Заглавная страница Избранные статьи Случайная статья Познавательные статьи Новые добавления Обратная связь FAQ Написать работу КАТЕГОРИИ: ТОП 10 на сайте Приготовление дезинфицирующих растворов различной концентрацииТехника нижней прямой подачи мяча. Франко-прусская война (причины и последствия) Организация работы процедурного кабинета Смысловое и механическое запоминание, их место и роль в усвоении знаний Коммуникативные барьеры и пути их преодоления Обработка изделий медицинского назначения многократного применения Образцы текста публицистического стиля Четыре типа изменения баланса Задачи с ответами для Всероссийской олимпиады по праву

Мы поможем в написании ваших работ! ЗНАЕТЕ ЛИ ВЫ?

Влияние общества на человека

Приготовление дезинфицирующих растворов различной концентрации Практические работы по географии для 6 класса Организация работы процедурного кабинета Изменения в неживой природе осенью Уборка процедурного кабинета Сольфеджио. Все правила по сольфеджио Балочные системы. Определение реакций опор и моментов защемления |

Analysis of activity of Kazkommertsbank in formation of deposit market and implementation of deposit policy.Содержание книги

Поиск на нашем сайте

About 75% of liabilities of Kazakh banks are deposits of legal entities and individuals, and for some time there is tendency to growth in weight of retail deposits as liabilities of commercial banks. However, respondents' Ks' experts can hardly call deposits as a reliable source of funding. According to the National Bank of Kazakhstan, from December 2011 to December 2012 the total amount of deposits in Kazakhstan's commercial banks increased by 607.9 billion KZT (7%), the volume of deposits of legal entities decreased by about 40 billion KZT (about 7%), while retail deposits increased by 650 billion KZT (about 20%). This suggests that the strategy of many Kazakh banks have recently focused on the increase in the share of deposits, including the consumer in the overall structure of their liabilities. Retail deposits and deposits of legal entities constitute a significant share of liabilities in commercial banks of Kazakhstan at the beginning of 2013. They amounted to 75% of the market average. In number of banks, such as Halyk and Center Credit, the share of liabilities is above average market share over 80%. According to research by Standard & Poor `s, provided by the business portal Kapital.kz, indicators of funding and liquidity of the banking sector in Kazakhstan will remain adequate, stimulating the growth of lending without attracting significant external funding. Taking the limited investment opportunities in Kazakhstan into consideration, experts expect a further increase in the volume of deposits of Kazakhstan banks with economic growth in the country. Analyst of Halyk Finance Bakay Madybaev outlined two polarity of deposit funding of second tier banks. On the one hand, attraction of deposits reduces the concentration of funding sources, but on the other hand, a relatively short period of time of deposits hinders corporate and mortgage lending, and the risks of an early withdrawal of funds make banks hold excess liquidity, thereby reducing the return on assets. A large percentage of the risks is noted by director of the Center for Macroeconomic Research Olzhas Hudaybergenov, noting that the overall volume of deposits is growing, but among them short-term deposits dominate. In addition, the depositor may withdraw the deposit at any time. As well as deposits are now the main source of funding for banks, but quite unreliable. An analyst "Uralsib Capital" Natalia Berezina has another opinion, noting that in more or less stable macroeconomic deposits of the population can be considered a reliable source of funding. According to her, the high proportion of retail deposits makes sense in case of the corresponding share of retail lending, or lending to small and medium-sized businesses. For example, Kaspi Bank can afford to keep 60% of liabilities in retail deposits, but if we take the" Halyk ", in which retail deposits are about 20% of the loan portfolio, or" Kazkommertsbank " where the share reaches only 10%, it seems reasonable that the share of retail deposits in the liabilities is about 30% that banks have. The most popular terms for investors are usually the first, deposits in KZT at 6.5-8% with the possibility of partial withdrawals and replacements, and, second, the deposits by more than 8% (up 9.4%), but with a higher minimum deposit amount or without the option of partial withdrawals. According to statistics of the National Bank of Kazakhstan as of February 1, 68% of the deposits of legal entities and 88.5% of retail deposits were made in KZT. National Bank statistics show a trend of popularity of KZT deposits. According to data as of February 1, 2013, deposits of legal entities in Kazakhstan's commercial banks amounted to more than 1,467 trln. KZT or about 68% of the total amount of deposits of this group of investors. The volume of retail deposits in KZT amounted to nearly 323.7 billion KZT, or 88.5% of total deposits of individuals. These do not include data on deposits of non-residents. Contributions are often made for a period of 12 to 36 months in the national currency. The banks themselves encourage Kazakhstanis to save in the national currency. Taking into consideration the fact that for the bank the national currency is preferred for maintaining needs of business units, the highest interest rates are set on deposits in KZT. As a result customers usually place deposits in the national currency. In addition, the Kazakhstan Deposit Insurance Fund (KDIF) recommends a nominal interest rate of 9% per annum for deposits in KZT and 5.5% for deposits in foreign currency. In December 2012 average rates for the system on retail deposits in KZT (6.7%) and foreign currency (4.7%) were below the maximum recommended rate (from 1 January 2013 - 9% and 5.5%, respectively, in the second half of 2012 was 9% and 6%).It is obvious that the Kazakh banks offering more than 9%, involve the effective rate (which is always above par), or offer award to depositors, which in the case of a bank failure may be unwarranted. The scheme is built like this: the bank itself determines what he wants to guarantee deposits, and in proportion to the volume of this contributes to the KDIF and the fund, in turn, sets the recommended rates at size of which will be guaranteed reward. The Bank may establish a higher rate, but there is no guarantee on difference.

