Заглавная страница Избранные статьи Случайная статья Познавательные статьи Новые добавления Обратная связь FAQ Написать работу КАТЕГОРИИ: ТОП 10 на сайте Приготовление дезинфицирующих растворов различной концентрацииТехника нижней прямой подачи мяча. Франко-прусская война (причины и последствия) Организация работы процедурного кабинета Смысловое и механическое запоминание, их место и роль в усвоении знаний Коммуникативные барьеры и пути их преодоления Обработка изделий медицинского назначения многократного применения Образцы текста публицистического стиля Четыре типа изменения баланса Задачи с ответами для Всероссийской олимпиады по праву

Мы поможем в написании ваших работ! ЗНАЕТЕ ЛИ ВЫ?

Влияние общества на человека

Приготовление дезинфицирующих растворов различной концентрации Практические работы по географии для 6 класса Организация работы процедурного кабинета Изменения в неживой природе осенью Уборка процедурного кабинета Сольфеджио. Все правила по сольфеджио Балочные системы. Определение реакций опор и моментов защемления |

Exercise 1. Listening (Guide to Economics, unit 8 “Factors of Production” – track 23)Содержание книги

Поиск на нашем сайте What is Economics? One of the things that young people discover as they grow older is that you can’t have everything. You are reminded of it every time you shop. Although you may see twenty or thirty items that you would really like to buy, you know that you will have to limit your selection to one or two. Everyone goes through life having to make choices. Governments, too, cannot have everything. Every year the most important political debates concern questions about spending taxpayers’ money. Neither individuals nor societies can have all the things they would like to have. There simply is not enough of everything to go around. Economists note that there is no limit to the amounts or kinds of things that people want. There is, however, a limit to the resources, things used to produce goods and services, available to satisfy those wants. Once that limit is reached, nothing else can be produced. In other words, when a nation’s resources (all its workers, factories, farms, etc.) are fully employed, the only way it will be able to increase the production of one thing will be by reducing the production of something else. This happened during World War II. In its efforts to increase the production of tanks and other military vehicles, our nation’s factories stopped producing automobiles. Therefore, if somebody tries to sell you a 1944 Ford or Chevrolet, run, do not walk, to the nearest exit – none were produced that year. To summarize: human wants are unlimited, but the resources necessary to satisfy those wants are limited. Thus, every society is faced with the identical problem, the problem of scarcity. Since there is not enough of everything to go around, everyone – individuals, business firms and government – needs to make choices from among the things they want. In the process they will try to economize, to get the most from what they have. With this in mind, we can define economics as the social science that describes and analyses how society chooses from among scarce resources to satisfy its wants. The need to choose is imposed on us all by our income, wealth and ability to borrow. Individuals and families are limited by the size of their personal income, savings and ability to borrow. Similarly, business firms are limited by their profits, savings and borrowings and governments by their ability to tax and borrow. Income, earnings, profits and taxes enable people, institutions and governments to purchase goods, products you can see or touch, and services, work performed for pay that benefits others. The problem that each must face, however, is that once the decision has been made to choose one set of alternatives, one loses the opportunity to choose the other. Business is faced with the problem of choices and opportunity costs. The opportunity cost of something is its cost measured in terms of what you have to give up to get it. In planning an advertising campaign, for example, a local store might have to choose between a newspaper ad or a direct-mail campaign. If it puts its efforts into newspaper advertising, the opportunity cost is the benefits of a direct-mail campaign. Like individuals and business firms, government also pays opportunity costs. If, for example, the federal government chooses to increase its spending for roads by reducing the number of warships to be built, the opportunity cost of the improved road network would be a more powerful navy. The resources that go into the creation of goods and services are called the factors of production. The factors of production include natural resources, human resources, capital and entrepreneurship. Each factor of production has a place in the economic system, and each has a particular function. People who own or use a factor of production are entitled to a “return or reward”. This generates income which, as it is spent, becomes a kind of fuel that drives the economy. Natural Resources or “Land”. Natural resources are the things provided by nature that go into the creation of goods and services. They include such things as mineral, wildlife and timber resources, as well as the air we breathe. Economists also use the term “land” when we speak of natural resources as a factor of production. The price paid for the use of land is called rent. Rent becomes income to the owner of the land. Human Resources or “Labor”. Economists call the physical and mental efforts that people put into creation of goods and services labor. The price paid for the use of labor is called wages. Wages represent income to workers, who own their labor. Capital. To the economists, physical capital (or “capital” as it is commonly called) is something created by people to produce other goods and services. A factory, tools and machines are capital resources because they can be used to produce other goods and services. The term capital is often used by business people to refer to money that they can use to buy factories, machinery and other similar productive resources. Payment for the use of someone else’s money, or capital, is called interest. Entrepreneurship. Closely associated with labor is the concept of entrepreneurship, the managerial or organizational skills needed by most firms to produce goods and services. The entrepreneur brings together the other three factors of production. When they are successful, entrepreneurs earn profits. When they are not successful, they suffer losses. The reward to entrepreneurs for the risks, innovative ideas and efforts that they put into the business are profits, whatever remains after the owners of land, labor and capital have received their payments. Exercise 1. Listening (Guide to Economics, unit 8 “Factors of Production” – track 23) “Entrepreneurship is the fourth factor of production”. Which things from the list below do you think entrepreneurs bring to the economy?

