Заглавная страница Избранные статьи Случайная статья Познавательные статьи Новые добавления Обратная связь КАТЕГОРИИ: ТОП 10 на сайте Приготовление дезинфицирующих растворов различной концентрацииТехника нижней прямой подачи мяча. Франко-прусская война (причины и последствия) Организация работы процедурного кабинета Смысловое и механическое запоминание, их место и роль в усвоении знаний Коммуникативные барьеры и пути их преодоления Обработка изделий медицинского назначения многократного применения Образцы текста публицистического стиля Четыре типа изменения баланса Задачи с ответами для Всероссийской олимпиады по праву

Мы поможем в написании ваших работ! ЗНАЕТЕ ЛИ ВЫ?

Влияние общества на человека

Приготовление дезинфицирующих растворов различной концентрации Практические работы по географии для 6 класса Организация работы процедурного кабинета Изменения в неживой природе осенью Уборка процедурного кабинета Сольфеджио. Все правила по сольфеджио Балочные системы. Определение реакций опор и моментов защемления |

Text D The meaning of a few basic termsСтр 1 из 5Следующая ⇒

Wh^Lexac_tlyjsa_ share? A share is a part of a company, offered for sale to the public. The company is able to raise cash for expansion and new ventures by selling shares to investors. Some companies - family businesses, for example - do not trade their shares. Firms than do are known as public limited companies (pic), and seek a listing on the Stock Exchange. The first time it «goes public» (aslo known as a flotation), a company will often announce its intentions with advertisements in the press. This is called an offer for sale. a shareholder? As a shareholder, you are an owner of the company and are entitled to take part in its decisions. You are sent an annual company report; you can vote on company issues; and you have the right to attend shareholders' meetings. If the company is doing well and profits rise, you benefit. Your shares should be worth more than when you bought them; and you may receive an income or dividend. How can_s hares make moneyJor_yQ_u?_ A share's value is not fixed. Its price is determined by many things: the company'; recent performance; the state of the sector of the economy the company trades in; national and international economic and political changes; the level of consumer demand; and the peculiarly unpredictable human factors of confidence and pessimism. So, if you buy a share at one price and sell it at a higher price, you make a profit; if you sell it at a lower price, you make a loss. Shares can provide an income (though not necessarily a regular one) through the payment of dividends. However, a company can choose not to pay a dividend at all, investing any profits back into the company. Ordinary shares As a private investor in the stockmarket, you will almost always be dealing with what are known as ordinary shares. You may come across some other types of shares. Preference shares These shares earn a fixed income. Their owners are entitled to receive any dividend before the holders of ordinary shares. If a company is wound up, preference shareholders are paid first, once all the creditors have been paid in full. Unlisted securities^ Companies which are not big enough for a Stock Exchange listing, or which do not wish to pay for listing, can trade their shares on a secondary market, the Unlisted Securities Market (USM). USM shares are highly volatile. _ or gilt-edged securities - are securities issued by the British government carry a fixed rate of interest, usually for a set term, and are traded on the arket. The money that they raise funds government spending. They can be _ longs, with a redemption date more than fifteen years away - mediums, with a redemption date of between five and fifteen years -shorts, with a redemption date of five years or less. Some gilts are undated, witti no fixed redemption date. Generally gilt prices fluctuate according to interest rate movements. f^fvvting your shares For steady long-term investment, you should consider bluechip shares. These are the shares of secure and respected British companies, many of which are household names: for example, ВТ, 1C!, Glaxo and Marks & Spencer. The term «blue chip» derives from the highest-value chip in a game of poker, You are unlikely to see spectacularly fast rises in their share prices, but it is likely that over a number of years they will earn steady profits for their shareholders. These shares will be listed on the FT-SE 100 Index (nicknamed the Footsie) which was started in 1 984 at 1,000 points and is based on the Stock Exchange's 100 largest listed companies. Footsie is often quoted to show the state of the stockmarket. Two prices are always quoted: the offer price (the higher price, and the one at which you buy shares), and the bid price (the lower price, and the one at which you sell shares). The price you will usually see quoted, in the newspapers for example, is the mid price, halfway between the bid and offer prices. To understand this idea of bid and offer prices, it may be helpful to think of what you see when you buy foreign currency; in the bank or bureau de change there are two sets of figures, headed «We buy» and «We se!b.