Table 6 Volume of deposits in second tier banks

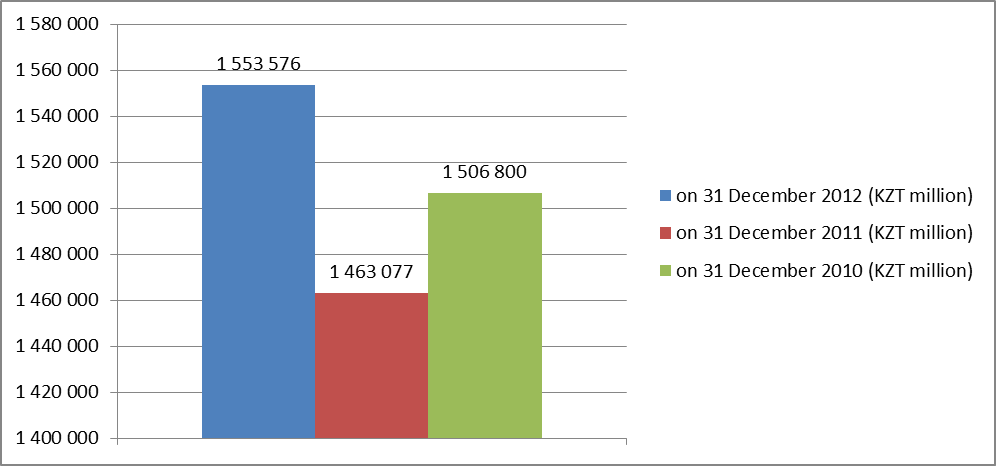

The amount of deposits in Kazkommertsbank on 31 December 2012 was 1,554 trillion KZT, in comparison with 2011, it increased by 6,2%.

Table 7 Volume of deposits of Kazkommertsbank

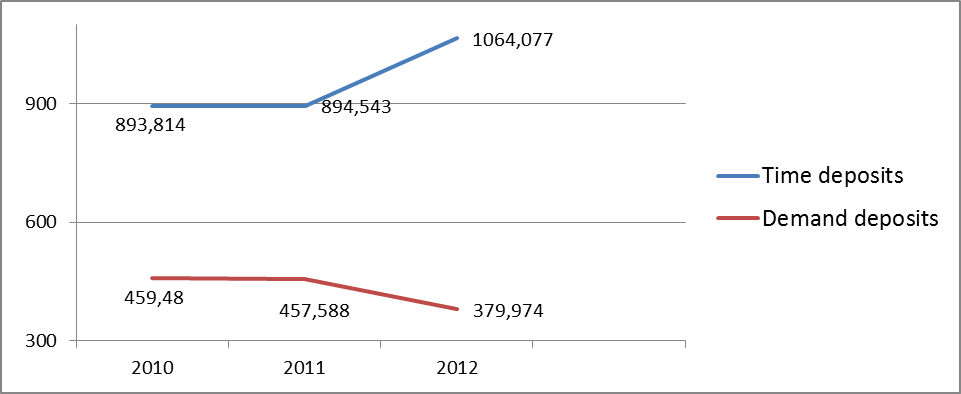

If we look at diagram we can see that the volume of deposits decreased in 2011, and increased in 2012. In comparison with 2011, we see positive tendency to the growth.