Listen and check your predictions

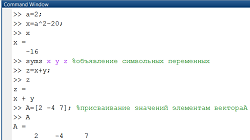

Exercise 2. Listening (Guide to Economics, unit 5 “Opportunity cost” – track 15) Exercise 1.4 (study Guide, unit 1). Use the words - economic, economical, economist, economics, economy, economize - to complete the sentences below. Use each word once only. 1. The subject matter of ______________________________ is that part of human behavior which relates to the production, exchange and use of goods and services. 2. The heart of Adam Smith’s philosophy was his belief that the __________________________ would work best if left to function on its own without government regulation. 3. Since there is not enough of everything to go around, everyone needs to make choices from among things they want. In the process they will try to ___________________________. 4. David Ricardo is one of history’s most influential _______________________________. 5. In many cases ___________________________ issues can not be solved with theories and models alone. Solution to these problems involves opinion, politics and personal value judgements. 6. It is usually more ___________________ to buy large quantities of a product than small quantities. · Video (TTC Economics 01) “How Economists Think” · Basic Economics. “What is economics?” Chapter 01 The Basic Economic Problems The central problem of economics is to determine the most efficient ways to allocate the factors of production and solve the problem of scarcity created by society’s unlimited wants and limited resources. In doing so, every society must provide answers to the following three questions: What goods and services are to be produced and in what quantities are they to be produced? How are those goods and services to be produced? Who will receive and consume (get to use) those goods and services? ECONOMIC экономические ресурсы; экономическая деятельность; экономическая проблема; экономический цикл; экономическая инициатива; экономическая система; экономические переменные; экономические данные; экономическая эффективность; экономическая теория; экономическая стабильность; экономический выбор; экономический рост; экономическое регулирование; экономика услуг; экономическая политика; политическая экономия; народное хозяйство; экономика управления; денежное хозяйство PRODUCTION процесс производства; средства производства; производство и потребление; повысить производительность; расширить производство; издержки производства; производство на душу населения; общий объем произведенной продукции; товарное производство REGULATION государственное регулирование; правила безопасности; частное регулирование; таможенные инструкции; финансовый регламент; регулирование рынка GOVERNMENT государственная политика; государственное вмешательство; государственные доходы; государственные пенсионные программы; государственный долг; государственные закупки Types of Economic Systems Every society has worked out a way to answer the question of What, How and Who. These economic systems, as they are called, generally fall into one of three categories: traditional, command and market economies. The Traditional Economy As the name implies, the answers to the What, How and Who questions are decided by tradition in these economies. Traditional economic systems are usually found in the more remote areas of the world. Such systems may characterize isolated tribes or groups, or even entire countries. They are less common today than they were in earlier decades. Typically, in a traditional economy, most of the people live in rural areas and engage in agriculture or other basic activities such as fishing or hunting. The goods and services produced in such a system tend to be those that have been produced for many years or even generations. They are produced as they always have been. In short, the questions of what the traditional society produces and how it is produced are determined by very slowly changing traditions. Who gets to keep what is produced in such an economy? Since there is little produced, there is little to go around. Most individuals live near a subsistence level: they have enough to sustain them but little more than that. In some years, when the harvest is poor, some will not be able to subsist and will either leave the society or die. In better years, when the yield is high, there may be more than enough to allow subsistence. When such a surplus exists, it will be distributed traditionally. For example, the bulk of the produce might go to a tribal chief or large landholder, while the balance is distributed according to custom. The Command Economy Countries such as the Soviet Union, Albania, and China are examples of command economies. Groups of high-level technicians, made up of engineers, economists, computer experts and industry specialists known as "planners," advise political leaders who develop and implement a plan for the entire economy. Essentially, it is the planners who decide what goods and services will be produced. If they want ship production expanded and mining operations cut back, they issue the orders to do so. If more food is needed, the planners might direct tractor production to be increased or fertilizers to be imported from the West. Those same plans might also encourage labor to remain on the farms and direct that transportation and storage facilities be made available to move and hold farm products. How are goods produced in a command economy? The planners decide which products will be made. They decide where to locate a new truck assembly plant and whether the factory will use more labor or more modern machinery. It is the planners, too, with guidance from the country's political leadership, who decide who will receive the goods and services produced. By setting wage rates for everyone, as well as interest rates, profits and rents, the planners directly answer the question: Who will receive the goods and services produced? The Market Economy When the fastest-rising young rock group, the And-So-Forths, appeared recently in a televised concert, they wore old-fashioned saddle shoes. That week shoe stores around the country reported receiving calls for saddle shoes "like the And-So-Forths wear." Although some of the storekeepers thought the first customers to ask for the strange shoe style were joking, they soon got the message. Before long, saddle shoes could be seen in most of the nation's shoe stores. The events described in the paragraph above probably would not have taken place in a traditional or a command economy. Changes in clothing styles in a traditional society could occur only over a period of many years. Those who make the decisions in a command economy might give in to public pressure and produce saddle shoes, but it is their decision to make. In a market economy, or free enterprise system as it is sometimes called, it is likely that if consumers really want saddle shoes, they will get them. A market, or free enterprise, economy is one in which the decisions of many individual buyers and sellers interact to determine the answers to the questions of What, How and Who. In addition to buyers and sellers, there are several other essential elements in a market economy. One of these is private property. By "private property" we mean the right of individuals and business firms to own the means of production. Although markets exist in traditional and command economies, the major means of production (firms, factories, farms, mines, etc.) are usually publicly owned. That is, they are owned by groups of people or by the government. In a market economy the means of production are owned by private individuals. Private ownership gives people the incentive to use their property to produce things that will sell and earn them a profit. This desire to earn profits is a second ingredient in a market economy. Often referred to as the profit motive, it provides the fuel that drives sellers to produce the things that buyers want, and at a price they are willing to pay. The profit motive also gives sellers the incentive to produce at the lowest possible cost. Why? Because lower costs enable them to (1) increase their profit margins, the difference between cost and selling price, or (2) reduce prices to undersell the competition, or (3) both. Economists often compare markets to polling booths. However, unlike the booths in which people vote for politicians, markets provide a kind of economic polling booth for buyers to cast their votes (in the form of purchases) for the goods and services they want. Producers who interpret the votes correctly by producing the things that buyers demand can earn profits. Those who interpret the voting incorrectly, producing too much or too little, or charging a price that is too high or too low, do not earn profits. In fact, they often lose money. As hundreds of thousands of followers of the And-So-Forths descended upon their local shoe stores in search of saddle shoes, the store managers did their best to find the hot new item. They did this because they knew that the sales of these shoes would add to their profits. Manufacturers soon learned about the calls for the new shoe style from their wholesale customers and did their best to satisfy the requests because they too were interested in profits. Mixed Economies What most distinguishes command economies from market economies is the role of government and the ownership of the means of production. We have seen that in command economies factories, farms, stores, and other productive resources are government owned. We have also noted that the economic questions of What, How, and Who are answered by government planners. In contrast, market economies look to the decisions of individual buyers and sellers to answer the same questions, and the means of production are privately owned. Government plays a relatively minor part in this model. There are, however, no "pure" market economies in the world today. While we can say that markets account for most economic decisions in this country, government has been playing an ever-widening and important role. For example, 50 years ago, government purchased 15 percent of all American goods and services. It now purchases 20 percent. This blend of market forces and government participation has led economists to describe our economic system and those of most other democratic countries as mixed economies. Recent changes in the economies of the Soviet Union, China, and certain other communist countries, have served to bring elements of the market into those command economies. As the number of privately owned businesses has increased, economists have begun to refer to those nations as having “mixed economies.” Exercise 1. Translate from English into Russian and back:

Exercise 2. Discuss. 1. Most economists would prefer to categorize the U.S. economy as a mixed economy. Why don’t they call it a market economy? 2. Suppose in your previous life you were an economic advisor to Nikita Khrushchev of the Soviet Union. How did you, as a central planner, decide what, how and for whom to produce goods and services in a country of roughly 123 million people at the time? 3. What is the meaning of “free” in free market? 4. Proponents of free market systems argue that free enterprise leads to more efficient production and better response to changing consumer preferences. But others point to the fact that markets are not perfect. Why aren’t markets perfect? Exercise 3. Write a short essay on one of the following topics: 1. The strength of the marketplace and motivations for government involvement. 2. Russia – from plan to market. Exercise 4. Understanding a lecture: Yates, Unit 3. 1. You are now going to hear part of a lecture, divided into short sections to help you understand it. As you listen, answer the questions below. Section 1 Complete the following statement with the words the lecturer uses: · Markets are _________________through which prices influence how we ____________________. · Note down how many kinds of economy the lecturer is going to talk about. Section 2 · Note down the first kind of economy. ________________________________________________________________________________ · Is this statement correct or incorrect? In this kind of economy the government decides what should be produced and what should be consumed. Section 3 · Is this statement correct or incorrect? To plan this kind of economy is very simple. · Note down the country that is an example of this kind of economy. ________________________________________________________________________________ · Is this statement correct or incorrect? In this kind of economy the government does not own factories or land. Section 4 · Note down the kind of economy the lecturer is talking about. ________________________________________________________________________________ · Is this statement correct or incorrect? “You cannot become a millionaire in this kind of economy.” · Note down the country that is an example of this kind of economy. ________________________________________________________________________________ Section 5 · Note down the kind of economy the lecturer is talking about. ________________________________________________________________________________ · Which two sections of society interact in this kind of economy? ________________________________________________________________________________ · Is this statement correct or incorrect? “Most countries have economies of this kind.”