Discussion 1. Do you think Stock Exchanges are necessary in general and in this 2. Wouid you share the idea that this way of exchanging stocks and shares 3. What do you corne to know about the largest securities markets in the world? 4. How can you characterize the activity of an exchange member? Is it an 5. How can you explain the term «listed companies»? 6- In what way do people contribute to the economic growth of a country? 7- Is investing on the Stock Exchange a risky business? Comment on this.

Topical vocabulary banking institutions savings commercial banks merchant to issue notes personal cheques money shares to undertake management monetary policy to pay interest on the account receipt of deposits transfer of money encashment to save money to keep money safe to lend = to loan (to make a loan) lender to borrow borrower to deposit a depositor insolvent legal tender Unit 6 BANKING банковские учреждения сберегательные

коммерческие торговые - выпускать, выдавать - проводить, осуществлять - кредитно-денежная политика - платить процент по счёту - получение вкладов - оплата наличными - экономить; сберегать, копить - хранить - заимодавец - брать в кредит - положить на счет (срочный) неплатежеспособный законное платёжное средство Text A The British banking system has developed over the past few hundred pars to become one of the most highly specialised financial centres in the western vortd The head offices or main branches of banking institutions are concentrated in the City of London: the Bank of England and the most important commercial and merchant banks are situated in close proximity* to one another. The Bank of England is the central bank of the United Kingdom. It was founded in 1694 by Royal Charter*. It acts as the bank for the Government and works in close cooperation with the other banks: as the central note-issuing authority* and as agent of the Government for important financial operations. The Bank also undertakes management of the National Debt* and the administration of exchange* control. Thus it is through the Bank of England that the Government's monetary policy is implemented. Savings banks keep money safe until it is needed. The National Savings Bank receives money from its customers in two distinct forms: en current account and on deposit account. With a current account, a customer can issue personal cheques. No interest is paid by the bank on this type of account. With a deposit account however, the customer undertakes to leave his money in the bank for a specified* period of time. Interest is paid on this money. The commercial banks, owned by shareholders and working for profit, offer many services. Their primary business is receipt, transfer and encashment of different types of deposits. They receive money from savers on current and deposit accounts and in their turn lend the deposited money to customers who need capital. This activity earns interest for the bank and this interest is almost aJways at a higher rate than any interest which the bank pays to its depositors. In this way the bank makes its main profit. If a bank lends out too much and cannot repay its depositirs when they want their money back, it is insolvent. This is known as a bank «crashing». The major commercial banks in Great Britain are: National Westminster, Barclays, Lloyds and Midland - the «Big Four».

The merchant banks are in many ways different from commercial banks as they deal mainly with businesses. Their services include: issuing shares for companies; arranging international payments and finance; making large loans to UK and foreign businesses; taking large deposits from businesses and managing investments for businesses and other organizations. Some merchant banks are known as accepting houses* as they specialise in acceptance credit*. Others are called issuing houses* as they float* new issues of shares on the capital market, both at home and overseas*. foximity - близость R°yal Charter - Королевская грамота uthority - зд. учредитель ational Debt - государственный долг

exchange - зд.обмен to specify - указывать, специально упоминать specified - указанный, определённый accepting house-акцептный дом: торговый банк по международной торговле acceptance credit ~ акцептный кредит: метод платежа в международной торговле issuing house - эмиссионный дом: банк, организующий еыпуск ценных бумаг to float - зд. выпускать at home and overseas - в своей стране и за рубежом / Discussion I. Answer the following questions: 1. Is the British banking system young or old? 2. Where are the head offices of banking institutions concentrated? 3. What do you know about the central bank of the United Kingdom? 4. How is the Government's monetary policy implemented through the 5. What is the main function of British savings banks? 6. In what forms do the savings banks receive money from their customers? I 7. What is the difference between these two types of accounts? 8. What services are offered by commercial banks? What is their primary j 9. In what way do commercial banks make profit?

10. Why may the bank become insolvent? 11. What are the major commercial banks of Great Britain? 12. What are the main activities of merchant banks in Great Britain?