Note - Compiled by the author according to the financial statement of Kazkommertsbank

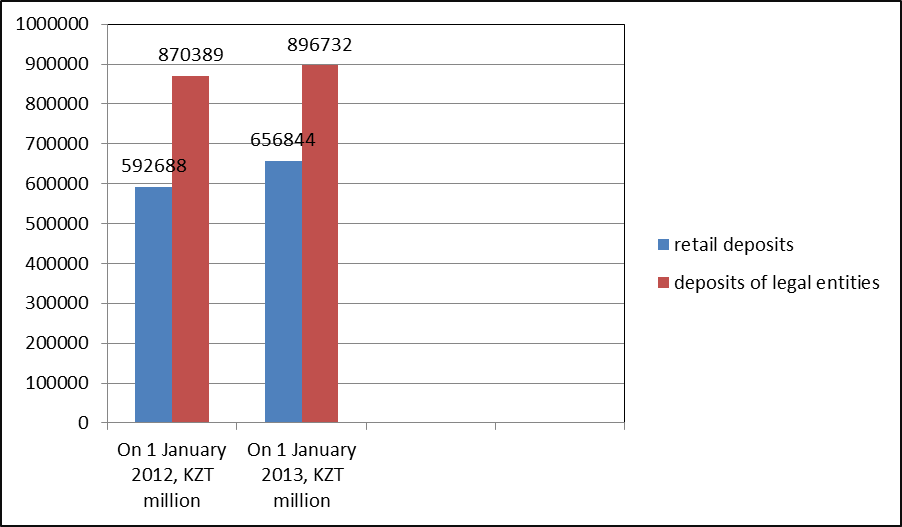

Figure 7. Dynamics of change in volume of deposits of Kazkommertsbank from 2010- 2012, mln. KZT The volume of retail deposits was 656,844 billion KZT on 1 January 2013, 592,688 billion on 1 January 2012.The increase in retail deposits was 10.8%.

Table 8 Volume of retail deposits in banks

The volume of deposits of legal entities was 896,732 billion KZT on 1January 2013, 870,389 billion on 1 January 2012. The growth of deposits of legal entities was 3%.

Table 9 Volume of deposits of legal entities in banks

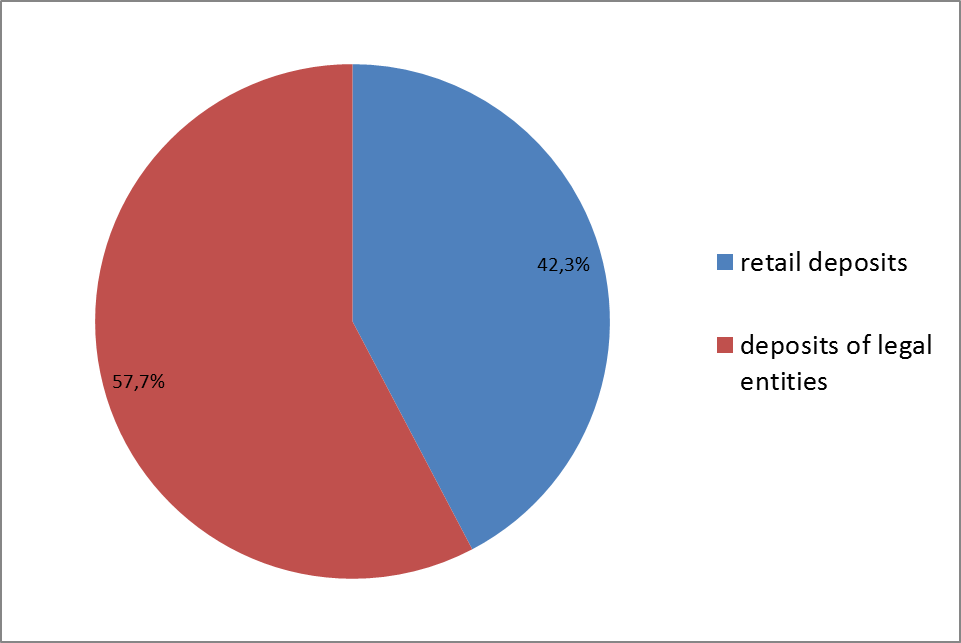

Figure 8. Dynamics of change in volume of retail and deposits of legal entities of Kazkommertsbank on 1 January 2012, 2013, mln. KZT The share of retail deposits is 42,3%, the share of deposits of legal entities is 57,7% in 2012. Nowadays we can see that retail deposits grow rapidly. Earlier in the structure of deposit portfolio the deposits of corporate clients dominated, in the last couple of years, there is such a tendency that retail deposits pursue deposits of legal entities.

