed on risk management in Basel III, require the introduction or re-designing an approach to risk management is just as full as the existing infrastructure of the financial management. Basel III is the regulatory regime, as well as in many aspects of giving a framework approach to risk management of the enterprise. Such wide risk management encompasses all business risks. While banks are not forced to choose - to follow the standards of Basel III or not - the chosen method of implementing regulations may give the bank a significant competitive advantage. Those banks that are implementing Basel III in order to improve their business processes and processes to meet the requirements of regulators, will continue to be rewarded, but not so for those banks that are considering compliance with the rules of Basel III as an end in itself. The presence of a consolidated set of data will help to streamline the process of implementation of regulatory standards. In addition, it also allows managers of the organization - perhaps for the first time - to get a complete, integrated and consolidated view of the business. The ability to see consolidated picture quality and at the same time to go into details let managers make timely and informed decisions based on a more robust analytical picture. In addition, a centralized data model can provide senior management to implement a more complete administrative control over their business. Thus, it may help to introduce a more effective system of limits. In making a decision on the issuance of new loans this will help ensure that the bank will not be exposed to undue risks on one client. In addition, a centralized data model can help the bank to improve the way the management of their assets and liabilities, giving full, not having a distorted picture of assets and liabilities of the bank. This will make wide risk management more efficient and cost-effective for the bank. Re-use in different situations, the data provided by the regulator allows the bank to improve the way business management, helping to improve overall risk management at the enterprise level, as well as the growth and profitability. Basel III standards are both an opportunity and a challenge for banks. These guidelines can serve as a solid basis for further developments in the banking sector and will ensure that the excesses observed in the past can be avoided. That the bank can consider standards of Basel III as an opportunity to improve their position in the first place, it is necessary to choose the right technical architecture that will be used to support the Framework. In this technical architecture should be taken into account the scale and structure, process and geographical coverage of banks that need to seamlessly fit into the scale and scope of the rules. The solution must be flexible to meet the needs of the bank, and open enough to accommodate changes in the business and regulations. The complexity of regulations and requirements of Basel III, as well as the level of expectations from the commercial sector in the banking sector requires flexible solutions for controlling regulations of Basel III. To give a competitive advantage, such a solution must provide the speed, precision and productivity. And banks that have adopted the best solution, not only have the perfect platform to meet the standards of Basel III - they will also have a solid foundation for their future commercial development. The process of implementation of Basel III standards for any organization creates a unique set of challenges, no matter what stage in each organization begins. This is due to the fact that Basel III - is more a set of principles rather than a detailed set of rules, and there are no ready-made solutions for their implementation. This flexibility gives banks more freedom in choosing the method of adopting the rules. For banks, implementing regulations opened two basic approaches. This of these is most appropriate for each organization will depend on the existing environment of the bank and its effectiveness, from the period in which the organization wishes to implement standards, as well as the resources available.

Table 24 Options for implementation of Basel III and the issues that need to be taken into account in the implementation process:

In some cases, the best option would be to upgrade the existing system in accordance with the required standards by adding additional modules to help deal with additional requirements, whether it be managing liquidity and leverage, stress testing, storage and preparation of reports. Expansion and modernization of the existing environment will give the organization the opportunity to adopt rules within the allowable time for it, with the least disruption to its operations. This means that the implementation can be done with less cost to the business, as much easier to build a regulatory system in the business than to form a business around its rules. This approach will allow banks to make optimal use of existing investments, and for some organizations, it may be the most cost-effective approach to achieving compliance, because it is associated with less interruptions in the functioning of the bank. Here, the key point is that the bank must have a very clear idea of how to build its environment. This problem can be much more complex than you imagine it initially, especially if the legal regulations for some time there and within the organization have been significant changes. Once defined the current environment, gap analysis will help identify where to make major efforts to meet the requirements of the specification. For other organizations, the most cost-effective option is to replace the existing regulatory model to a new, specially designed solution that makes it possible to use the rules of Basel III «off the shelf" and eliminates the need for large-scale production of the technical requirements of the client. This method is often the most expensive work of the organization and braking solution. However, in some cases, it may be the most economical and because it allows the organization to adjust to the regulations implementing Basel III in their processes. This approach has the potential to reduce the overall cost of the bank for the period of application of standards of Basel III, unless they are part of the corporate image of the bank's actions. The key to the successful deployment of the system is to determine the optimal architecture for managing norm Basel III and then define the strategy of coexistence of media and migration strategy