Заглавная страница Избранные статьи Случайная статья Познавательные статьи Новые добавления Обратная связь FAQ Написать работу КАТЕГОРИИ: ТОП 10 на сайте Приготовление дезинфицирующих растворов различной концентрацииТехника нижней прямой подачи мяча. Франко-прусская война (причины и последствия) Организация работы процедурного кабинета Смысловое и механическое запоминание, их место и роль в усвоении знаний Коммуникативные барьеры и пути их преодоления Обработка изделий медицинского назначения многократного применения Образцы текста публицистического стиля Четыре типа изменения баланса Задачи с ответами для Всероссийской олимпиады по праву

Мы поможем в написании ваших работ! ЗНАЕТЕ ЛИ ВЫ?

Влияние общества на человека

Приготовление дезинфицирующих растворов различной концентрации Практические работы по географии для 6 класса Организация работы процедурного кабинета Изменения в неживой природе осенью Уборка процедурного кабинета Сольфеджио. Все правила по сольфеджио Балочные системы. Определение реакций опор и моментов защемления |

Multiple Tasking in Western AustraliaСодержание книги

Поиск на нашем сайте Diamonds and Gold According to official statistics, the annual export value of minerals and metals accounts for nearly 30% of the total exports of goods and services from Australia. The remote Kimberley region of Western Australia makes a valuable contribution, with diamonds and gold high on the list, from open pit mines that have some of the toughest working conditions on earth. In such difficult locations, the client places more reliance on manufacturers, not just to supply the most flexible, robust and reliable equipment, but to assist in commissioning, training, ongoing maintenance, and the resolution of any abnormal parts and service problems that may occur. Atlas Copco engineers and fitters regularly visit each mine, and the client can call them for advice at any time. They have demonstrated a high degree of product and industry knowledge, and are proving to be a valuable source of information, keeping the clients up to date on product developments. Access to such relevant expertise helps keep the machines working at their very best. Rock Engineering at Argyle Australian company Rock Engineering specializes in the contract supply and installation of ground support products in underground and open pit mines and civil construction applications, and is one of the first to offer this service. Rock Engineering has a large portfolio of projects, both in Australia and overseas. These include the ground support programme at the Argyle Diamond Mine, located 130 km south of Kununurra, in the isolated Kimberley region of Western Australia. The Rock Engineering fleet on site was strengthened by the addition of an Atlas Copco ROC F9 surface drillrig in May, 2002. As the first Atlas Copco machine to be used by the company, there was great interest in its performance. The Argyle mine was commissioned in 1985, following a long period of exploration that initially commenced in the Kimberley more than a decade earlier, in 1972. It now produces more diamonds than any other mine in the world, and is renowned for being the only source of the rare and valuable pink diamond. For what is now a large open pit mine, Argyle has relied on Rock Engineering to provide ground support and pre-splitting of the final walls for nearly four years. Currently eighteen months into the two-year second phase of the ground support fixed-price contract, Rock Engineering has been on site for around three years in total, having completed Phase One prior to the current contract. Mine life for the open pit is predicted for another four years, with the potential to commence underground operations after that time. To perform its work on site, Rock Engineering owns and operates a fleet of underground and surface equipment. Rugged and Reliable The ROC F9, along with all of the machines in the Atlas Copco Open Pit Series, has been designed for rugged conditions, with enough strength and flexibility to handle the most demanding tasks. Thanks to its folding boom, the ROC F9 boasts the longest vertical and horizontal reach of any similar machine. It is also equipped with the most powerful top-hammer in its class.The rig is powered by a 231 kW engine and an Atlas Copco screw compressor delivering 188 lit/sec. The design facilitates more holes per rig set-up, because less time is spent on tramming, making more time available for drilling. Rock Engineering's decision to purchase the ROC F9 was based heavily on its versatility, because the folding boom is suitable for both drilling cablebolt holes, and for presplitting. At Argyle, cablebolt holes are drilled at 89 mm-diameter to a depth of 23 m, while pre-splitting is carried out to a depth of 25 m. As well as these two main functions, the machine is also occasionally used for drilling blast-holes, and pit holes for dewatering. The company appreciates this versatility, but has also found that the ROC F9 outperforms its predecessor on all functions. This is partly credited to the angling capability of the drillrig's mast, which allows the operator to insert bolts quickly, and with minimal manoeuvring of the unit. The operators are also able to see all of the rods from the cab, which they report has led to more efficient drilling. Good Company The ROC F9 drillrig is used at Argyle on a 10 h shift basis and, even in the site's variable rock conditions, is meeting all requirements placed upon it. It was recently joined by a ROC L8, another machine from the current Atlas Copco series, which arrived on site during May, 2003. This latest addition is being used to drill 150 m-long dewatering holes at a 5-degree upward angle, and 200 m-deep vertical holes, although it is also capable of pre-split and production drilling. The rig uses a 5 in hammer, 89 mm drill pipes, and 140 mm bits, and the carousel has been modified to allow for re-load of pipes every 48 m. The Australian drilling contractor market has a reputation of being one of the most demanding in the world, with some of the toughest working conditions. In summertime, the operators face ambient temperatures above 55 degrees C in the pits. The rock stores the heat, and radiates it at night. The Atlas Copco rigs have been customized to handle these sorts of conditions, together with the contractors' specific needs. Widened application range, exceptionally low running cost, and enhanced reliability are the main reasons for the rapid acceptance of the ROC L8 in Australia. Fitted with a Caterpillar C12 317 kW engine, the ROC L8 provides powerful down-the-hole drilling with COP 44, 5-i and 64 Gold hammers, which are among the fastest on the market. Combining manoeuvrability, strength and precision, the rig can drill accurate throughout a large range of angles. An optional electronic inclination instrument and depth controller ensures perfectly aligned and orientated holes to a preset depth. Heavyduty tracks, a fuel-saving device, and a dust collector and preseparator are among the many standard features of the unit. Many other options are available, including an electronic refuelling pump, engine preheater, and hydraulic support leg.