Note - Compiled by the author according to the data of website www.kapital.kz

Figure 9. The share of retail deposits and deposits of legal entities on 1 January 2013

In comparison with other banks, we can see that an increase in retail and legal entities deposits is not high. This is can be explained by the fact that Kazkommertsbak has sufficient liquidity and sufficient funds to provide growth. As a result during 2 years Kazkommertsbank has reduced interest rates on deposits which reduced interest rates on loans to public. Another reason why bank decreases interest rate on deposits is that in July of this year, Kazakhstan Deposit Insurance Fund (KDIF) lowered the recommended interest rate for banks. So, KDIF lowered the recommended rate on KZT deposits from 10 to 9% per annum in foreign currency - from 7 to 6% per annum. According to managing director of bank Andrey Timchenko, the bank has no plans to revise interest rates on deposits. Effective annual rate of KZT deposits for individuals in Kazkom ranges from 7.2-7.7% per annum.

Table 10 Deposits with high interest rates

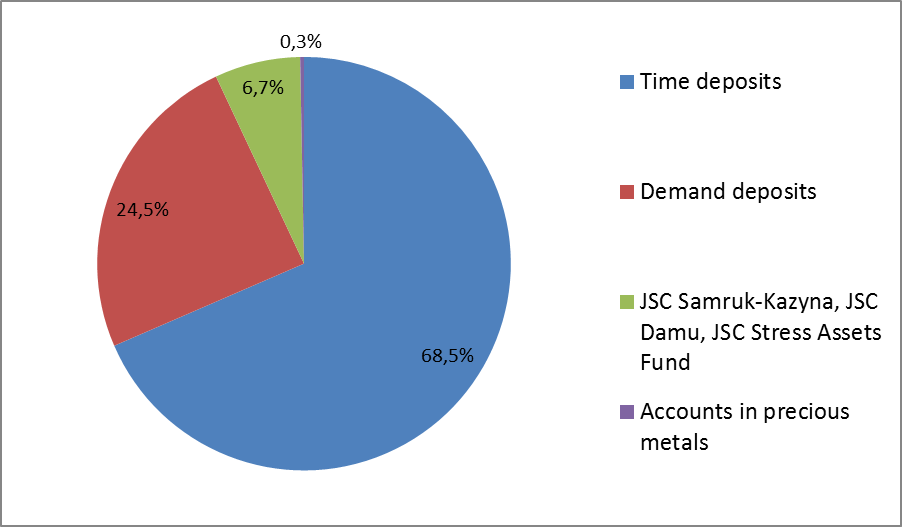

Let’s consider deposit portfolio of Kazkommertsbank. We can see that time deposits exceed demand deposits. Bank encourages people to put money in time deposits by setting high interest rates in comparison with demand deposits. For a bank fixed deposit is advantageous because it can use these funds for a longer time for making loan to the borrower and receiving high interest rates.

Note - Compiled by the author according to the financial statement of Kazkommertsbank

Figure 10. The share of time deposits, demand deposits, JSC National Welfare Fund’s “Samruk-Kazyna”, JSC Entrepreneurship Development Fund’s “Damu” and JSC Stress Assets Fund’s deposits, accounts in precious metals in 2012.

There is a tendency to an increase in volume of time deposits and opposite tendency to decrease in volume of demand deposits.

Table 11 Dynamics of change in time and demand deposits

Note - Compiled by the author according to the financial statement of Kazkommertsbank

Figure 11. Dynamics of change in volume of time and demand deposits from 2010-2012, mln. KZT

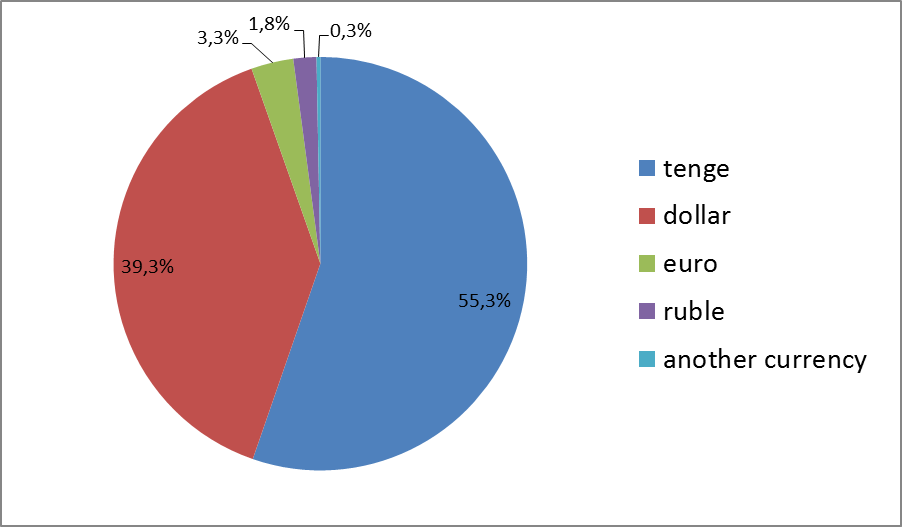

Statistics shows that customers prefer to keep their money in KZT. KZT is the most popular currency. Dollar takes second place, euro the third place. Deposits in KZT amounted to 55,3% in 2012. For the bank the national currency is preferred for maintaining needs of business units, the highest interest rates are set on deposits in KZT. As a result customers prefer to place deposits in the national currency.