from existing environment. Migration can be carried out in a modular approach, where certain system is transferred to a new environment. This will reduce the risks inherent in this approach. Another issue to be resolved no matter which of the previously described embodiments, the bank will choose - is the degree to which the new framework will include the use of automated management and control. Many banks are still in some way to manually control how respected regulatory standards. Taking into account the higher workload on the requirements of Basel III, the rationale of higher compared with the automated control of the costs of manual processes will become difficult, if at all possible. Increased overhead for performance standards, as well as larger and more voluminous banking will make unjustified execution of these processes manually, because such a practice would require a lot of time and money. Also, in such processes the probability of errors due to the human factor. Despite the marked complexity, these rules are being introduced, and some banks are keen to keep this issue aggressively. We can say that these banks making process and implementation will not be delayed. They will be able to convince their customers, shareholders and regulators that are taking positive steps to achieve the required amount of capital, improved liquidity position and optimize risk management. Those banks that will be the norm before the others will be able to use their position to stand out from the competition. Others, mindful of the distant 2019 (estimated) as of the deadline for the full implementation of standards can apply a more restrained approach. With the right model, you need to think about what will happen after the widespread adoption of standards of Basel III. In the best case, the rules of Basel III will require adjustment needed to the course of time this standard was transformed into a Basel IV, V Basel and so on. The reason is that the BIS seek to solve the problems of the theory of Basel III and its practical application (as happened with the regulations of Basel I and Basel II). Regulators are already thinking about a fundamental revision of the rules on market risk and trading book. They can become the starting point for Basel IV. Whatever approach is used by the organization, its decision must be fully integrated so that it can fully reflect the structure of the rules themselves. The ideal would be a solution to help consolidate data, perform calculations and testing, and to make statements on the capital of the organization and its liquidity risk on a single platform. Such a solution is effectively integrated with other source systems. It has a robust audit function and an impressive amount of data storage. Rapid tools to simplify the calculations weekly and even daily calculations and give out information for an integrated and comprehensive reporting to the regulator, which is precisely aligned to the requirements of local regulatory authorities. Implementation of all these features help to streamline the process by allowing risk-manager to focus on priority actions for risk management, rather than on time-consuming data extraction, verification of their quality and reporting. In the central data repository housed the most important information about the risks necessary to meet the standards of Basel III. Such a data warehouse must have the capacity to collect data and provide a complete picture of the situation on the regulatory risks at the enterprise level. End users - including a number of heads of businesses and corporate risk managers, finance staff, personnel responsible for regulatory compliance and analysts - also need to make the most of this system. This consolidated approach means that the calculation of the critical indicators of the level of capital adequacy and liquidity ratios and the ratio of equity and debt that are at the basis of the framework approach, Basel III, greatly facilitated, as well as their storage. This also means that the stress test may be carried out using the same cohesive or integrated data sets. The final step is to provide important reports for the business and for the regulator. This task will be much more demanding under Basel III. Reports of the first component, covering the capital adequacy should be provided to the appropriate state regulator in the correct format. Report for the third component, which cover similar, but not identical regions are created for the regulator, as well as a broader range of stakeholders to help adhere to the principles of transparency and building confidence in the market. With this consolidated approach can easily provide the information that the regulator may require any subsequent request for additional information. Management reports should also be provided to business structures, often daily. These reports give an idea of how the business is relatively established for the purposes of his business, and also form the fundamental analytical picture of the business. Thus, compliance with Basel III becomes an opportunity, not just a source of overhead. This goal is much more difficult to achieve when using the data stored in disparate systems. This increases the likelihood of errors, and time costs are rising. Consolidated, integrated, but open a data warehouse is the only way to ensure the correct risk management at the enterprise level. Another aspect of the deployment for Basel III is the choice: to develop the system yourself or buy it from a supplier? With the exception, perhaps, of a deeper analytical view of the business, making independent development does not have much competitive advantage. Regulatory requirements are fundamentally the same for all banks. In addition, the international rules are systematically subject to change. Tracking these changes is an important but daunting task. In software vendors have special units for the analysis of these changes and bring the product into compliance with them. Is not profitable for banks to do this work yourself. Maintenance costs of the routine work associated with the regulations, it is easier to carry the suppliers, especially if the bank does not understand the effect of changes in regulations./26/ Applying the requirements of Basel III to different regions and countries, different problems arise. EU countries have consistently taken the previous rules of the Bank for International Settlements (BIS). So there is hope for an organic transition from the requirements of Basel II to Basel III. The European Union plans to produce a single