2. Make sure you know the English equivalents to the collocations below: - командная экономика - планирующий орган - центральное планирование и руководство - свободный рынок - вмешиваться - преследовать собственные интересы - превышать благосостояние - создавать новые рабочие места - государственное вмешательство - смешанная экономика - государственные ограничения 3. You should also write a summary of the lecture, based on your notes. Exercise 5. Listening (from Guide to Economics, unit 3 C, F and unit 4 C, F) – Describe their way of life. Track 09 – Market economy Adam Smith’s invisible hand theory: 1. People are naturally selfish / helpful. 2. The free market only demands what is good for society/ producers. 3. When people work for their own good, they do good for consumers/ society also. In the real economy 4. In the free market there is demand for goods which are not expensive/ necessary. 5. There is also demand for goods which ………………… 6. The market/Advertising can create demands that do not normally exist. Here is a list of arguments against state-run hospitals and arguments against private hospitals. After your first listening, try to fill in the table yourself. After the second listening, check your answers with the help of the statements given, which have to be properly classified.

1. Long waiting lists for patients 2. Only the rich can afford health care 3. Staff are poorly paid 4. Taxpayers support everyone 5. Badly organized 6. Creates a class of poor, unhealthy people 7. Hospitals in bad condition 8. Hospitals will reduce costs to make money 9. Is bad for society in general An invisible hand Adjustment in prices Command A central planning office Markets Mixed Government Free market Private sector Self-interest

Industrial Western countries rely extensively on ___/1/ to allocate resources. It is the process by which production and consumption decisions are coordinated through ___/2/. In a ___/3/ economy, government makes all decisions about production and consumption. Typically, ___/4/ draws up a plan, which is then put into effect by regional and local government agencies. A ___/5/ economy has no government intervention. Resources are allocated entirely through markets in which individuals pursue their ___/6/. Adam Smith argued that ___/7/ would nevertheless allocate resources efficiently. Between these two extremes lies ___/8/ economy. Both ___/9/ and ___/10/ play important roles in answering the “what”, “how”, and “for whom” questions for society as a whole. The Market We already defined markets in a very general way as arrangements through which prices guide resource allocation. We now adopt a narrower definition. A market is a set of arrangements by which buyers and sellers are in contact to exchange goods or services. Some markets (shops and fruit stalls) physically bring together the buyer and the seller. Other markets (the London Stock Exchange) operate chiefly through intermediaries (stockbrokers) who transact business on behalf of clients. In supermarkets, sellers choose the price, stock the shelves, and leave customers to choose whether or not to make a purchase. Antique auctions force buyers to bid against each other with the seller taking a passive role. Although superficially different, these markets perform the same economic function. They determine prices that ensure that the quantity people wish to buy equals the quantity people wish to sell. Price and quantity cannot be considered separately. In establishing that the price of a Rolls Royce is ten times the price of a small Ford, the market for motor cars simultaneously ensures that production and sales of small Fords will greatly exceed the production and sales of Rolls Royse. These prices guide society in choosing what, how, and for whom to purchase. To understand this process more fully, we require a model of a typical market. The essential features on which such a model must concentrate are demand, the behaviour of buyers, and supply, the behaviour of sellers. It will then be possible to study the interaction of these forces to see how a market works in practice. Demand is the quantity of a good buyers wish to purchase at each conceivable price. Thus demand is not a particular quantity, such as six bars of chocolate, but rather a full description of the quantity of chocolate the buyer would purchase at each and every price which might be charged. The first column of Table 1 shows a range of prices for bars of chocolate. The second column shows the quantities that might be demanded at these prices. Even when chocolate is free, only a finite amount will be wanted. People get sick from eating too much chocolate. As the price of chocolate rises, the quantity demanded falls, other things equal. We have assumed that nobody will buy any chocolate when the price is more than £0.40 per bar. Taken together, columns (1) and (2) describe the demand for chocolate as a function of its price. Demand спрос на капитал; требование наличных денег; потребность в деньгах; спрос опережает производство; пользоваться спросом; удовлетворять спрос; оживлённый спрос; спрос на средство потребления; текущий спрос; устойчивый спрос; нехватка жилья; спрос на рабочие места; низкий уровень спроса; общественный спрос. Supply спрос и предложение; товарный запас; обеспеченность рабочей силой; снабжение рынка; совокупное предложение; критический уровень запасов; прямые поставки; эластичное предложение; совместная поставка двух и более товаров; общий объём предложения; резервный запас; недостаточный запас; предложение удовлетворяет спрос; иметься в избытке; истощить запасы. Price устанавливать цену; не допускать роста цен; средняя цена; цена производства; договориться о цене; цена подлежит скидке; высокая/низкая цена; сбивать цену; рыночная цена; оптовая цена; розничная цена; мировая цена; трансфертные цены; неконтролируемые цены; цена поставки; стабильные цены; продажная цена; соотношение цен; поштучная оплата; закупочная цена; умеренная цена; цена в условиях свободного рынка; равновесная цена. Market на рынке; спекулировать (играть на бирже); удовлетворять требованиям рынка; рынок капитала; оживлённый рынок; Европейское Экономическое сообщество; господствовать на рынке; внутренний рынок; рынок акций; рынок по сделкам на срок; появиться на рынке; насыщенный рынок; закрытый рынок; внешний рынок; инвестиционный рынок; рынок труда; фондовая биржа. Equilibrium экономическое равновесие; равновесие спроса и предложения; неустойчивое равновесие; равновесие на рынке рабочей силы; рыночное равновесие; устойчивое равновесие; равновесие платёжного баланса. Prices in a Market Economy Prices perform two important economic functions: They ration scarce resources and they motivate production. As a general rule, the more scarce something is, the higher its price will be, and the fewer people will want to buy it. Economists describe this as the rationing effect of prices. In other words, since there is not enough of everything to go around, in a market system goods and services are allocated, or distributed, based on their price. Did you ever attend an auction or see one conducted on TV? What you saw was the rationing effect of prices in action. The person leading the sale (the auctioneer) offered individual items for sale to the highest bidder. If there was only one item, it went to the single highest bidder. If there were two items, they went to the two highest bidders, and so on. Prices increases and decreases also send messages to suppliers and potential suppliers of goods and services. As prices rise, the increase serves to attract additional producers. Similarly, price decreases drive producers out of the market. In this way prices encourage producers to increase or decrease their level of output. Economists refer to this as the production-motivating function of prices. But what causes prices to rise and fall in a market economy? Demand The Law of Demand. Demand is a consumer’s willingness and ability to buy a product or service at a particular time and place. If you would love to own a new pair of athletic shoes but can’t afford them, economists would describe your feeling as desire, not demand. If however you had the money and were ready to spend it on shoes, you would be included in their demand calculations. The law of demand describes the relationship between prices and the quantity of goods and services that would be purchased at each price. It says that all else being equal, more items will be sold at a lower price than at a higher price. Suppose that last April two of your friends developed their own special recipe for homemade ice cream, and they decided to sell ice cream cones to students every day after school. They conducted a survey to see if students were interested in the idea. Each student was asked the following question: “Would you spend $.50 to have an ice cream cone for an after-school snack?” This question was repeated using higher and higher prices up to $2 per cone. The Demand Schedule. The results of the survey were assembled in a demand schedule, a table showing the quantities of a product that would be purchased at various prices at a given time.