II. Speak about the main types of banks in Great Britain. III. Can you compare British banking institutions with those of Russia? Tatarstan? I IV. Read the text about the main functions of banks in the world economy. Say: I

1. What is the main concern of banks in every developed country? 2. How can banks help the government to stabilize economy and prevent 3. Why is it so important for the banking system to rest upon a basis of trust? Banks in Great Britain as in every developed country are closely concerned with the flow of money into and out of the economy. They often cooperate with the Government in its efforts to stabilize economies and io prevent inflation.

v are specialists in the business of providing capital, and in allocating funds credit. We can say that the primary function of a bank today is to act as an. termediary between depositors who wish to make interest on their savings and borrowers who wish to obtain capital.The bank is a reservoir of loanable money, with streams of money flowing in and out. For this reason, economists antj financiers often talk of money being «liquid», or of the «liquidity» of money. The system of banking rests upon a basis of trust. Innumerable acts of trust build up the system of which bankers, depositors and borrowers are part. They ail agree to behave in certain predictable ways in relation to each other, and in relation to the rapid fluctuations of credit and debit. Consequently, business can be done and cheques can be written without any legal tender visibly changing hands. Banks were organized as places to which people took their valuables for safe-keeping, but today the great banks of the world have many functions in addition to acting as guardians of valuable private possessions. A list of terminology concerning banking services Opening an account

to have an account with /in the bank interest on an account to pay an interest of 2% a specimen of signature genuine signature initial sum account in roubles (dollars) current account (UK) checking account (USA) deposit account (UK) savings account (UK, USA) salary account loan account Personal loan standing order Paying into an account j° Pay in /into an account

•° Put some money into an account to deposit /to put in smb's account

Withdrawing from an account to withdraw to take out to draw out to make withdrawals a balance of... an overdraft to change roubles for dollars to change into... rate of exchange exchange rate (for the dollar) Cheques /checks (USA) to cash a cheque a cheque in

pounds sterling a cheque for ($200) to draw a cheque on a certain account a cheque in favour of... to make out to issue ache^ue to endorse to sign ache4"e to accept the cheque traveller's cheques - обменный курс (доллара) - оплатить чек, получить деньги по чеку - чек в фунтах стерлингов - чек на (200 долларов) - выписать чек на определённый счёт - выписать чек - подписать (заверить) чек - принять чек для оплаты - дорожные чеки

Bank services The banking system does more than provide money for industry and trade. it als° provides a whole range of services for individuals. More than half of working oopulation makes direct use of a bank. Current account (paying by cheques). A customer fills in a form and deposits some money on what is called a current account. From now on* the bank will keep his money safe for him until he wants to spend it. In a few days the bank will supply a cheque-book if references* have been satisfactory. And this is for a customer a new way of spending his money using a cheque-book instead of carrying a lot of cash around. If he sees something he wants to buy he makes out a cheque backed up by the cheque-card. The shop will send the cheque to its account at its own bank. The shopkeeper's bank will pass the cheque on to the customer's bank and the money will be transferred from one account to the other. Automatic cheque-processors can sort millions of cheques in a day. The electronic eyes read the details on each cheque which are then recorded on the bank's computers against the relevant account. So the more people use cheques to pay for things the less need there is to move cash around from one place to another. Credit cards. Yet another convenient way of paying for things is by using credit or purchases cards. The most widely used credit cards in Britain are provided by companies owned by the banks. The customer does not need to carry cash or a cheque-book. Instead he uses his credit card which allows him to spend up to a limit which has been agreed*. At the end of a month the cardholder receives a statement showing what he has spent. He can then pay for all the purchases with one cheque either by posting it off for the credit-card company or by paying into the bank. It's easier than running around the town paying everything by cash, especially as many employers pay wages straight into your bank account. Regular payments. And the banks can help to make it easier to pay other bills as well. There are some payments that have to be made regularly, say, every month such as insurance premiums or the rent for your house, for instance. In this case there's no need to make out any cheques at all*. Instead, a customer signs what is called a standing order or a direct debit mandate*, and the bank sees that the regular bill is paid every month, providing of course, that a customer keeps enough money in his account.

Cash now can be obtained from ATM (cash dispensers)' by using special cash-cards together with a private code (PIN)*. It saves a lot of time. Similar equipment linked to the bank computers are available in shops as well. By using special terminals customers will be able to pay for their purchases by transferring ГГ10пеУ directly from their bank account to the shop's account. The computers ^n cope with almost unbelievable amount of transactions. New developments n automatic banking are transforming the whole industry.