set of rules for the whole of Europe, not to encourage stricter requirements in individual states and ensure a level playing field by reducing the differences in regulatory arbitrage. U.S. essentially skipped Basel II. Therefore, the country will implement the specification with new energy, building it on the basis of the principles of Basel I, simplified according to the law the Dodd-Frank. The degree of transition to a particular cycle varies considerably from country to country: Japan, Hong Kong, Singapore and Australia have made progress in this area - they are now on a par with the EU. Painting in Russia, Eastern Europe, Middle East, Africa and the Asia-Pacific region is less clear. Some countries may decide to start with a clean slate and implement a complete set of rules. Other - Use of Basel III as a starting point, not covering the whole set of requirements. For example, Russia recently announced the transition from standardized approach to the calculation of credit risk to an approach based on internal ratings (IRB) 2015 some of the Middle Eastern countries are in the process of transition to IRB-model. In a number of countries could also be another current system of regulation, which in some cases can mean the replacement of the internal standards requirements of Basel III. However, it may be necessary to parallel execution of domestic and international law. Some may decide to move to the requirements of Basel III on its own, tightening regulations if, in the opinion of the authorities, Basel III does not meet the requirements within a particular country. This can lead to the creation of specific requirements and processes that need to be taken into account when implementing the specification. Global differences further complicate the situation, because banks may have to comply with different rules in different jurisdictions. Some banks will have to report in accordance with the requirements of Basel II in the same country and in accordance with the requirements of Basel III to another, depending on their location. The situation is further complicated by the fact that many regulators require banks to continue to submit reports in accordance with Basel I framework approach using a standardized model for calculating credit risk. This will allow the regulator to have a single method for comparison of all the banks, whose activities it regulates, regardless of whether they use the banks themselves - IRB-approach or the standardized model. In Europe, banks using IRB, regulators agreed that the lower limit on the Basel I should be within 80-90% of the index, calculated using the most "costly" standardized approach. In the U.S., this lower limit is 100%. In fact, it may mean that banks will have to comply with the requirements for compliance with the whole set of standards under Basel I, II and III, depending on the location of the activities and the requirements of local regulators. Reports will be required to provide detailed information regarding this matter, so as not to mislead the regulator or the market. Organizations using models based on separate data become extra burden in terms of additional costs and overheads in the cast of the companies that use a more centralized approach to the collection and consolidation of data and filing reports on standards of Basel I, II and III. All this must be taken into account in applying the principles of Basel III and the implementation of new solutions in the framework of a particular bank. To comply with the requirements of Basel III, all banks are now required to take the necessary measures to provide financial departments and departments of risk management quick and easy access to centralized, verified and accurate data. These data should reflect the credit, market, operational risks, and the risks of concentration, lower credit quality and liquidity risks of the Bank. You will also need to calculate the increased capital, new liquidity ratios and new gearing ratio means that already in 2013 to be able to start reporting to the local supervisory authorities across the set of forms required by various state regulators. The requirements of Basel III to data management are important. To the bank, the regulator and the market could get a clear picture of the situation of the bank; the data must be fresh, accurate, and consistent. This problem cannot be solved efficiently if the data is stored in scattered form in several departments of the bank. Furthermore, they must be carefully structured. Proper data management must ensure receipt invariably true calculations of capital adequacy ratios, the ratio of equity and debt, and a measure of liquidity. This requirement, coupled with significantly increased standards of Basel III - in terms of detail and frequency of reporting - means that the data management in the Basel III standards required to perform more work than ever. Quality, relevance and timeliness of the data are perhaps the most important criteria for determining the success of the implementation of Basel III. After filing reports the regulator there is a high probability that he will continue to work with the bank to determine the key issues concerning the method of calculating the results and application of standards. This requires rapid determination procedures, testing, approval and submission of data. Information provided in addition, must not contradict the report, including the format. Data preparation should be done as cost-effectively as possible. Also, remember that it should not affect other business operations. Such audit process will be particularly difficult for the banks in which data are stored separately in the storage and a large number of systems because the necessary information on the search will take longer. Banks using a centralized storage model will be able to respond to inquiries more quickly and efficiently, thereby streamlining the compliance standard rules and reporting processes. Stress testing, or the ability to understand how significant developments in the market will affect the key performance indicators and ratios, acquired increased importance in the framework of Basel III. Stress testing should be more careful, it will be more frequent, affecting a wider range of data. Ensure that such a stress test will be difficult, if the data in the organization spread across multiple repositories. Testing will take longer, require more effort and give less accurate results with an alignment with the model data storage, in which all the important information is in one central repository. Using a