Why Demand Behaves the Way It Does. The survey results illustrate the law of demand in action. As you can see, the number of ice cream cones that students were ready, willing and able to buy was greater at the lowest prices than at the higher prices. Demand behaves the way it does for some of the following reasons. Ø More people can afford to buy an item at a lower price than at a higher price. Ø At a lower price some people will substitute ice cream cones for other items (such as candy bars or soft drinks), thereby increasing the demand. Ø At a higher price some people will substitute other items for ice creams. Ø How many ice cream cones can you eat? Some people will eat more than one if the price is low enough. Sooner or later, however, we reach the point where enjoyment decreases with every bite no matter how low the cost. What is true of ice cream applies to most everything. After a certain point is reached, the satisfaction derived from a good or service will begin to diminish. Economists describe this effect as diminishing marginal utility. “Utility” refers to the usefulness of something. Thus “diminishing marginal utility” is the economist’s way of describing the point reached when the last item consumed will be less satisfying than the one before. Diminishing marginal utility helps to explain why lower prices are needed to increase the quantity demanded. Since your desire for a second cone is bound to be less than it was for the first, you are not likely to buy more than one, except at a lower price. At even lower prices you might be willing to buy additional cones and give them away. The demand curve illustrates the demand for ice cream cones that day in April. It also enables us to estimate what the demand would be for those prices falling in between the prices we surveyed. Although the students were not questioned about how many cones they would buy if the selling price were $1.60, the curve lets us estimate the number would be about 55. Demand for Ice Cream Cones Near Your School Price per cone

0 25 50 75 100 125 150 175 200 Number of cones Elasticity of Demand The shape and slope of demand curves for different products are often quite different. If, for example, the price of a quarter of milk were to triple, from $.80 to $2.40 a quart, people would buy less milk. Similarly, if the price of all cola drinks were to jump from $1 to $3 a quart (an identical percent increase), people would buy less cola. But even though both prices changed by the same percentage, the decrease in milk sales would probably be far less than the decrease in cola sales. This is because people can do without cola more easily than they can do without milk. The quantity of milk purchased is less sensitive to changes in price than is the quantity of cola. Economists would explain this by saying that the demand for cola is more elastic than the demand for milk. Elasticity describes how much a change in price affects the quantity demanded. How Elasticity is Measured. When the demand for an item is inelastic, a change in price will have a relatively small effect on the quantity demanded. When the demand for an item is elastic, a small change in price will have a relatively large effect on the quantity demanded. Elasticity can also be measured by the "revenue test." Total revenue is equal to the price times the number of units sold. If, following a price increase, total revenue falls, the demand would be described as elastic. If total revenue were to increase following a price increase, the demand would be inelastic. Similarly, if total revenue increased following a price decrease, demand would be elastic. If the price decrease led to a decrease in total revenue, the demand for the item would be described as inelastic. Super Sally's Supermarket sells 500 quarts of milk and 100 quarts of cola daily. At $.80 a quart she grosses $400 on her milk sales, and at $1 a quart she grosses $100 on her cola. Last week she increased the prices of the milk and cola by 50 percent— milk sold for $1.20 a quart, and cola for $1.50. Following the price increases, milk sales slipped to 350 quarts daily, while soda sales dropped to 35 quarts. Total revenue from the sale of milk increased (to $420) following the price increase because the demand for milk is inelastic. Total revenue from the sale of cola fell (to $52.50), and for that reason we can say that the demand for cola is elastic.