Traveller's cheques. When you go abroad the bank has another trick up its sleeve*. It provides foreign currency or traveller's cheques which are accepted by foreign banks, hotels, shops in almost every country in the world. And if the worst does happen and the cheques are stolen or lost, provided the customer has kept a note of a series or numbers, then the advantage of the traveller's cheque is that the bank will replace it so that the holiday enjoyment will not be spoilt. Deposit account. But holidays abroad are expensive. It's a kind of thing that most of us have to save up for. That's why banks have systems that enable people to save regularly or whenever they feel like it*. The best known of these is called a deposit account into which the customer puts all the money which he or she is able to save. What makes this system so much better than «a piggy bank»* is that the real bank actually pays you for looking after your money. The money the bank pays to the customer is called interest. If a customer is in any doubt as to how he should save his money or if he wants any advice about any aspect of his financial affairs the bank manager is there to give him expert advice. Personal loan. Most of us need expert advice and banks have a whole range of special services. It's no small matter* buying a house or even a car or a new furniture. For one thing*, we don't always have enough money for things like that. Even a bank manager can't give you money, but if he is sure that you can afford to pay it back he may agree to lend you some as a personal loan. The most common way of borrowing money from a bank is to open a loan account. The customer takes the money he needs from the account and agrees to pay back so much every month. You can ask to borrow for most things and today the banks are happy to consider loans for house purchase. Overdraft. If it is a small sum of money that is needed, perhaps for a student who is awaiting for his grant to come through*, then a bank may agree to give an overdraft. This means that the customer can draw more money out of his ordinary current account than he actually has in it up to an agreed limit. Both he and the bank manager know that his grant will enable him to pay the money back quickly. from now on - с этого момента references - банковские референции agreed (upon) - согласованный, заранее оговоренный at all - совсем, вовсе direct debit mandate - приказ о прямом дебитовании another trick up its sleeve - ещё один сюрприз для вас whenever they feel like it - когда им заблагорассудится piggy-bank - копилка (обычно в виде свиньи) it's no small matter - не простое дело for one thing - с одной стороны to come through - поступить (на счёт) cash dispenser - раздатчик наличных (не связан с банком); это слово выходит из употребления, его заменяет ATM дТМ (automated telling machine) - автоматическая кассовая машина для операций между банком и клиентом (выдача наличности, справки о состоянии счёта и т.п.) PIN - persona! identification number

Opening a bank account Read the text about opening a bank account in Great Britain. Say: 1. What is a young Englishman asked when he begins to work? 2. Why do bankers ask him to give the name and address of a responsible person? 3. How long does it take a young Englishman a) to become a customer b) to receive a cheque guarantee card? When a young Englishman begins to work, he usually finds that he is to be paid by cheque or directly into a bank account. Thus he may be asked whether he has a bank account, (f he does not he usually chooses a bank near his work, so that he eal visit it in his lunch hour. Or he chooses a branch with «late night opening» near his home as he may find it convenient to go there to draw his money out. So a young worker as employee goes to the bank of his choice, looks for the "Enquiries" desk and tells the clerk that he wants to open a current account. He will be asked to give the name and address of a responsible person (who also has a bank account) who can give him a reference*. If one of his parents has a bank account and a young man goes to his or her bank, he will be accepted on that basis. The bank will write to a young man's referee to ask whether he is a suitable person to have a bank account. About a week or two rater the bank will get in touch with him. He pays in some money to open his account, gives a specimen signature*, and he is then a customer of the bank, with access to all banking services.

If a yaung£nglishman opens a current account, tie will be given a paying-'n book* and a cheque book. Both of these will ha» counterfoils* (or special font pages) which a new client of the bank can fill in each cheque issued or "Payment made to make a record for future reference. If as a new customer he •roves to be trustworthy* and maintain the current account sensibly*, the bank after a few months agree to issue him with a cheque guarantee card which le must sign with a specimen signature. ;rence - зд. рекомендация eree - лицо, дающее рекомендацию

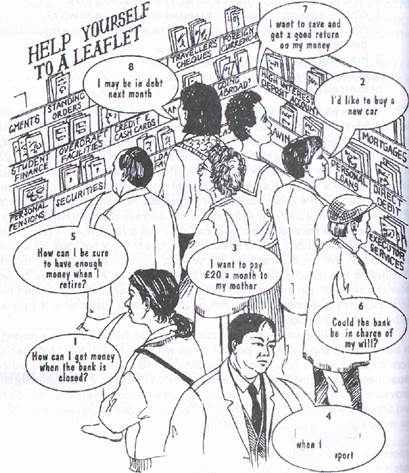

specimen signature - образец подписи paying-in book - расчётная книжка counterfoil - корешок чека trustworthy - заслуживающий доверия sensibly-разумно Comprehension Look at these customers of a bank and choose a leaflet that they each