centralized storage will enable the bank to perform a wide range of complex stress tests that will meet the needs of business, giving analytical picture of the organization, as well as meet the requirements of the regulator, that is, to ensure compliance with the standards. Basel III rules reflect the integrated nature of banks and banking. Administrative decision in accordance with the data should help to fulfill the requirements of integration - otherwise, to carry out its provisions will require a much higher overhead than necessary. In view of the growth occurred banks, they develop new services (and supporting systems), and the combined activity of the transition to a truly integrated system without disturbing the functions of the bank will be challenging. The ideal management solution will consolidate and calculate the capital of the organization's liquidity and financial leverage, and to report on these indicators on a single, centralized platform for reporting. Such a system can be seamlessly integrated with other systems of the original data. It will support data validation function at a high level and will store large amounts of information. This approach would streamline the process and allow risk managers to focus on the priority actions for risk management, instead of engaging in the time-consuming tasks, such as data extraction, quality, and reporting. Rapid tools to facilitate the calculations weekly and even daily calculations and the data will lead to an integrated and comprehensive financial statements prepared in strict accordance with the requirements of local regulators. Also, these tools are more fully disclose the situation to the bank. The pursuit of this ideal for many banks will be a tedious process. If we examine this question in context with other tasks described above, it becomes clear why underestimate the difficulties of implementing Basel III standard so easily. However, when these issues are addressed in the context of the organization of the bank, if you have the right approach and a set of tools you can find a solution that will allow the bank to go to the standards on time and within budget. On January 1, 2013 in Kazakhstan was planned to start a phased introduction of the new version of the document - Basel III - with the full transition to the new standards in 2015. However, it was postponed indefinitely. The cause lies in the unpreparedness of a number of countries, and more specifically, their banking systems to new standards of banking regulation. Probably position of the U.S. and the UK was decisive. The experts spoke highly controversial implications of Basel III for both banks and the economy of various countries. Basel III will influence primarily on the structure and quality of capital - increase the minimum requirements for banks' capital adequacy and Tier I capital, of which also excludes a number of tools. The main task of bank capital will be prevention of potential losses in the normal course of business of a bank, and even in the event of complete termination. Also important new standard requirements for liquidity management of banks have important meaning i.e. they are formulated for the first time and adopted as uniform international standards. Basel II includes a new approach to diversification of the loan portfolio of banks' risk management in general, and even to the standards of disclosure. Even without implementation of Basel III, we can see that requirements of minimal size of bank capital are higher than in other countries. If you look at the requirements for minimum capital of the world, the largest number of countries is in the area from 1 to 5 million euro. Lower limit for regional banks is 5,000,000,000 tenge, for Republican is 10 billion tenge. However, this does not affect the stability of the banking system, but rather reduces competition and promotes the expansion of the various micro-credit organizations. In comparison with Russia, where only recently the requirement for minimum capital of banks increased to $ 6 million, then of course, our banking system is more "clean" and healthy. If you look at the situation in general, excessive demands of our National Bank is largely due to previous plans to create a regional financial center of Almaty. They planed that market of financial institutions from near and far abroad will come into our market. However, the financial center for objective reasons could not be established, and we live in is not quite a normal situation that impedes the creation of new small banks, which could also contribute to the development of the peripheral areas of the country. For example, in some U.S. states, the bank can be opened with only 70 thousand dollars. This, of course, these banks fully falls within the scope of all regulatory standards. Raising the bar four times higher than the average values, the regulator has seen the future of the country "Eurasian Leopard" with the economy like the "Asian Tigers" - Singapore, Malaysia, Indonesia and Taiwan. By the way, there are minimum capital requirements - $ 100 million. But do not forget that the level of monetization of the "Asian tigers" is several times higher than in Kazakhstan. In Singapore it exceeds 100%, while in Kazakhstan - less than 40%. It is impossible to ensure economic growth and stability of the banking system only by a single parameter - the capital. At the same time implementation of Basel III has strengths and weaknesses. Advantage of Basel III is the creation of additional capital. Also Basel directed towards the reduction of operational risk and liquidity risk. Weaknesses are that the banks will have to not only reduce the current minimum lending period exceeding one year, but also encourage customers to repay previously issued the medium and long term loans for balancing their assets and liabilities as soon as possible. Obviously, it will have negative impact on the domestic business. The second disadvantage is that it reduces competition and leads to the increase in number of the various micro-credit organizations. We’d like to say that only time will tell that the introduction of Basel was right decision or not.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Последнее изменение этой страницы: 2016-08-06; просмотров: 403; Нарушение авторского права страницы; Мы поможем в написании вашей работы! infopedia.su Все материалы представленные на сайте исключительно с целью ознакомления читателями и не преследуют коммерческих целей или нарушение авторских прав. Обратная связь - 18.226.214.1 (0.013 с.) |

(3)

(3)