Why the Demand for Some Goods and Services Is Inelastic. The demand for some goods and services will be inelastic for one or more of the following reasons: Ø They are necessities. Ø It is difficult to find substitutes. Cola drinkers can switch to other soft drinks, but there are few substitutes for milk. Ø They are relatively inexpensive. People are less apt to change their buying habits when the price of something that is relatively inexpensive is increased or decreased. If, for example, the price of an item were to double from 10 cents to 20 cents, it would have less of an effect on demand than if the price had gone from $250 to $500. Ø It is difficult to delay a purchase. When your car is running out of gas, it is not always possible to shop for the best deal. Changes in Demand. Until now, we have been describing the relationship between an item's price and the quantity of an item people will purchase. Sometimes things happen that change the demand for an item at each and every price. When this occurs, we have an increase or a decrease in demand. What are some of the factors that would cause the demand for ice cream, or any other product, to increase or decrease at each and every price? Substitutes. When two goods satisfy similar needs, they are described as substitutes. A change in the price of one item will result in a shift in the demand for a substitute. Black and brown shoes are close substitutes. If the price of black shoes goes up, then people will tend to substitute brown shoes for black shoes, and the demand curve for brown shoes will shift out at every price. If the price of black shoes goes down, then people will tend to substitute black shoes for brown shoes, and the demand curve for brown shoes will shift in at every price. Complementary goods. Goods that are often consumed together, like peanut butter and jelly, are complements. If the price of peanut butter should increase, the quantity of peanut butter consumed will decrease. Since peanut butter and jelly are consumed together, the quantity of jelly demanded at each and every price will also decline, and the demand curve for jelly will shift in.

What are some other factors that might cause the demand for ice cream your friends are selling to increase or decrease at each and every price? How would these changes be reflected in the demand curve? The following is a brief list of factors that might affect the curve: Ø Change in the environment. It is a much hotter month than usual. Ø Change in the item’s usefulness. The Surgeon General of the United States issues a report that states ice cream is good for you and enhances your attractiveness. Ø Change in income. Allowances are raised as an economic boom sweeps your community. Ø Change in the price of a substitute product. The price of candy decreases. Ø Change in the price or availability of complementary products. Ø Change in styles, taste, habits, etc.

Price per Cone

If any of these events occurred, the demand schedule would change in such a way that the quantity demanded at any particular price would be higher or lower than our original demand schedule indicates. If the demand were to increase, the curve would shift outward (Figure). If demand were to decrease, the curve would shift inward.

0 50 100 150 200 250 300 Number of cones

Supply Thus far we have only spoken about the effects of prices on buyers. But it takes two parties to make a sale: buyers and sellers. To the economist supply refers to the number of items that sellers will offer for sale at different prices at a particular time and place. A supply schedule is a table summarizing this information. The table below is the supply schedule that was in effect that day in April when your friends conducted their survey. It tells us how many ice cream cones they were willing to sell the students at the prices indicated. The Law of Supply. As the supply schedule indicates, more ice cream cones would be offered for sale at higher prices than at lower ones. This is in keeping with the law of supply which states that sellers will offer more of a product at a higher price and less at a lower price. Why does the quantity of a product supplied change if its price rises or falls? The answer is that producers supply things to make a profit. The higher the price, the greater the incentive to produce and sell the product. If ice cream prices around your school are high, your friends may buy a larger ice cream maker so they can produce and sell more ice cream. Additionally, if word gets out that ice cream sells for a relatively high price near your school, other vendors will be tempted to leave their present locations and come to your high school in the belief that they can make more profit.

Our supply schedule is based on holding variables other than price at some fixed or constant level. On this basis we can use the supply schedule to draw the supply curve (Figure below). Number of cones

0 50 100 150 200 250 300 Number of cones

As in the case of demand, supply curves need not be straight lines. Unlike demand, the typical supply curve slopes upward from left to right. Changes in Supply. When supply changes, the entire supply curve shifts either to the right or to the left. This is simply another way of saying that sellers will be offering either more (if supply has increased) or less (if supply has decreased) of an item at every possible price. Any or all of the following changes are likely to affect the quantities supplied. Ø Changes in the cost of production. If it costs sellers less to produce their products, they will be able to offer more of them for sale. An increase in production costs will have the opposite effect — supply will decrease. Ø Other profit opportunities. Most producers can make more than one product. If the price of a product they have not been producing (but could if they chose to) increases, many will shift their output to that product. For example, as personal computers increased in popularity, a need developed for computer stands. As a result, many furniture manufacturers began to produce desks and carts specifically designed for the computer market. Ø Future expectations. If producers expect prices to increase in the future, they may increase their production now to be in position to profit later. Similarly, if prices are expected to decline in the future, producers may reduce production, and supply will fall. Changes in supply are illustrated graphically in Figure 6.