need. Vocabulary exercises Ex.1. Supply prepositions where necessary. as/about,'by/during/for/from/in/into/of/ on / on behalf of/ out /to/ through / with a\ 1. Commercial banks of Russia have developed... the past few yy<*fs. 2 The Central Bank acts... the Government and works... close cooperation with the other banks of Russia. 3. It is... the Central Bank that the Government's monetary policy is implemented. 4. Savings banks receive money... Ir.eir customers in two forms:... current account and deposit account- 5.... a airrsnt account a customer can issue cheques. 6. No interest is paid... British bankc.. current accounts. 7. Commercial banks receive money... savers... current and deposit accounts. They work... profit and earn interest... the bank. b) The man decided to open an account... the bank and to put some -*зпеу.,. his account. He asked the bankers... the interest he might pet.. his icney. Then he decided to draw... some dollars. He intended to transfer his money... another bank because the bank's charges... all services are rather htg!.. I'd!ike to buy some foreign currency and-, change roubles... dollar Here is a cheque... roubles. It is a cheque... 1000000 roubles... my name. Ex.2. Complete the sentences with the words from the box Г bank borrowers current close discount draw out opsn! exchange interest lenders limit settlement status VAT! 1. The sum... pay to... for the use of their money is determined bv the... 2. 1 he value of the money of one country compared to that of another is 3. The rate of the tax added to the price of an article, paid by the buyer to 4. The rate of interest fixed by a central bank, such as the Bank of England, 5. The bank account that covers daily needs - salaries are paid into it. 6. To start an account with a bank or with a supplier is to... it; to finish arrangement is to...it. 7. To obtain cash from bank at which ono has an account is to cash, 8. An enquiry to a bank, asking whether a customer is credit-worthy, is у 9 Paying of a debt in cash is a cash.... Ю. The greatest sum which debtors are allowed to owe is their credit....

11. A percentage deduction made for an order over a stated value, or) 12. Credit terms is a statement of how much... is available and for what. It Ex.3. Look at these two pictures and find the six objects in them which start with the word «cash».

I. Read these short dialogues and act them out. - Next, please. - I'd like to cash this cheque, please. - Yes, madam 30 Oh! You haven't signed it yet, madam. - Haven't I? Oh, I'm terribly sorry. Here you are. - Thank you. How would you like the money? - Four fives and ten ones, please. * * * * - I'd like to change these francs, please. - Yes, sir. How many francs have you got? - 200. What's the rate of exchange, please? - The current rates are on the notice board, sir. * * * * - I'd like to buy this.... But I haven't got enough cash with me. Do you take - Certainly, sir. - Good. How much is that? - It's 30.

- What s the exchange rate? - I'm not sure sir. П! go and check. Do you have American or Canadian - Good morning. Can I help you? - Yes, my name is Davies. f'm expecting some money from my bank in - By post, cable or telex, sir? - By telex. -Let me see. Ah, yes. Davies. 200. from Royal Bank of Canada, Toronto, Have you got any identification, sir? - Well, I haven't got my passport, but I've got my driving licence. Will that - Yes, sir. That'll be all right. Bank Manager: Come in. You're Mr.Carson, aren't you? Please, have a

Mr. Carson: Thank you. Bank Manager: What can I do for you, Mr.Carson?' Mr. Carson: Well, I want to borrow some money. Bank Manager: What for? Mr. Carson: I'm going to buy a car. I've been saving for two years. Bank Manager: Ah, how much have you saved? Mr. Carson: I've saved about a thousand pounds. * * * * -1 was wondering if the head office of your bank is open on Sundays. ь - And what are the usual banking hours?., -: - From 9 in the morning till 1 in the afternoon Monday.through-Friday. •<;;< - And what about the day before a big holiday? - r, - On those days bank closes at noon., -..•>-, • ^.• ••.,,. -1 see. Many thanks. •••? - -v:-. ' ;,',>.•:;'r..> -Glad to be of service.., • v,.,. and discuss this humorous story. Speak about your own banking experiences if you have any. Does the bank frighten you? Is it good to be afraid of the bank? What may come out of it?