Note - Compiled by the author according to the financial statement of Kazkommertsbank

Figure 12. Shares of deposits in KZT, dollar, euro, ruble, another currency in 2012

Why do people prefer to make deposits in Kazkommertsbank? The main reason is an advertisement. Nowadays advertisement plays an important role in attracting new depositors. Kaskommertsbank is one of the leaders in volume of funds directed at advertisement. More than 19.4% of the market of advertising budget belongs to Kaspi bank; the second place is taken by Eurasian Bank 15.2%. Kazkommertsbank 14.3% took the third place. So, in 2012, Kaspi bank spent on advertising more than 1.3 billion, "Eurasian Bank" -1.0 billion, Kazkom - 953.6 million in 2012. In comparison with 2011, Kazkommertsbank reduced its expenses on advertisement by 11.2%, according to website www.kapital.kz.

Table 12 Leaders in volume of funds directed at advertisement.

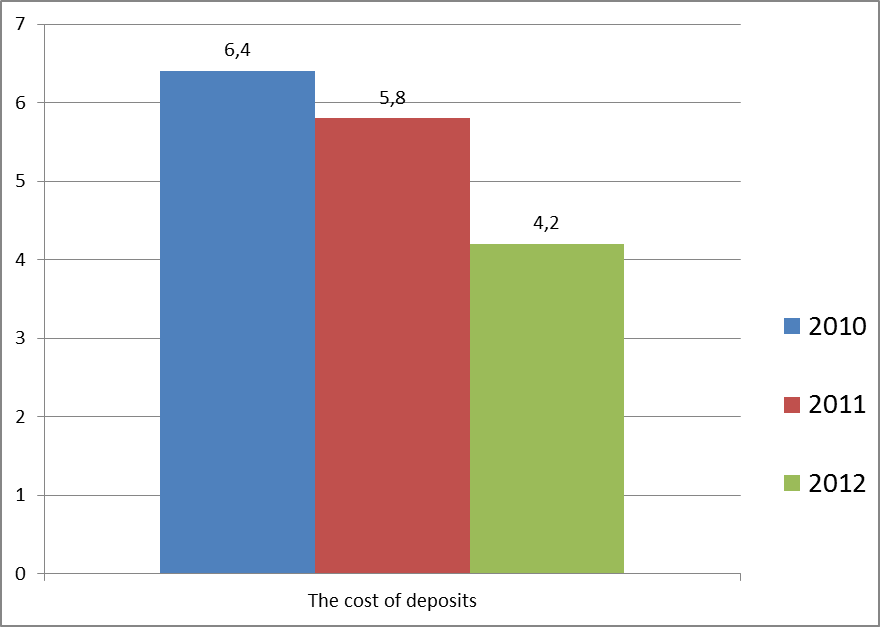

As at 31 December 2012, interest on customer accounts was KZT 65,986 billion (2011: KZT 85,490 billion, 2010: KZT 96,997 billion).The volume of deposits was 1,554 KZT trillion in 2012, KZT 1,463 trillion in 2011, KZT 1,507 trillion in 2010. The cost of deposits is equal to: 65,986 billion / 1,554 trillion *100% =4,2 % in 2012 85,490 billion /1,463 trillion=5,8 % in 2011 96,997 billion / 1,507 trillion=6,4% in 2010 We see the tendency to the decrease in cost of deposits. It is explained by the fact that bank reduces interest rate on deposits.

Note - Compiled by the author according to the financial statement of Kazkommertsbank

Figure13. The cost of deposits in 2010, 2011, 2012

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Последнее изменение этой страницы: 2016-08-06; просмотров: 426; Нарушение авторского права страницы; Мы поможем в написании вашей работы! infopedia.su Все материалы представленные на сайте исключительно с целью ознакомления читателями и не преследуют коммерческих целей или нарушение авторских прав. Обратная связь - 18.117.101.250 (0.009 с.) |

Note - Compiled by the author according to the data of website www.kapital.kz

Note - Compiled by the author according to the data of website www.kapital.kz