The price at which supply exactly equals demand is known as the market price, or the point of equilibrium. In the table above, the market price would be $1.00 because at that price the quantity of ice cream cones demanded and the quantity supplied are exactly equal. Figure 8 represents this information graphically. School Number of cones Equilibrium Supply and demand schedules tell us how many items buyers would purchase and how many items sellers would offer at different prices. By themselves they do not tell us at what price goods or services would actually change hands. When the two forces are brought together, however, something quite significant takes place. The interaction of supply and demand will result in the establishment of an equilibrium or market price. The market price is the one at which goods or services will actually be exchanged for money. Exercise 1.Translate and identify what terms are meant. 1. Графическое изображение взаимосвязи между рыночной ценой товара или услуги и тем количеством, которое по этой цене будут спрашивать покупатели. 2. Положение на рынке, при котором количество товаров или услуг, которые хотят приобрести потребители, абсолютно идентично количеству товаров и услуг, которые желают преложить производители, и, таким образом, силы, влияющие на спрос и предложение на рынке, сбалансированы. 3. Степень изменения в количестве предлагаемых товаров и услуг в ответ на изменения в их цене, измеряемая как отношение процентного изменения в количестве к процентному изменению в цене. 4. Желание и способность продавцов поставлять на рынок товары для продажи. 5. Группа товаров и услуг, для которых рост цены на один из них приведет к увеличению спроса на все другие. Такими товарами являются, например, чай и кофе. 6. Закон, отражающий взаимосвязь между количеством потребляемого блага и степенью удовлетворенности от потребления каждой дополнительной единицы. Exercise 8.6 (Study Guide).Complete the text using the words in the box.

In everyday language we refer to an increase in demand..... between shifts in the demand curve and movements along a given demand curve. The demand curve..... when any of the factors..... quantity demanded (other than the price of the good) change. Such shifts show the..... of consumers to changes in the prices of other goods, income, tastes, and...... ....., a movement along a demand curve shows the response of quantity demanded to a change in the..... of the good itself. Why does the difference.....? A shift of the demand causes..... price and quantity to change, but..... along the demand curve are just part of the process by which the market comes into equilibrium. This distinction between the two kinds of demand change is very...... Movement along the demand curve represents consumer..... to changes in the market price. Shifts in the demand represent adjustment to outside factors (other prices, income, tastes) and lead..... to changes in equilibrium price and......

Read the text attentively. Point out the essential problems touched upon. Divide the text into logical units. Suggest a plan of the text in the form of statements in English. Render the text in English. The following word-combinations can be of use: the average income of potential buyers; the quantity of haircuts demanded; to be determined by social conventions; to depend on fashion; exercise centers; natural foods; expected future prices; gasoline prices. Число потребителей При постоянном среднем доходе потенциальных покупателей, чем больше число потребителей на рынке, тем больше объём спроса на любой товар при всякой цене. Таким образом, увеличение числа потребителей переместит кривую спроса вправо. Сокращение числа потребителей сдвинет кривую спроса влево.

Вкусы потребителей Вкусы или предпочтения потребителей являются важнейшим фактором, определяющим объём спроса на любой товар. Предпочтения потребителей формируются частично под влиянием общества, обычаев и рекламы. Например, объём спроса на стрижки определяется, в частности, существующими в обществе обычаями относительно того, какой длины должны быть волосы. Объём спроса на ткани для производства юбок зависит частично от моды. Растущая озабоченность собственным здоровьем и работоспособностью повысила спрос на принадлежности для бега, на услуги центров физической культуры, на натуральную пищу, сократив в то же время объёмы спроса на кондитерские изделия и другие высококалорийные продукты. Обычаи и привычки меняются, как правило, довольно медленно. Мода может меняться быстро. Но какой бы ни была причина, по которой вкусы потребителей или их предпочтения по отношению к какому-либо товару меняются, кривая спроса на этот товар сдвигается соответствующим образом.