Lists of words

1. ground suuport – відповідно до 2. rock – скеля, порода 3. diamond - алмаз 4. gerew compressor – гвинтовий компресор 5. reliable - надійний 6. boom - стріла 7. drilling - буріння 8. combining -об'єднання 9. contractor -підрядник 10. demanding -вимогливий

11. equipped - обладнаний 12. mast – щогла, опора 13. orientated – орієнтований 14. including – включаючи, в тому числі 15. electronic– електронний 16. ensure – гарантувати 17. production -виробництво 18. commissioning – здача в експлуатацію 19. appreciate -цінувати 20. maintenance - обслуговування Trends in Underground Mining Low Price, High Output

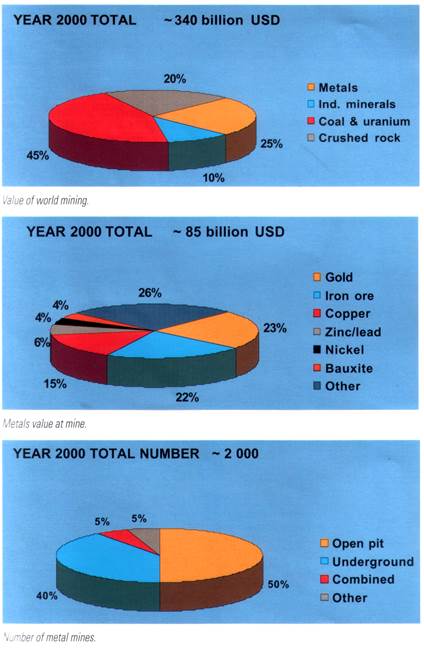

Once again metal prices are low, and mining industry profits are generally poor. The market capitalization of the entire mining industry is falling, and is currently valued at less than 1% of the global figure for all industries. In fact, some of largest non-mining companies have an individual market capitalization exceeding the sum of all mining companies. At a cursory glance the situation is gloomy. However, despite the current economic downturn, the demand for mined products, such as metals, industrial minerals, construction materials or energy minerals, has not reduced in the same way as in economically difficult periods in the past. Paradoxically, the production of metals and minerals is steadily growing.

Improving Productivity New, more effective, technology makes it possible to extract more metal out of lower grade material, and at a lower cost than earlier generations of miners could achieve. External pressures have also had an impact on the operations of the mining industry, causing it to move in many ways. Intensive cost-cutting is now standard in all companies, while, at the same time, they have been investing in new and more productive equipment. Non-core businesses have been sold off, in order to focus management attention, and many unprofitable mines have been closed down. Mergers and acquisitions have been made, in order to create larger, more cost-effective, and financially stronger entities. During the first years of the new millennium, the international mining industry has been in the midst of an intensive period of change. Many long-established, well-respected mining companies have disappeared, and new giants are emerging. Undergroun Mining Table 1. Total world underground ore production.