My bank account When I get into a bank I get frightened. The clerks frighten me; the desks frighten me; everything frightens me. I knew this before, but my salary had been raised to fifty dollars a month and 1 felt that the bank was the only place for it. So I walked in and looked round at the clerks with fear. I had an idea that a person who was about to open an account must necessarily consult the manager. I went up to a place marked «Accountant». The accountant was a tall man. He frightened me. «Can I see the manager?» I said, and added, «alone». I don't know why I said «alone». «Certainly,» said the accountant, and brought him. The manager was a calm, serious man. «Are you the manager?» I said. I didn't doubt it. «Yes,» he said. «Can I see you, alone». I didn't want to say «alone» again, but without this word the question seemed useless. The manager looked at me with some anxiety. He felt that i had a terrible secret to tell. «Come in here,» he said, and led the way to a private room. He turned the key in the lock. «We can talk here,» he said, «sit down». We both sat down and looked at each other. «You are one of Pinkerton's detectives,! suppose,» he said. My mysterious manner had made him think that I was a detective. «No, not from Pinkerton's,» I said- «To tell the truth,» I went on, «I am not a detective at all. I have come to open an account. I'd like to keep al! my money in this bank». The manager looked relieved but still serious; he felt sure now that I was a very rich man, perhaps a son of Baron Rothschild. «A large account, I suppose,» he said. «Fairly large,» I answered. «I intend to place in this bank the sum of fifty-six dollars now and fifty dollars a month regularly». The manager got up and opened the door. He called to the accountant. «Mr. Montgomery,» said the manager unkindly loud, «this gentleman is opening an account. He will place fifty-six dollars in it. Good morning». I stood up. «Good morning,» 1 said and walked to the accountant's position. I pushed the money at him with a quick, sudden movement. My face was terribly pale. «Here,» I said, «put it in my account». He took the money and gave it to another clerk. He asked me to write the sum on a bit of paper and sign my name in a book. I no longer knew what I was doing. The bank seemed to swim before my eyes. «Is it in the account?» I asked in a shaking voice. «It Is,» said the accountant. «Then (want to draw a cheque». My idea was to draw out of it six dollars for the present use. Someone gave me a cheque-book and someone else told me how to write it out. I wrote something on the cheque and pushed it toward the clerk. He looked at it. «What! Are you drawing it ail out again?» he asked in surprise. Then I realized that 1 had written fifty-six dollars instead of six. 1 had a feeling that it was impossible to explain the thing. д11 the clerks had stopped writing to look at me. Then I fnade a decision. «Yes, the whole thing». «You wish to draw your money out of the bank?» «Every cent of it». «Are you not going to put any more in the account?» said the clerk. «Never». The clerk prepared to pay the money. «How will you have it?» I answered without even trying to think, «tn fifty-dollar notes.» He gave me a fifty-dollar note. He gave me six dollars as well and rushed out. As the big door closed behind me I heard the sound of laughter. Since then I use a bank no more. I keep my money and my savings in a sock.

Unit? ACCOUNTING

C0st accountant overheads goodwill advisory services consulting return on investment credible report Text A

- бухгалтер по учету издержек; - накладные расходы -деловая репутация, клиенты и кадры компании, то есть её актив, который может быть занесён на специальный счёт - консультации,консалтинг - доход с инвестиции - достоверный отчёт Role of accounting

Topical vocabulary fiscal record making actual making of records be concerned with financial statements issued by the business operate at a profit meet commitments accounting data accounting equation financial accounting assets liabilities tax liability tax returns debts / money owing owner's equity net worth management accounting public accounting CFA (certified public accountant} chartered accountant (UK) executive controller /comptroller internal auditors cost accounting

