Заглавная страница Избранные статьи Случайная статья Познавательные статьи Новые добавления Обратная связь КАТЕГОРИИ: ТОП 10 на сайте Приготовление дезинфицирующих растворов различной концентрацииТехника нижней прямой подачи мяча. Франко-прусская война (причины и последствия) Организация работы процедурного кабинета Смысловое и механическое запоминание, их место и роль в усвоении знаний Коммуникативные барьеры и пути их преодоления Обработка изделий медицинского назначения многократного применения Образцы текста публицистического стиля Четыре типа изменения баланса Задачи с ответами для Всероссийской олимпиады по праву

Мы поможем в написании ваших работ! ЗНАЕТЕ ЛИ ВЫ?

Влияние общества на человека

Приготовление дезинфицирующих растворов различной концентрации Практические работы по географии для 6 класса Организация работы процедурного кабинета Изменения в неживой природе осенью Уборка процедурного кабинета Сольфеджио. Все правила по сольфеджио Балочные системы. Определение реакций опор и моментов защемления |

The economics of the welfare state

The term "welfare state" refers to a type of governing in which the national government plays a key role in the protection and promotion of the economic and social well-being of its citizens. A welfare state is based on the principles of equality of opportunity, equitable distribution of wealth, and public responsibility for those unable to avail themselves of the minimal provisions of a good life. Social Security, federally mandated unemployment insurance programs, and welfare payments to people unable to work are all examples of the welfare state. Most modern countries practice some elements of what is considered the welfare state. That said, the term is frequently used in a derogatory sense to describe a state of affairs where the government in question creates incentives that are beyond reason, resulting in an unemployed person on welfare payments earning more than a struggling worker. The welfare state is sometimes criticized as being a "nanny state" in which adults are coddled and treated like children. • The welfare state is a way of governing in which the state or an established group of social institutions provides basic economic security for its citizens. • By definition, in a welfare state, the government is responsible for the individual and social welfare of its citizens. • Most modern countries have programs that are reflective of a welfare state, such as unemployment insurance and welfare payments. • However, the term "welfare state" is a charged one, as critics of such a system say it involves too much government involvement in the lives and well-being of citizens. Understanding the Welfare State The welfare state has become a target of derision. Under this system, the welfare of its citizens is the responsibility of the state. Some countries take this to mean offering unemployment benefits and base level welfare payments, while others take it much further with universal healthcare, free college, and so on. Despite most nations falling on a spectrum of welfare state activity, with few holdouts among the most developed nations, there is a lot of charged rhetoric when the term comes up in conversation. A lot of this owes to the history of the welfare state.

The History of the Welfare State

Although fair treatment of citizens and a state-provided standard of living for the poor dates back further than the Roman Empire, the modern welfare states that best exemplify the historical rise and fall of this concept are the U.K. and the United States. From the 1940s to the 1970s, the welfare state in the U.K.—based on the Beveridge Report—took hold, leading to a growth in the government to replace the services that were once provided by charities, trade unions, and the church. In the U.S., the groundwork for the welfare state grew out of the Great Depression and the massive price paid by the poor and the working poor during this period. The U.K.'s system grew despite some spirited opposition by Margaret Thatcher in the 1980s, and it continues today although it frequently needs restructuring and adjustments to keep it from getting too unwieldily. The U.S. never went to the extent of the U.K., let alone somewhere like Germany or Denmark, and Ronald Reagan had much more success than Thatcher in shrinking government. Many people look at the differing economic growth rates of the U.S. and the U.K. throughout periods where the welfare state flourished and floundered to make conclusions on whether it is good or bad for a nation as a whole. Special Considerations

While it is true that the government is rarely the most cost-effective agent to deliver a program, it is also true that the government is the only organization that can potentially care for all its citizens without being driven to do so as part of another agenda. Running a welfare state is fraught with difficulties, but it is also difficult to run a nation where large swaths of the population struggle to get the food, education, and care needed to better their personal situation.

Chapter 20

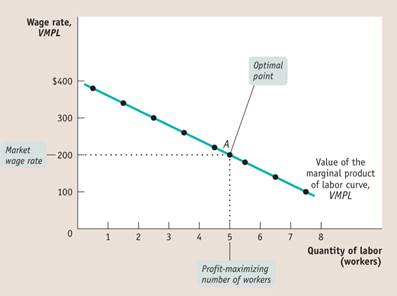

Physical capital – consist of manufactured productive resources such as equipment, buildings, tools, and machines. Human capital is the improvement in labour created by education and knowledge that is embodied in the workforce. The factor distribution of income is the division of total income among labor, land, and capital. In a perfectly competitive market economy, the price of the good multiplied by the marginal product labor is equal to the value of the marginal product of labor: VMPL = P × MPL. A profit-maximizing producer hires labor up to the point at which the value of the marginal product of labor is equal to the wage rate: VMPL = W. The value of the marginal product of labor curve slopes downward due to diminish- ing returns to labor in production. The value of the marginal product of a factor is the value of the additional output generated by employing one more unit of that factor. The value of the marginal product curve of a factor shows how the value of the marginal product of that factor depends on the quantity of the factor employed.

The market demand curve for labor is the horizontal sum of all the individual demand curves of producers in that market. There are three main aspects that causes factor demand curves to shift: 1) Changes in prices of goods 2) Changes in supply of other factors 3) Changes in technology As in the case of labor, producers will employ land or capital until the point at which its value of the marginal product is equal to its rental rate. According to the marginal productivity theory of income distribution, in a perfectly competitive economy each factor of production is paid its equilibrium value of the marginal product. The equilibrium value of the marginal product of a factor is the additional value produced by the last unit of that factor employed in the factor market as a whole. The rental rate of either land or capital is the cost, explicit or implicit, of using a unit of that asset for a given period of time.

Existing large disparities in wages both among individuals and across groups lead some to question the marginal productivity theory of income distribution. Compensating differentials, as well as differences in the values of the marginal products of workers that arise from differences in talent, job experience, and human capital, account for some wage disparities. Market power, in the form of unions or collective action by employers, as well as the efficiency-wage model, also explain how some wage disparities arise. Discrimination has historically been a major factor in wage disparities. Market competition tends to work against discrimination. The choice of how much labor to supply is a problem of time allocation: a choice between work and leisure. A rise in the wage rate causes both an income and a substitution effect on an individual's labor supply. The substitution effect of a higher wage rate induces longer work hours, other things equal. This is countered by the income effect: higher income leads to a higher demand for leisure, a normal good. If the income effect dominates, a rise in the wage rate can actually cause the individual labor supply curve to 66 slope the "wrong" way: downward.

The market labor supply curve is the horizontal sum of the individual labor supply curves of all workers in that market. It shifts for four main reasons: changes in prefer ences and social norms, changes in population, changes in opportuni ties, and changes in wealth.

|

|||||

|

Последнее изменение этой страницы: 2021-07-19; просмотров: 34; Нарушение авторского права страницы; Мы поможем в написании вашей работы! infopedia.su Все материалы представленные на сайте исключительно с целью ознакомления читателями и не преследуют коммерческих целей или нарушение авторских прав. Обратная связь - 18.222.239.77 (0.007 с.) |