Ожидаемые в будущем цены Объём спроса на товар в пределах какого-либо данного периода зависит не только от цен, складывающихся в этом периоде, но также от цен, которые ожидаются в будущем. Например, объём спроса на автомобили в данном месяце может быть выше при любой данной цене, если ожидается рост цен на автомобили в следующем месяце. Точно так же величина спроса на автомобили в этом месяце зависит от цен, которые потребители предполагают платить за бензин в будущем. Если ожидается, что цена на бензин в будущем будут значительно выше, то объём спроса на автомобили в данном месяце будет ниже при любой заданной цене, чем если бы не ожидалось роста цен на бензин. Ожидаемые в будущем доходы также окажут влияние на объёмы спроса в текущем периоде. Если люди верят, что их доходы вырастут в ближайшем будущем, то качество товаров, которое они желали бы приобрести по любой данной цене в данном периоде, увеличится. Types of Markets Economists often speak of the “structure” of a market. By that they mean the number and the relative power of the buyers and sellers. In certain industries, such as automobile manufacturing, three or four American firms and a few major foreign manufacturers meet the needs of millions of buyers. By contrast, the military aircraft industry consists of only a few manufacturers and a handful of buyers (such as the United States and a few foreign governments). In the stock and bond markets there are both many buyers and sellers. In what follows we will be describing the principal kinds of market structures: perfect competition, monopolistic competition, oligopoly and monopoly. Oligopoly: A Few Sellers Oligopoly is a term applied to markets dominated by a few (roughly three to five) large firms. Breakfast cereals, automobile and computer hardware are examples of industries dominated by oligopolies. As the market structure of an industry changes from many firms selling differentiated products to a few firms dominating an industry, economists say that the “concentration ratio” is changing. The concentration ratio is determined by the percentage of an industry’s output accounted for by its four largest firms. Oligopolies exist because it is difficult for competing firms to enter the market. Circumstances that make it difficult to enter the market are described as "barriers to entry." One such barrier is the high cost of entry. The capital needed to enter the automobile manufacturing business, for example, would run to billions of dollars. Another barrier to trade is created by patent protections. The products of certain industries, such as aluminum, chemicals and electronics, are protected by patents. Competing firms cannot enter those industries unless they pay the patent holders for permission to use the process or find a new method of production not covered by existing patents. Price competition is less effective where there is oligopoly. Firms know that if they reduce their prices the competition will do the same. Therefore, instead of increased sales (as would be the case in a competitive market), price reductions would simply reduce revenue. In place of competition, oligopolies often look to price leadership, collusion, and custom to determine their pricing policies. Ø Price leadership is the practice of one firm in the industry, usually the largest, setting a price which other firms follow. Ø Collusion is a secret arrangement between two or more firms to fix prices or share the market. These agreements are usually illegal. Ø A Custom is the practice of establishing prices and market shares based on longstanding tradition. Sometimes the courts have found such practices to be unlawful; in other instances they were found to be legal. Monopoly: One Seller A market in which there is only one seller is a monopoly. You will recall that under conditions of perfect competition market price could be found at the intersection of the supply and demand curves. In those circumstances both supply and demand reflect the thinking of many buyers and sellers; no individual or group could affect the market price. In a monopoly, however, supply is determined by a single firm. This gives that firm the power to select any price it chooses along the demand curve. Which price will it choose? The one that yields the greatest profit. Monopolies have the following characteristics: · A single seller or monopolist. · No close substitutes. The product sold by a monopoly is different from those offered by other firms. Buyers must either pay the monopolist's price or do without. · Barriers to entry. Competing firms are unable to enter a market where a monopoly exists. Legal Monopolies Although monopolies are generally illegal in this country, the law does provide for a variety of legal monopolies such as: public utilities, patents, copyright and trademarks. Public Utilities are privately owned firms that provide an essential public service. They are granted a monopoly because it is felt that competition would be harmful to the public interest. Your local electric, gas and water companies are public utilities. Utilities are subject to extensive government regulation and supervision. Imagine the complications that one electric company served your community. Each would have its own power lines, maintenance organization and generating plant. Competition, however, provides businesses with the incentive to keep prices down and improve services. In place of competition, government protects the public by regulating the activities of the utilities. Government supervision is carried out by regulatory commissions which determine the services the utilities provide and how much they are permitted to charge for them. Patents as Monopolies. How would you like to come up with a new idea – something that could be turned into a new product or service that would make you rich and famous? To encourage you, the federal government grants patents to cover new products and processes. In a sense, a patent is a monopoly. It gives the inventor exclusive use of a product or idea for 17 years. You may sell your idea or give it away, but it is yours to do with as you wish. Eventually, someone will develop a product or service that will be acceptable alternative to yours. It, too, might qualify for a patent and perhaps compete with yours. Copyright and Trademarks as Monopolies. Though the Federal Copyright Office, the government gives the authors of original writing and artistic work a copyright – the exclusive right to sell or reproduce their works. That copyright is a special monopoly for the lifetime of the author plus fifty years. Trademarks are special designs, names or symbols that identify a product, service or company. “Coke” is a trademark of the Coca-Cola Company. Competitors are forbidden from using registered trademarks or ones that look so much like trademarks consumers will confuse them with the originals. How Competition Benefit Us All In a competitive market, producers constantly strive to reduce their production costs as a way to increase profits. The in

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Последнее изменение этой страницы: 2016-04-08; просмотров: 1607; Нарушение авторского права страницы; Мы поможем в написании вашей работы! infopedia.su Все материалы представленные на сайте исключительно с целью ознакомления читателями и не преследуют коммерческих целей или нарушение авторских прав. Обратная связь - 216.73.216.102 (0.009 с.) |

Price per Cone

Price per Cone