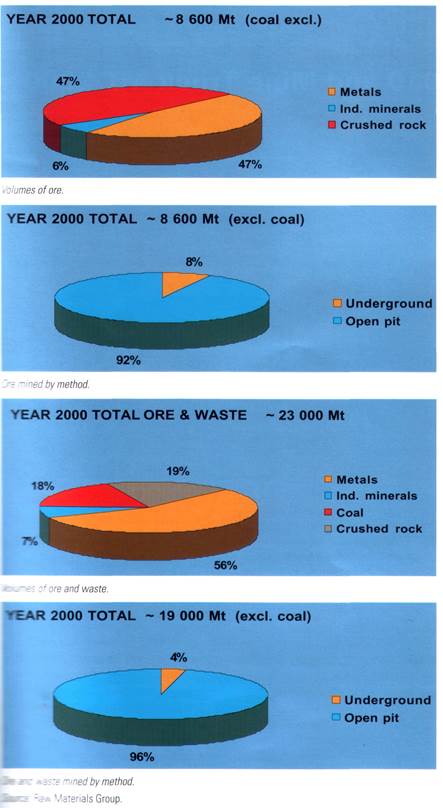

Mining is, to a large extent, about moving enormous amounts underground mining is by nature selective, always trying to take the meat out of the pie while leaving the crust. Open pit mining, on the other hand, takes the whole pie and then separates the meat from the crust.

The proportion mined underground equates with some 16% of the total volume of ores extracted. In the centrally planned economies of the eastern bloc, underground mining accounts for 32% of the total activity in the sector, while the figure is 15% in the Western world. There are 365 underground mines in the Western world, many of which are fairly small, but efficient, operations, hoisting an average of 400,000 t annually. Notwithstanding, many underground mines are huge, with very sophisticated equipment and a high level of automation.

Production Distribution

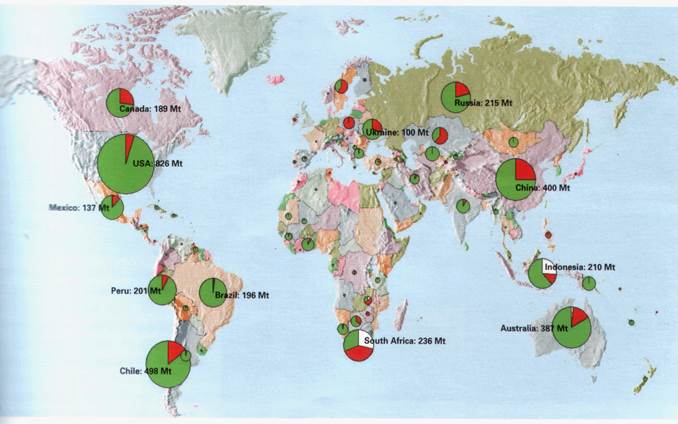

South Africa is the most important country in underground ore production, with 141 Mt produced annually. In a second group are found Canada, Australia and the formerly centrally planned economies of Russia, Ukraine, and Kazakstan with 40-55 Mt of underground production. The USA, Brazil, Peru, Poland and Sweden follow in a third group, with production between 26 and 41 Mt of ore annually. Zambia, Mexico, Indonesia, India and Bulgaria are also all producing around 10 Mt/year. Together, the first two groups comprising South Africa, Canada, Australia, Russia, Ukraine and Kazakstan, represent some 70% of total underground production. The most important mineral sector is zinc/lead, where over 80% of all ores are excavated in underground mines. A total of 115 Mt ore is needed to produce the Western world output of zinc; and over 90 Mt of this is mined underground. The corresponding figures for nickel are 80 Mt total for all ores, of which some 30 Mt from underground mines. Iron ore is at the other extreme, with a total of over 1,000 Mt ore produced, of which 675 Mt in the Western world. Less than 10% comes from underground mines located in Sweden, Norway, Slovakia and Colombia. The distribution of underground ore production around the world is shown on the map. Future Growth