- финансовый - ведение бухгалтерских записей - простая регистрация - заниматься чем-пибо - отчёты, представляемые фирмой - работать с прибылью, давать прибыль - выполнить обязательства - бухгалтерская отчётность - бухгалтерская сбалансированность / баланс - финансовое счетоводство - активы - пассивы, обязательства - задолженность по налоговым платежам - налоговые ведомости - задолженности - собственный капитал - чистый капитал - управленческий учёт - независимый бухгалтерский учёт дипломированный бухгалтер, выдержавший необходимые экзамены руководящий работник главный бухгалтер компании в США внутренние аудиторы /ревизоры учёт издержек производства, коммерческий расчёт Accounting frequently offers the qualified person an opportunity to move ahead quickly in today's business world. Indeed, many of the heads of large corporations throughout the world have advanced to their positions from the accounting department. In industry, management, government, and business, accountants generally are near the top rather than near the bottom of the organization chart. Management relies on the expert knowledge and experience of accountants to cope with the increasingly complex problems of taxes and cash flow. Accounting is a basic and vital element in every modern business. It records the past growth or decline of the business. Careful analysis of these results and trends may suggest the ways in which the business may grow in the future. Expansion or reorganization should not be planned without the proper analysis of the accounting information; and new products and the campaigns to advertise and sell them should not be launched without the help of accounting expertise. Government officials often have a legal background*; similarly, the men and women in management often have a background in accounting. They are usually familiar with the methodology of finance and the fundamentals of fiscal and business administration. * * * Today, a sharp distinction is made between the relatively unchanged work Performed by a bookkeeper and the more sophisticated duties of the accountant. The bookkeeper performs the routine work of recording figures in the books, whereas the duties of an accountant extend far beyond* the actual making of records. Accounting is concerned with the use to which these records are put, their analysis and interpretation. An accountant should be studying the various a|ternatives open to the business, and be using his accounting experience in Or(ler to aid the management to select the best plan of action for the business Accounting is often said to be the language of business. It is used in the world to describe the transactions entered into* by all kinds of

organisations. Accounting terms and ideas are therefore used by peop|e associated with business, whether they are managers, owners, investors bankers, lawyers, or accountants. The owners and managers of a business will need some accounting! knowledge in order that they may understand what the accountant is telling them., Investors and others will need accounting knowledge in order that they may: read and understand the financial statements issued by the business, and adjust their relationships with* the business accordingly. Probably there are two main questions that the managers or owners of aj business want to know: first, whether or not the business is operating at a profit; second, they will want to know whether or not the business will be able to meet its commitments as they fall due*, and so not have to close down owing to lac* of funds. Both of these questions should be answered by the use of the accounting data of the firm. The accounting equation The whole of financial accounting is based on the accounting equation. The resources possessed by the firm are known as Assets, and obviously, some of these resources will have been supplied by the owner of the business. The] total amount supplied by him is known as Capital, if in fact he was the only one who had supplied the assets then the following equation would hold true: On the other hand, some of the assets will normally have been provided by someone other than* the owner. The indebtedness of the firm for these resources is known as Liabilities. The equation can now be expressed as: Assets - Capital + Liabilities Assets consist of property of all kinds, such as buildings, machinery, stocks of goods and motor vehicles, also benefits such as debts owing by customers and the amount of money in the bank account. Liabilities consist of money owing for goods supplied to the firm, and for expenses, also for loans made to the firm-Capital is often called the owner's equity or net worth.

- юридическое образование - выходить далеко за рамки - в которых участвуют - строить отношения с - когда придёт срок (погашения) - помимо, кроме - использовать, употребить

The field of accounting The field of accounting is divided into three broad divisions: management, puplic and governmental accounting. Management accounting An accountant who is employed by a business is said to be in management accounting. Managerial (management) accountants work with the kinds of financial reports necessary to management for the efficient operation of the company, including budgets and cash flow projections*. A small business may have only one or a few people doing this work. As companies grow, their accounting staffs become increasingly specialized, and a medium-size or a large company may employ hundreds of people in their headquarters and branch offices for the purpose of fiscal administration. They are working under a chief accounting officer called a controller (or comptroller as he or she is often cal'ed), or financial vice-president. This position is very close to the top management. Indeed, a controller is often just a step away from the executive officer at' а corporation. Other positions thai may be held by accountants at lower managerial levels are assistant controller, internal auditor, system analist, financial accountant, and cost accountant. Those who work for manufacturing concerns are sometimes called industrial accountants. Internal auditors are in charge of the protection of the firm's assets - the things of value owned by the company, including cash, securities, property, and even goodwill. The internal auditor sees that* current transactions are recorded promptly and completely. He or she also identifies inefficient procedures or detects fraudulent transactions. He or she is usually called upon to propose solutions for these problems. One cf the specialities within the management accounting field is cosf. accounting, which is chiefly concerned with determining the unit cost of the products the company manufactures and sells. The unit cost must include not only the price of the materials in the product, but also other expenses, including labour and overheads. Without unit costs, manufacturing firms could not accurately deteimine the price they must sell their products for in order to bring an adequate return on investment. Public accounting The field of public accounting offers services in auditing, taxes., and ^anagement consulting to the public for a fee. A certified public accountant, or pPA. as the.term is usually abbreviated, must pass a series of examinations, after which he or she receives a certificate. This is done to protect the public by erisuring a high quality of professional service. Auditing. The most important and distinctive function of a certified public accountant is auditing, which is the examination and testing of financial statements. Society relies heavily on the auditing function for credible financial

