Заглавная страница Избранные статьи Случайная статья Познавательные статьи Новые добавления Обратная связь FAQ Написать работу КАТЕГОРИИ: ТОП 10 на сайте Приготовление дезинфицирующих растворов различной концентрацииТехника нижней прямой подачи мяча. Франко-прусская война (причины и последствия) Организация работы процедурного кабинета Смысловое и механическое запоминание, их место и роль в усвоении знаний Коммуникативные барьеры и пути их преодоления Обработка изделий медицинского назначения многократного применения Образцы текста публицистического стиля Четыре типа изменения баланса Задачи с ответами для Всероссийской олимпиады по праву

Мы поможем в написании ваших работ! ЗНАЕТЕ ЛИ ВЫ?

Влияние общества на человека

Приготовление дезинфицирующих растворов различной концентрации Практические работы по географии для 6 класса Организация работы процедурного кабинета Изменения в неживой природе осенью Уборка процедурного кабинета Сольфеджио. Все правила по сольфеджио Балочные системы. Определение реакций опор и моментов защемления |

The overheads per cost pool and the rate per cost driver are computed.Содержание книги

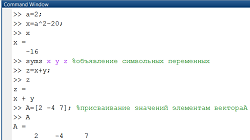

Поиск на нашем сайте Production processing costs: Production overhead £700,000 ----------------------------- = ------------ = £20 per mach.hr. Machine hours 35,000 Set-up costs: Cost per set-up Set-up cost £120,000 ---------------- = ------------ = £5,000 per set-up. No. of set-ups 24 Inspection cost: Cost per inspection Inspection cost ------------------- = £180,000 = £1,500 per No. of inspections The final stage of the process is to use the cost driver rates to assign overhead cost to products.

1 X =£20 x 1 machine hr. =£20; Y = £20 x 2 machine hours = £40 2 X = (£5,000 x 4 set-ups)/2,500 units = 80p; Y = (£5,000 x 20 set-ups)/5,000 units = £20 3 X = (£1,500 x 40 inspections)/ 25,000 units = £2.40; Y = (£1,500 x 80 inspections)/ 5,000 units = £24 The comparison of the two approaches is given:

Advantages of ABC It recognises the reality in advanced manufacturing environments that overheads are not related to direct labour since the proportion of direct labour costs is small in the total costs of a product. Instead activities cause overheads. Traditional costing systems tend to understate the overhead cost of a low volume complex product and overstate the overhead cost of a high volume product. ABC tends to allocate overheads to products which consume activities which in turn cause the overheads to arise. Since ABC produces more accurate product costs, decisions taken by management are better informed eg. pricing decisions. More accurate product profitability analysis can be produced. 6 It creates an awareness of the various activities that take place in an organisation and focuses on non-value added activities to ascertain whether they are needed or not. STANDARD COSTING Lesson 7 Standard Costing Standard costing is a management control system which is to be found in manufacturing industry in particular. Just like budgetary control, standard costing is also part of the control system. Both use variance analysis. Standard costing is a unitary concept ie. it uses standard material cost or standard labour cost. Budgeting, on the other hand uses these unit standard costs to compile total costs eg. material costs or labour costs. Variances represent the differences between standard costs and actual costs. The standard cost is what the cost is estimated to be and this is compared to what the cost is actually. Variances are classified as favourable if the actual costs are less than the standard costs and profit is increased as a consequence. Adverse variances decrease profits. Some variances may be controllable if the individual manager can influence the actual costs. Some organisations operate on the principle of management by exception. The accountant presents an exception report which highlights the significant variances. This means management need only investigate certain variances which lie outside set tolerance levels. A Standard cost is defined as ‘ a pre-determined cost calculated in relation to a prescribed set of working conditions, correlating technical specifications and scientific measurements of materials and labour to the prices and wage rates expected to apply during the period to which the standard cost is expected to relate, with an addition of an appropriate share of budgeted overhead’. It is a cost worked out in advance of production of the expected cost of a product or service. Advantages of Standard costing It provides management with a consistent method of comparing actual performance with planned performance. It provides a means of ensuring that prodution resources are purchased and used efficiently. In establishing standards management can examine and appraise existing practices and procedures to ensure cost-effectiveness and efficiency.

|

|||||||||||||||||||||||||||||||||||||||||

|

Последнее изменение этой страницы: 2017-02-07; просмотров: 331; Нарушение авторского права страницы; Мы поможем в написании вашей работы! infopedia.su Все материалы представленные на сайте исключительно с целью ознакомления читателями и не преследуют коммерческих целей или нарушение авторских прав. Обратная связь - 216.73.216.214 (0.008 с.) |