The grades of the ores from which metals are extracted vary greatly. Rich iron ores may contain up to 65% (650,000 g/t) of iron, while a gold ore in an average open pit mine might only be one part per million (0.0001 per cent, or 1 g/t). Hence, the volume of ore needed to obtain a tonne, or a kilogramme, of product varies considerably. The volume of ore production depends on the amount of metals consumed, and the grades of the ore deposits mined. Over time, the orebodies have become depleted, and less rich deposits have started to be exploited. The graph in Figure 1 illustrates this point clearly, with an example from the world of copper. The average grade of copper ore has sunk continuously over the last 70 years. Roughly 5 times more ore needs to be extracted to get a tonne of copper in 2003 than was the case in 1950. Technical developments, resulting in more deeply penetrating exploration methods, increase the probability of finding new, richer, deeper ore deposits. This counterbalances the trend towards lower quality to some extent, but obviously not to the full.

List of words 1. underground mining – підземнa розробкa,розробка підземним методом 2. to close down – закривати 3. open pit mining – відкрита розробка корисних копалин 4. selective mining – селективна розробка 5. crust – кора 6. development work – підготовчі роботи 7. to extract ores – видобувати,вилучати руди 8. to hoist – піднімати на поверхню 9. (sophisticated) equipment – (складне) обладнання, 10. to operate a mine – експлуатувати шахту 11. rich iron ore – багата залізна руда 12. ore grade – сорт, тип руди 13. ore deposit – поклад руди

Exercises: 1) Give Ukrainian equivalents of the following words and word combinations:

To make it possible, to have an impact, intensive cost-cutting, non-core business, centrally planned economy, annual growth rate,

2) Give English equivalents of the following words and word combinations: Нова більш ефективна технологія, видобувати більше металу із матеріалу нижчої якості, виникають (з’являються) нові гіганти, з іншого боку, існує 365 підземних копалень, найважливішими мінеральними секторами є, відповідними цифрами (показниками) для нікелю є; якість руд, із яких; об’єм видобутку руди залежить, середня якість мідної руди, співвідношення між відкритою та підземною.

|

||||||||||||

|

Последнее изменение этой страницы: 2016-06-29; просмотров: 220; Нарушение авторского права страницы; Мы поможем в написании вашей работы! infopedia.su Все материалы представленные на сайте исключительно с целью ознакомления читателями и не преследуют коммерческих целей или нарушение авторских прав. Обратная связь - 216.73.216.137 (0.009 с.) |

Each year, around 4,100 Mt of ore containing the most important metals copper, gold, iron ore, lead/zinc, nickel, platinum group metals and diamonds is produced globally. Of this, some 615 Mt is mined underground, for which Table 1 gives the regional split. To support this level of activity, a considerable amount of development work has to be carried out.

Each year, around 4,100 Mt of ore containing the most important metals copper, gold, iron ore, lead/zinc, nickel, platinum group metals and diamonds is produced globally. Of this, some 615 Mt is mined underground, for which Table 1 gives the regional split. To support this level of activity, a considerable amount of development work has to be carried out. Special skills are necessary to operate a profitable underground mine, and these skills have been developed in a few key countries where underground mining is more important than elsewhere.

Special skills are necessary to operate a profitable underground mine, and these skills have been developed in a few key countries where underground mining is more important than elsewhere. In 2005, ore production in the Western world was projected to increase to 3,700 Mt. This is equal to an annual growth rate of a little lower than 3%. The ratio between open 'pit and underground mining seems' to have stabilized at around 1:6, with 85% open pit and 15% underground in the Western world. Developments in the formerly centrally planned economies, including China, are more difficult to predict. The underground proportion of mining in these countries will decrease when economic views of profitability, and the influence of world markets, get stronger. Due to many years of neglect in these areas, there is a dramatic need for more reinvestment and new capacity, companies have disappeared, and new giants are emerging.

In 2005, ore production in the Western world was projected to increase to 3,700 Mt. This is equal to an annual growth rate of a little lower than 3%. The ratio between open 'pit and underground mining seems' to have stabilized at around 1:6, with 85% open pit and 15% underground in the Western world. Developments in the formerly centrally planned economies, including China, are more difficult to predict. The underground proportion of mining in these countries will decrease when economic views of profitability, and the influence of world markets, get stronger. Due to many years of neglect in these areas, there is a dramatic need for more reinvestment and new capacity, companies have disappeared, and new giants are emerging.