reports. All public corporations and many companies that apply for sizable loans must have their financial statements and records audited by an independent public accountant. Tax services. As the tax laws have grown increasingly complex, not only corporations but also individuals need to have their tax liability calculated. So, public accountants assist businesses and individuals in preparing tax returns* and complying with* tax laws. They also help plan business decisions to reduce taxes in future. Tax accounting calls for much knowledge and skill regardless of the size of business. Few business decisions are without tax effects. Management advisory services. A growing and important part of most public accounting firms'practice is management advisory services, or consulting. With their intimate knowledge* of a business's operations, auditors can make important suggestions for improvements. In the past, these recommendations have dealt mainly with accounting records, budgeting and cost accounting. But in the last few years they have expanded into marketing, organisational planning, personnel and recruiting, production systems, and many other business areas. CPAs are similar to doctors or lawyers. Like them, CPAs may be self-employed or partners in a firm; they may be employed by an accounting firm. Government accounting Many accountants work in government offices or for nonprofit organizations either regularly or on a part-time basis. These two areas are often joined together under the term «governmental and institutional accounting». Like those in private industry, they work on a salary basis. They tend to become specialists in limited fields like transportation or public utilities. projection - перспективная оценка, прогноз sees that - следит за тем, чтобы tax returns - сведения о доходах, облагаемых налогом complying with the law - приведение в соответствие с законом with their intimate knowledge - благодаря их близкому знакомству on a part-time basis - на основе почасовой оплаты

Audits - the year-end nightmare time and use), they write down its value to a realistic one. Although VAT have to be submitted to the Customs and Excise authorities every three months, they are checked again during the audit. A public company - one whose shares are quoted on the Stock Exchange I must lodge its accounts in Companies House, where they are available to the Dublic and to possible investors. The annual audit is a legal requirement in Britain: many professional firms of accountants only do this work and do not need to undertake any other type of work. Vocabulary exercises Ex.1. Translate groups of derivatives: employ - employer- employee - employement - unemployement - self-employed to utilise - utilisation - utilities - utilitarian efficient - inefficient - efficiency profit - nonprofit - profitable - profitability - profiteer account - accountant - accountability - accountable - accountancy - accounting advertise - advertisment - advertising - advertiser - ad finance - financial - financing - financier to calculate - calculable - calculated - calculation - calculator Ex.2. Match the words in list A with their synonyms in list B:

often administrative proper to utilise to bring adequate return to define to launch completely similar increasingly

An official examination, the audit, is made of the accounts of a business; this is usually done once a year. Independent auditors examine all the company's accounts for the previous year; this is known, colloquially, as «checking the books». The auditors attempt to reconcile all the bank statements, checking them against the receipts and invoices. They check all the company's stocks; if the value of any of them has decreased during this year (many items depreciate Ex.3. Match the words with their antonyms: full-time regularly corporation top growth to be salaried frequently to be paid a fee decline seldom part-time individuals on a part-time basis bottom

,

т to be performed... to have smb.... the staff to work... salary basis to be responsible... to be close... to be concerned... solution... the problem Ex.5. Give Russian equivalent to the following expressions: to perform audit, to practice accounting, to have a background in accounting, to perform the routine work, to set up a bookkeeping system, to interpretthe data, to record figures in the books, to acquire sufficient experience, the expert experience of accountant, accounting expertise, sophisticated duties of accountant Ex.6. Match English terms denoting доход, прибыль, выручка, приход, денежные поступления with the following definitions:

1. most general term for money we receive for our work, investments, etc. 2. profit from a transaction. 3. income, especially the total annual income of the state from taxes 4. money earned 5. increase in wealth, profit 6. money received by a business 7. money obtained by selling something 8. income received from holding securities, esp.bonds

|

|||||||||||||||||||||||||||||||||||

|

Последнее изменение этой страницы: 2016-08-26; просмотров: 69; Нарушение авторского права страницы; Мы поможем в написании вашей работы! infopedia.su Все материалы представленные на сайте исключительно с целью ознакомления читателями и не преследуют коммерческих целей или нарушение авторских прав. Обратная связь - 3.136.97.64 (0.476 с.) |